2.8.22: Fed Governors begin to relay Jerome's message for him. Can markets shake this off?

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: During the market hours, we witnessed a reset of pricing from yesterday’s gains. What markets gained yesterday was lost today, but it is still too early to say that Bulls have lost control of the narrative. Throughout the session, 3 key names essentially held up the indices: NVDA, MSFT, and TSLA.

And after-market this evening, DIS’s announced that they will revamp their cost structure in their earnings outcome - which will result in a more lean organization (something that shareholders favor). Tomorrow, Bulls hope to see the Consumer Discretionary sector experience a modest bounce if Disney can hold its post-market gains into tomorrow’s session.

Looking out longer-term, the debate between the Soft and Hard Landing crowd intensifies. In my latest Youtube Video, I share helpful data, insights, and research behind why the Sell-Side is so bearish on markets.

In the meantime, I’m working on an additional inter-market update later this week for members inside my private Substack/Patreon community. Protecting your capital during this key moment in markets is my top priority. I’m going for Singles, not Home Runs. Would love to have you come join us if you haven’t yet already.

Strategist Larry uses Interactive Brokers as his core brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4164.00

KWEB (Chinese Internet) ETF: $33.13

Analyst Team Note:

The percentage of US companies in the S&P 500 that have topped earnings estimates in the 4th quarter of the reporting season has decreased to 70% compared to 78% from the previous year.

Companies missed revenue estimates 18% of the time, compared to 16% from the previous year, while 48% topped the estimates compared to 60% from the previous year.

The S&P 500 index has increased by 5% since the start of the current earnings season.

Macro Chart In Focus

Analyst Team Note:

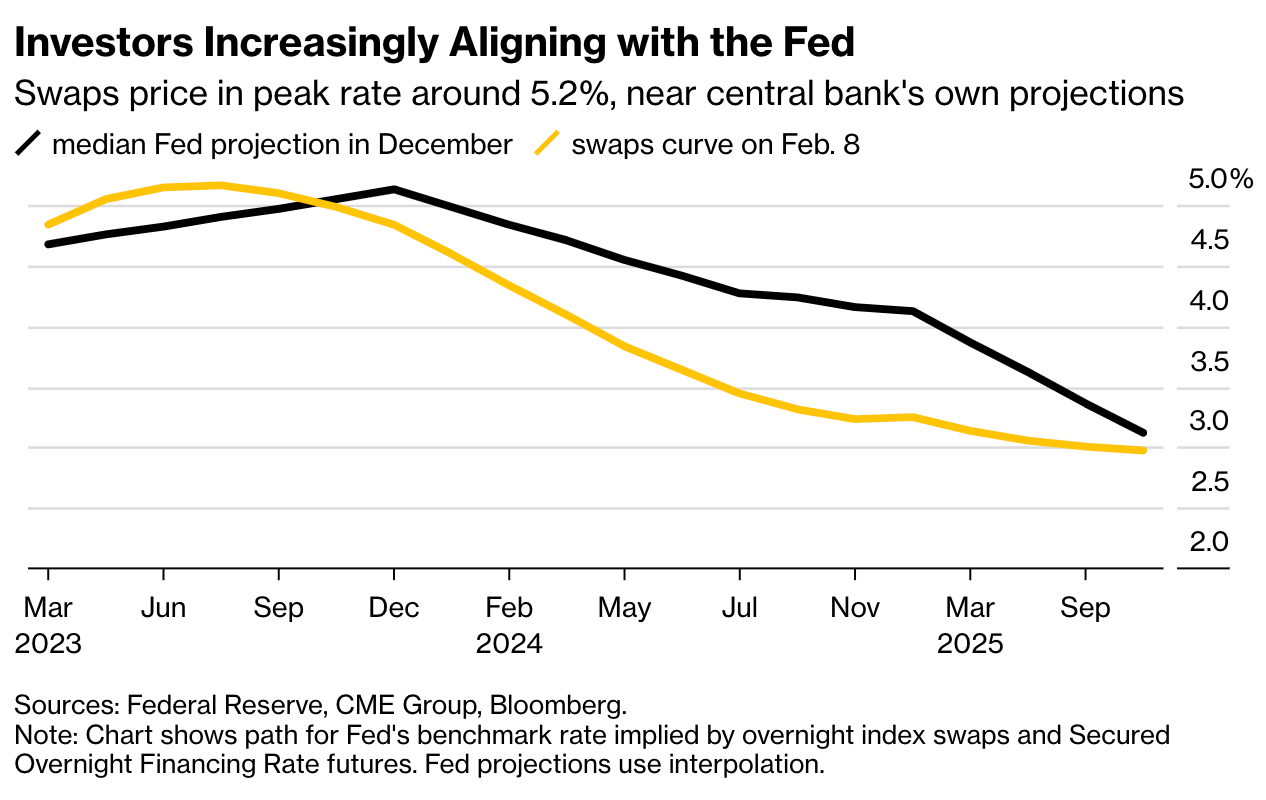

Fed President John Williams recently stated that the December forecasts submitted by Fed officials still provide a good guide for interest rate projections this year and that policy may need to stay restrictive for a few years to bring down inflation. He also emphasized the need to maintain a restrictive policy stance for a few years to reach the 2% inflation goal.

Policymakers had predicted a median of 5.1% for the federal funds rate by the end of 2023, which would imply a few more rate hikes this year.

However, the sentiment on Federal Reserve policy is shifting as interest-rate options show big bets on the fed funds rate reaching 6%, which is nearly a percentage point higher than the current consensus.

The belief that the Fed, after raising rates eight times in the past year, is near the end of its tightening cycle has been challenged by strong January employment data and comments from Fed officials, who suggest that a pause after just one or two more rate hikes may not be a done deal.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

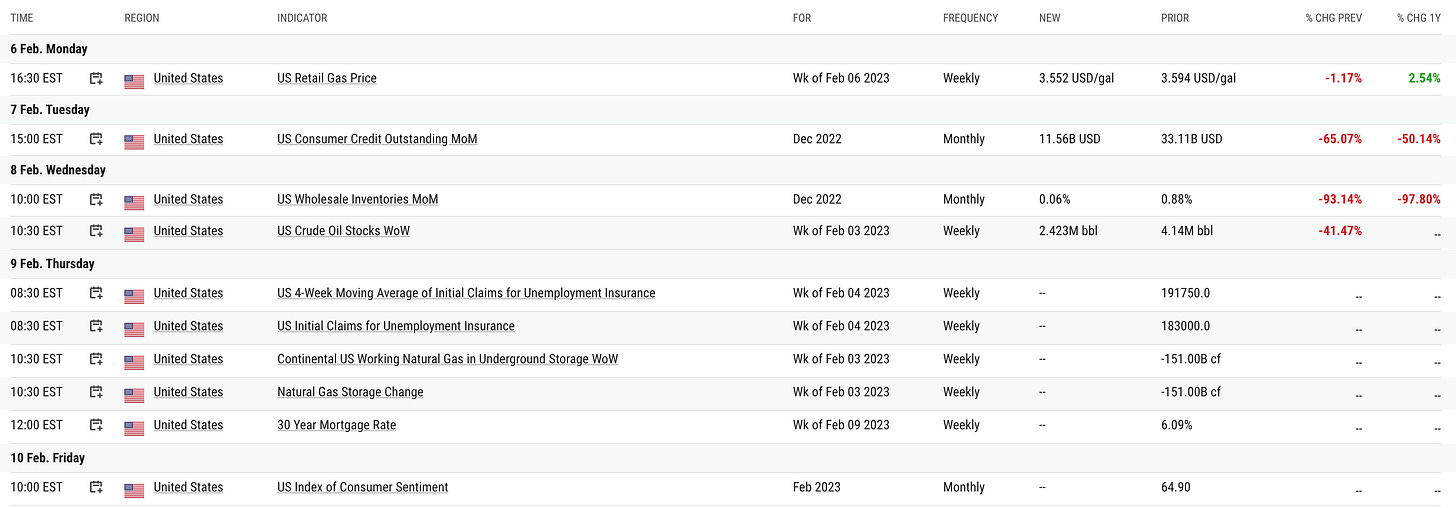

U.S Economic Calendar (Upcoming Data Points)

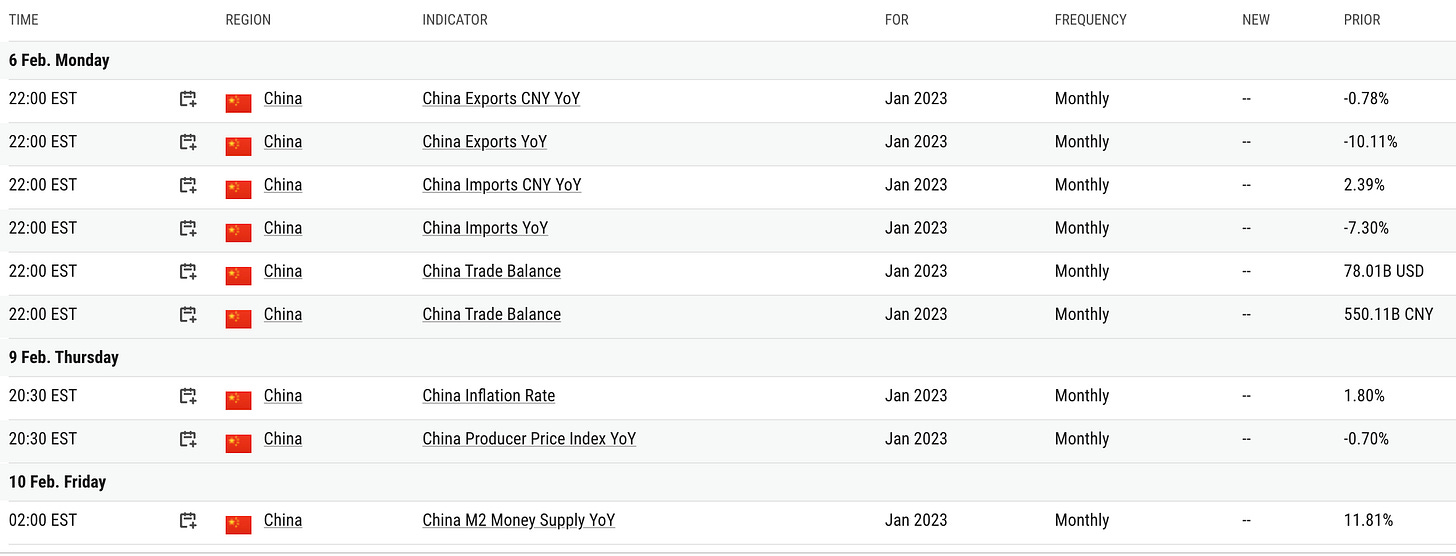

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

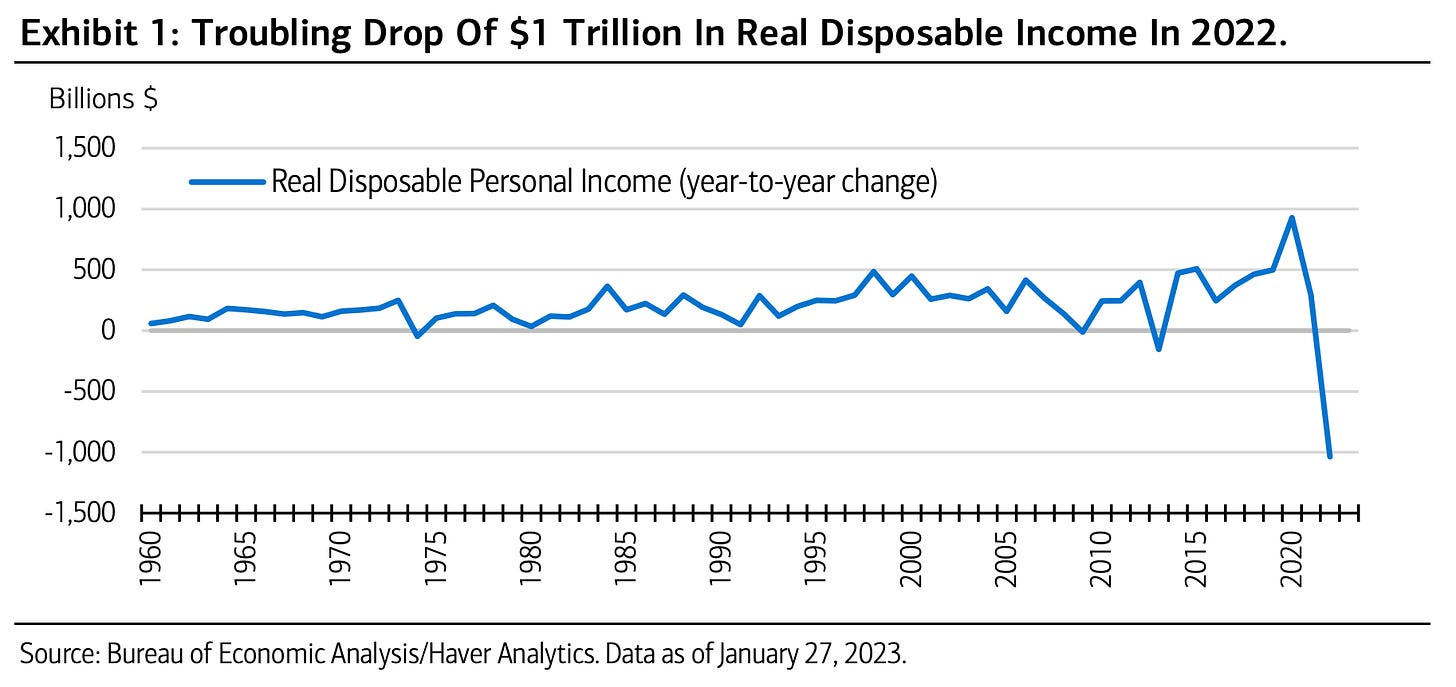

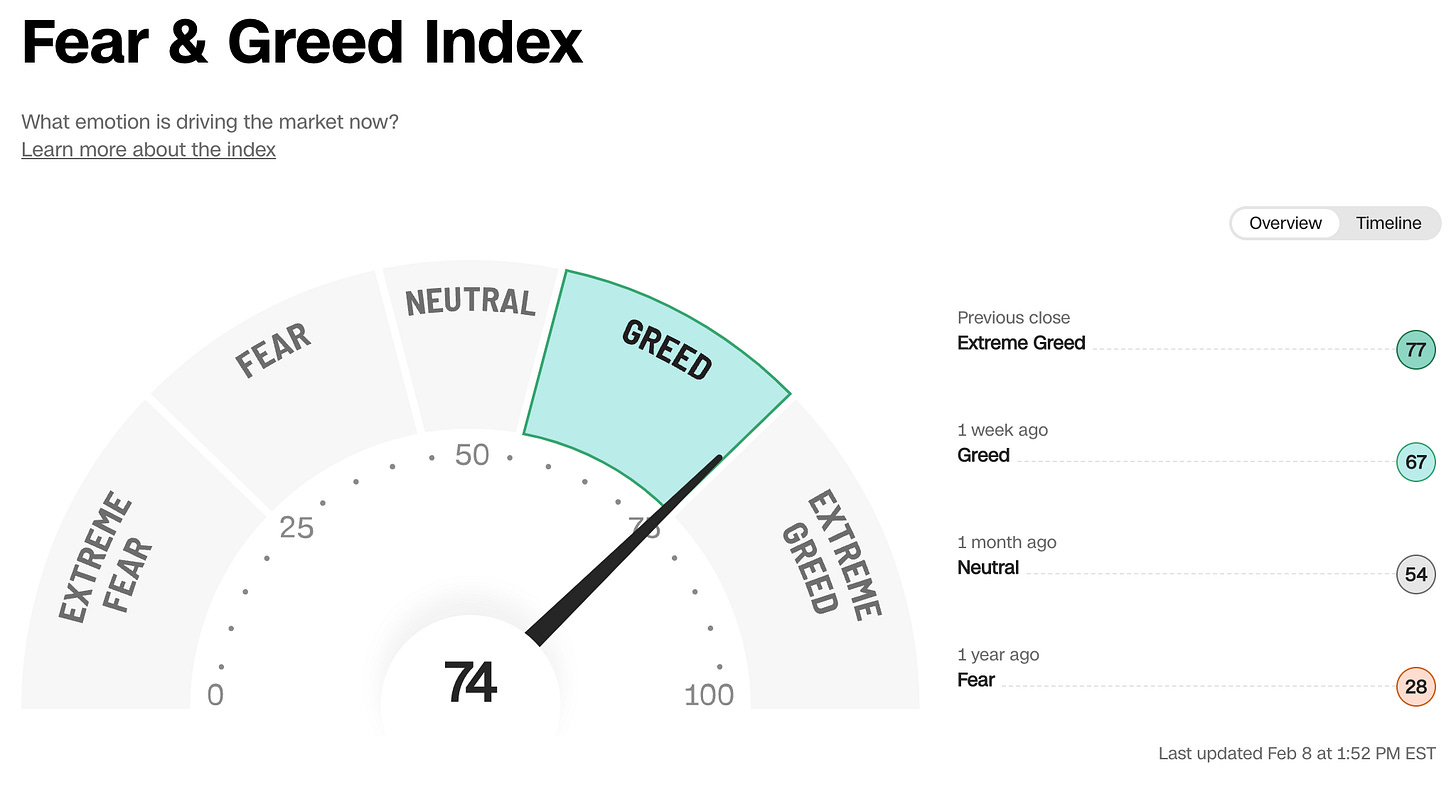

The U.S. economy is facing a catch-22 as the consumer is being asked to support the economy through spending even though real disposable income has been declining at a rapid rate.

In order to maintain a similar level of spending, consumers have been using their pandemic savings and borrowing more on credit cards. However, with unemployment likely rising by mid-year, the pressure to reduce spending will increase, making it difficult for the consumer to continue supporting the economy.

Buckle your seatbelts.

Chart That Caught Our Eye

Analyst Team Note:

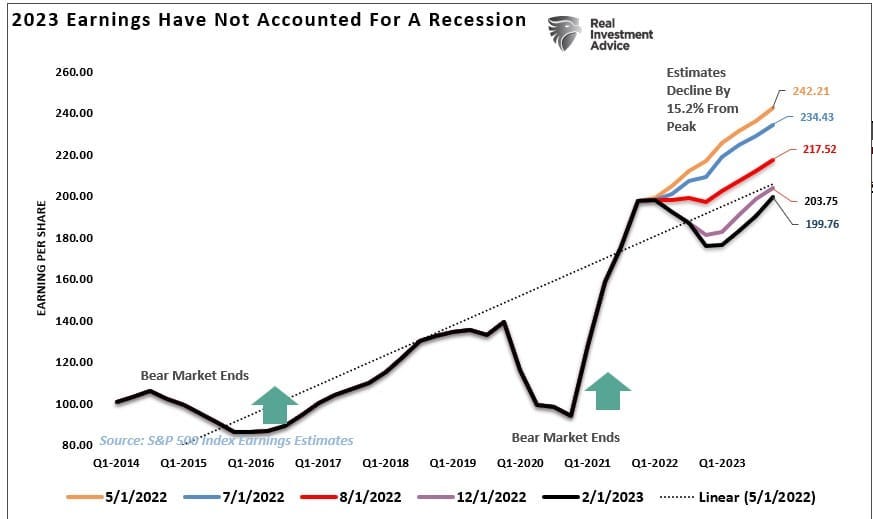

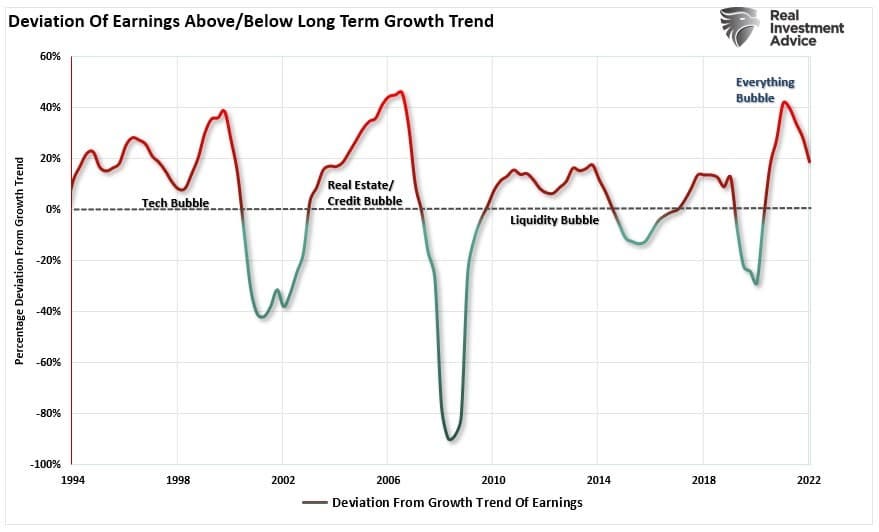

Even though there’s been much talk about earnings estimates being too high, these estimates still haven’t been marked down sufficiently (in our view).

An earnings recovery (that Wall Street is projecting) is contingent on a much stronger economic environment to support that growth in earnings.

Given that earnings still remain 20% above their long-term growth trend. This expected recovery seems like a fantasy.

Why? Hint: Pulled forward demand.