3.1.24: Crypto Funds See RECORD Inflows

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Click here to start your free YCharts trial and get 15% off your initial YCharts Professional subscription when you tell them I sent you (new customers only).”

Landing Page Link: https://go.ycharts.com/larry-cheung

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5128.24

KWEB (Chinese Internet) ETF: $26.01

Analyst Team Note:

Bitcoin ETFs have attracted substantial flows, with BlackRock’s IBIT alone bringing in a record $612 million in a single day.

This influx of funds is likely driven by the fear of missing out on the crypto rally and underscores the basic principle of supply and demand affecting Bitcoin's price. Since there’s no underlying cash flows or value, high demand is all that’s needed.

Macro Chart In Focus

Analyst Team Note:

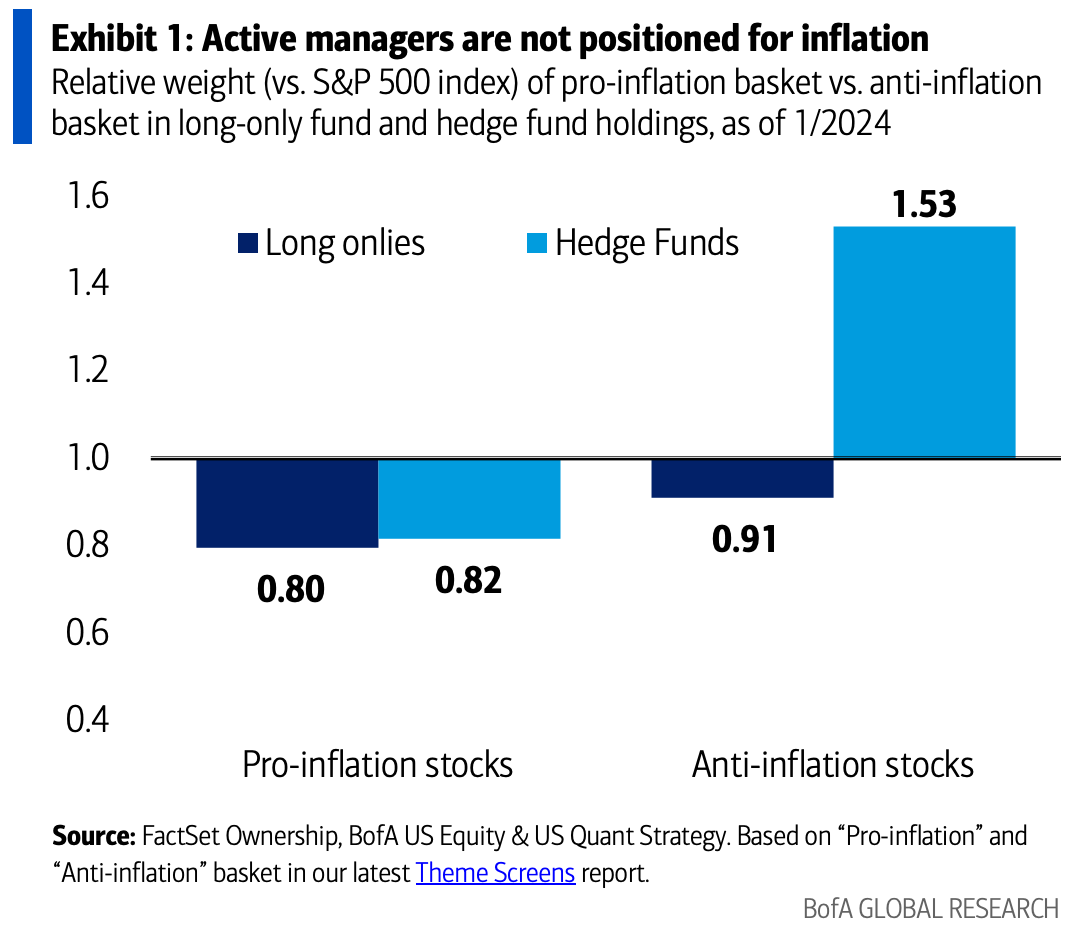

According to buy-siders, inflation worries are behind us…

The majority of BofA Global Fund Manager Survey investors expect lower short-term rates (90%) and lower inflation (77%); only 4% expect higher short-term rates while only 7% expect inflation to rise.

Only 7% of respondents cite inflation as the biggest risk to US equities this year

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

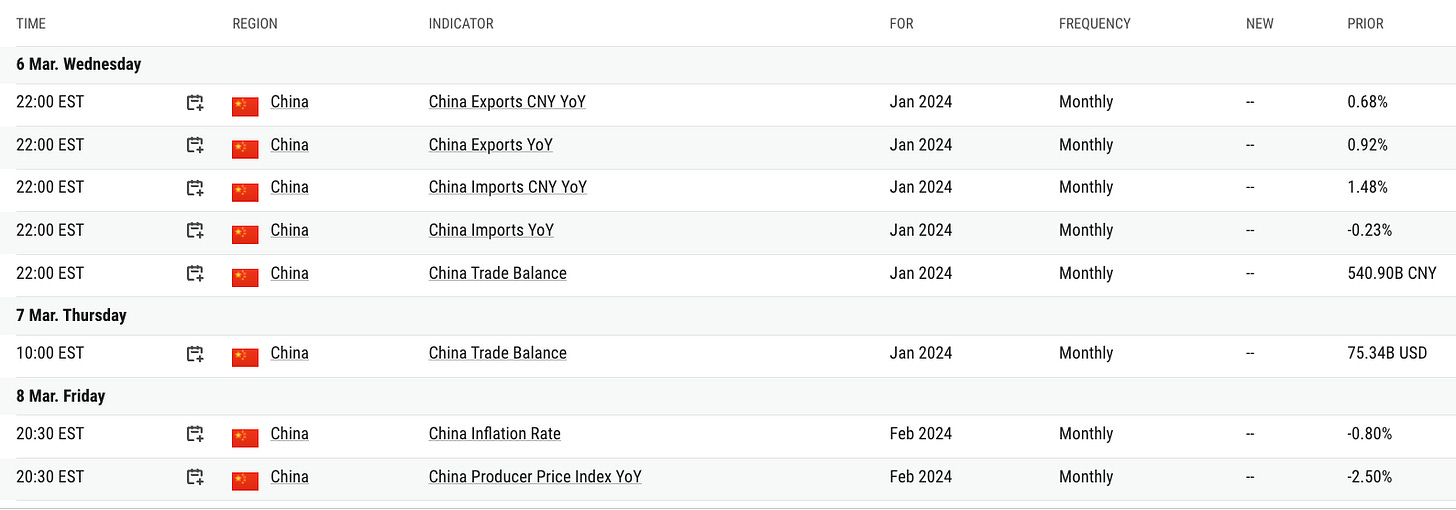

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In late February, US consumer sentiment experienced a significant decline, reversing earlier optimism observed in the month. The University of Michigan's final February survey reported a drop in the sentiment index to 76.9 from an initial reading of 79.6, marking the largest decrease since March 2020.

Consumers' inflation expectations for the coming year increased slightly to 3% from 2.9%, while their long-term outlook remained stable at 2.9%.

The decline in sentiment varied by political affiliation, with Republicans showing improved views and Democrats experiencing a notable decrease.

Chart That Caught Our Eye

Analyst Team Note:

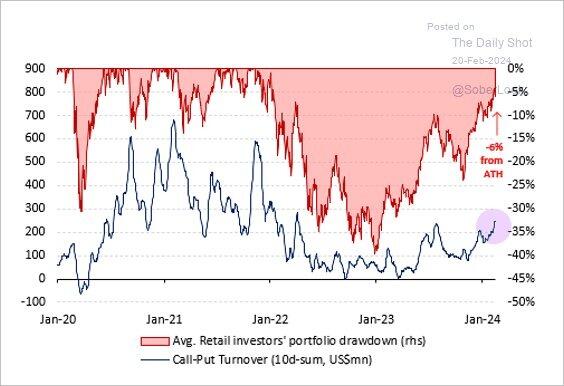

After over two years, retail investors are almost back to breakeven. A recent chart by Vanda Research shows that the average retail investor portfolio still sports a drawdown despite the markets making new all-time highs.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.