3.10.23: Big Sell Has Come. Better days will Come in the Future. Do not panic.

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I wish to make clear that Bearish markets do NOT bring me joy, even though our personal positioning has tremendously benefited from the stunning rise of TLT ETF (Long Duration Bonds).

I genuinely would like to see all my public readers be winners in the marketplace, but markets will sometimes be unkind to the majority of market participants. Do not fret - better days come ahead!

I am very proud of the defensive work that we have done for the Community, and you have my word that my best work is yet to come. Please understand this: I cannot control the market, but I can control the level of thought that goes into my research guidance.

Better days will come ahead - but the journey from now til then will not be easy. Should you accept me as your Strategist, I will do my best to help you succeed. My community on Substack/Patreon is my way of helping the good folks (you can see this through the globally accessible pricing).

You can see my opinions materializing in my latest Instagram Post (follow me). I’ll be spending this weekend to see if there’s newfound opportunity in the market. Do not rush. Act with careful intention. There is plenty of time.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4%) at Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3918.32

KWEB (Chinese Internet) ETF: $28.11

Analyst Team Note:

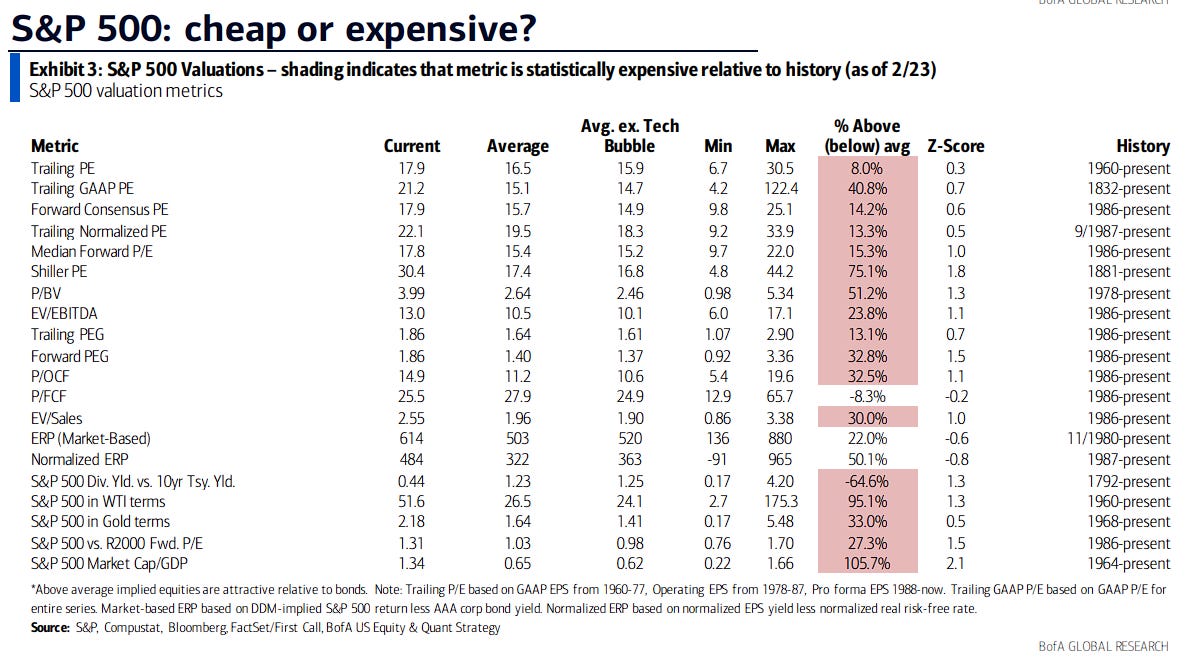

Macro Chart In Focus

Analyst Team Note:

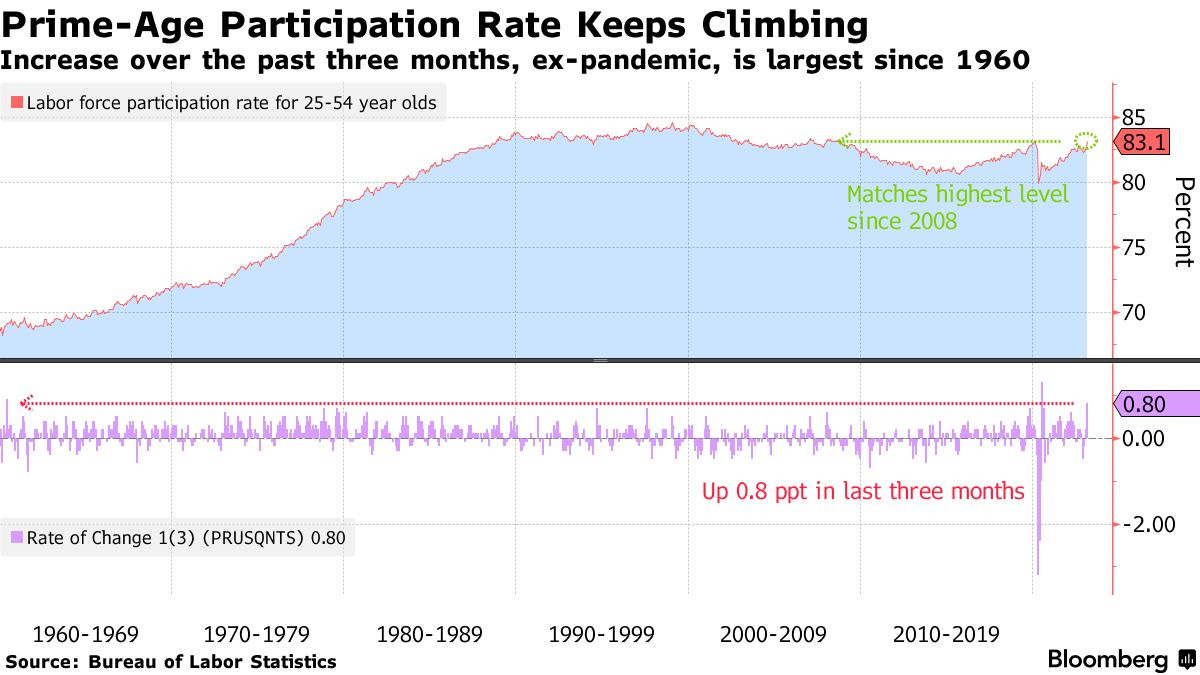

“The labor market strength of the past year has sowed the seeds of its own destruction, with more declines on the profit margins, hiring and economic growth fronts highly likely in coming quarters. The ~10% drop in S&P 500 company margins already reported for Q4 seems consistent with the negative signals coming from the correlation between surging labor costs and profit margins. If this correlation is any indication, a bigger drop in profit margins is baked in the cake over the next four quarters. How persistent and damaging to margins, hiring, capital expenditures (capex) and equity market prospects the effect of the surge in labor costs to date turns out to be depends on how soon and how much labor cost growth decelerates.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

New labor market data showed positive signs in February, with payrolls growing by 311,000 and job growth exceeding expectations for the 11th straight month.

The labor-force participation rate and employment-to-population ratio for prime-age workers also increased, and construction employment remained strong.

However, there were also some negative indicators, such as a smaller than expected increase in average hourly earnings and a shorter average workweek. The diffusion index also showed that most of the job gains were concentrated in specific industries, and there was an increase in job losers and those completing temporary jobs.

Chart That Caught Our Eye

Analyst Team Note:

While operating EPS has surged since 2011, actual sales grew nowhere near the same rate. Per Bloomberg, “For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.”