2.6.23: The U.S. Dollar Index has emerged from the ashes, now confronting U.S. equity markets with a new headwind

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: In a note to members on 1/31, which I also kindly opened up to the public over the weekend (the Post is now back to Private), I discussed the emerging strong potential of a U.S. Dollar Index rebound (the DXY).

Now that the DXY (and the ETFs that track it, which I’ve communicated to members) has risen a full 150 basis points (quite significant for currency movement) from 102 to 103.5, the S&P 500 has shaved off 100 points from its optimistic 4200 level back to a closely watched 4100 level. Our plan is now unfolding as discussed.

While there is of course the chance that the SPX could make a rebound, the probability of a rebound decreases if the Dollar stays strong.

Members inside our Community were given ETFs that tracked any recovery in the Dollar. This ETF is now up 3%, compared to a 2.5% retracement in U.S. markets, offering a very good hedge to portfolios looking for capital preservation. I’m looking for Singles - NOT home runs.

Again, many of my ideas in this environment are designed to raise the Sharpe Ratio of portfolios - meaning to find alpha while also attempting to lower portfolio variance (risk).

I understand that names like AMD, GOOG, and AMZN are sexier investments. However, there is a place and time for those companies. I discussed their upside potential in December. They may still have rebound potential, but it’s hard for me to get excited about the near-term risk/reward potential of companies that have had recent fundamental severe misses in their earnings this season. Especially in the context of an expensive valued market.

I’ll provide more market context to members later this week in a follow-up Strategy note. I would encourage you to join us and protect your capital before markets surrender your chance of doing so. Here’s my recent strategy note.

Strategist Larry uses Interactive Brokers as his core brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4136.48

KWEB (Chinese Internet) ETF: $33.35

Analyst Team Note:

The popularity of 0DTE options is rising precipitously. As the graph below shows, half of the volume of options on S&P 500 futures are 0DTE. That dwarfs the 5-10% share existing before the pandemic.

Individual and institutional investors are using options that have a very short time until expiry for speculative and hedging purposes. It is also likely investors may be using 0DTE options to manipulate markets. Regardless of the objectives, 0DTE options have a similar feature as portfolio insurance; they can significantly intensify market moves.

Source: RIA Advice

Macro Chart In Focus

Analyst Team Note:

Credit spreads are an extremely important indicator that is worth following. Here’s the rundown.

A credit spread reflects the difference in yield between a treasury and corporate bond of the same maturity. Debt issued by the United States Treasury is used as the benchmark in the financial industry due to its risk-free status being backed by the U.S. government. US Treasury (government-issued) bonds are considered to be the closest thing to a risk-free investment, as the probability of default is almost non-existent.

Corporate bonds, even for the most stable and highly-rated companies, are considered to be riskier investments for which the investor demands compensation. This compensation is the credit spread.

When faced with uncertain or worsening economic conditions, investors tend to flee to the safety of U.S. Treasuries (buying) often at the expense of corporate bonds (selling). This dynamic causes US treasury prices to rise and yields to fall while corporate bond prices fall and yields rise. The widening of credit spreads is reflective of investor concern.

This is why credit spreads are often a good barometer of economic health - widening (bad) and narrowing (good).

Right now, high-yield credit spreads are tightening and are nowhere near previous recession highs. Are the credit markets right or terribly wrong??

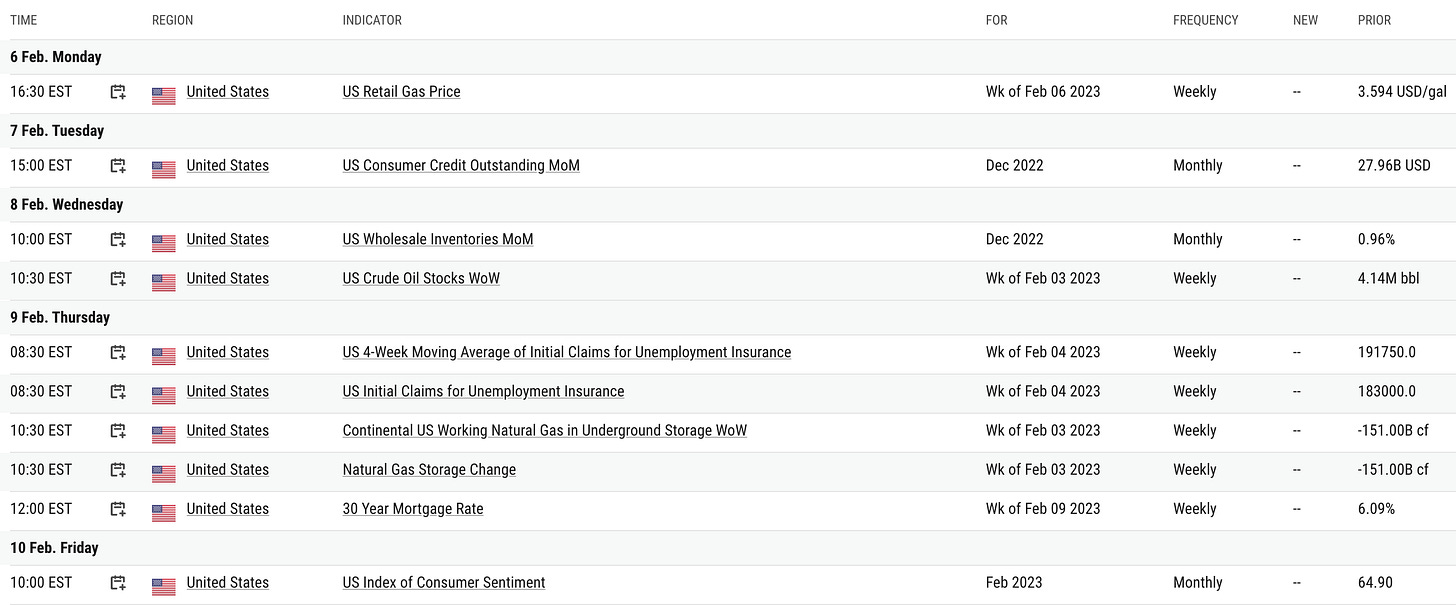

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“In Q4’22, central banks purchased 417 tons (t) of gold, bringing the annual total to 1,136t, a 55-year high. Central bank demand in 2022 was up an impressive 150% YoY.

The Peoples Bank of China (PBOC) reported its first increase in gold reserve holdings since September 2019, purchasing 62t in November and December 2022 and taking China’s total gold reserves to over 2,000t (a record). China was historically a larger buyer of gold, purchasing 1,448t of gold between 2002-2019, but its gold buying has been muted since then. The Central Bank of Türkiye was the largest central bank buyer of gold in 2022 at 148t, bringing total reserves to 542t (also a record).

Looking forward, elevated central bank demand may continue as the WGC’s annual central bank survey from June 8, 2022 showed that 25% of central banks want to increase exposure (vs. 21% the year prior)” - Bank of America

Hedging the chance of overtightening?

Chart That Caught Our Eye

Analyst Team Note:

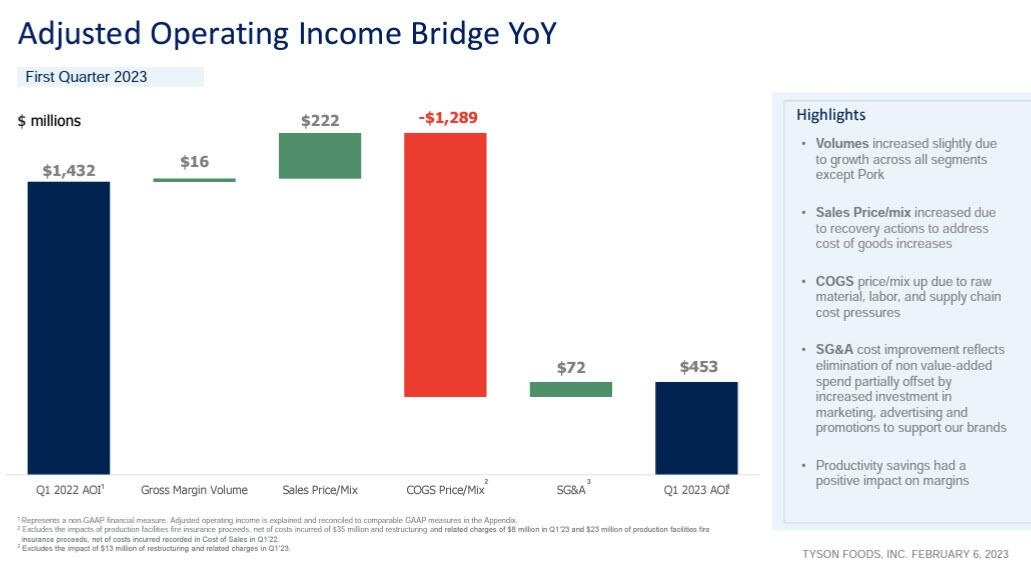

The largest US meat company, Tyson Foods, badly missed estimates for quarterly profit and cut its expectations for operating margins this year in the face of falling beef prices, easing demand for pork, and an ongoing crash in chicken prices as a result of overproduction.

Adjusted EPS of $0.85 were much lower than expectations of $1.33 per share, as first-quarter earnings plunged 70% from a year ago and missed expectations. The reason: a $1.3 billion hit from COGS price/mix as cost of goods sold rose while margins/selling prices shrank.

Tyson's average pork prices rose 1.4% in the latest quarter, while sales volumes declined 7.4%. The company cut its outlook for adjusted operating margins in pork to 0% to 2% for fiscal 2023 from a previous forecast of 2% to 4%.

In Tyson's beef business, its largest segment, operating margins shrank to 3.5% from 19.1% a year earlier. Average beef prices fell by 8.5%, compared to a surge of nearly 32% a year earlier, according to the company. Profit margins fell to 3.5% for the quarter, from over 19% a year ago, hurt by “softer domestic demand and higher live cattle costs.

Food deflation incoming?

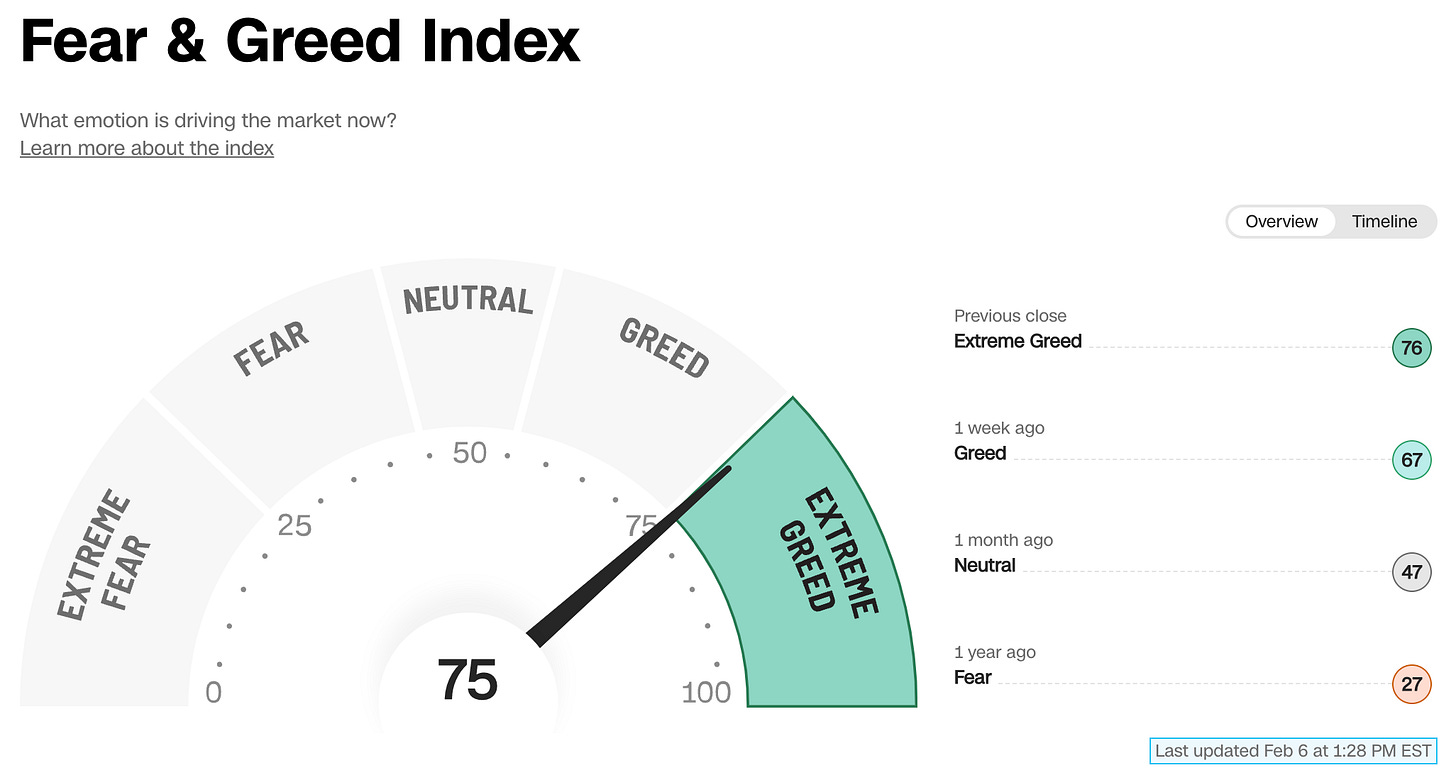

Sentiment Check

Strategist Larry’s Latest Popular Tweet: