2.5.24: Market Expectations Shift Back to NO March Cut

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4956.25

KWEB (Chinese Internet) ETF: $23.35

Analyst Team Note:

In 2023, active share plummeted amid career risk, benchmark concentration risk and macroeconomic uncertainty.

Macro Chart In Focus

Analyst Team Note:

In an interview with 60 Minutes, Fed Chair Jerome Powell indicated that Americans might have to wait beyond March for interest rate cuts as the Fed seeks more data to confirm a sustainable decrease in inflation towards the 2% target.

Powell emphasized the risk of moving prematurely and undermining recent positive inflation trends, suggesting a cautious approach to policy adjustments.

Despite recent improvements in inflation and a strong job market, Powell highlighted the need to maintain a prudent stance, suggesting that the FOMC is unlikely to have sufficient confidence in inflation's downward trajectory by its March meeting.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China is implementing tighter trading restrictions on domestic institutional investors and some offshore units to mitigate a worsening stock market downturn, which saw shares hitting a five-year low.

These measures include caps on cross-border total return swaps and prohibitions on sell orders for some quantitative hedge funds, aiming to curb short selling and market manipulation.

Despite these efforts and the China Securities Regulatory Commission's pledge to combat illegal market activities, investor sentiment remains low due to economic challenges, geopolitical tensions, and a lack of effective government intervention.

The market showed some recovery after the regulator announced steps to address risks associated with share pledges, but concerns about the sustainability of these measures and their impact on market liquidity persist.

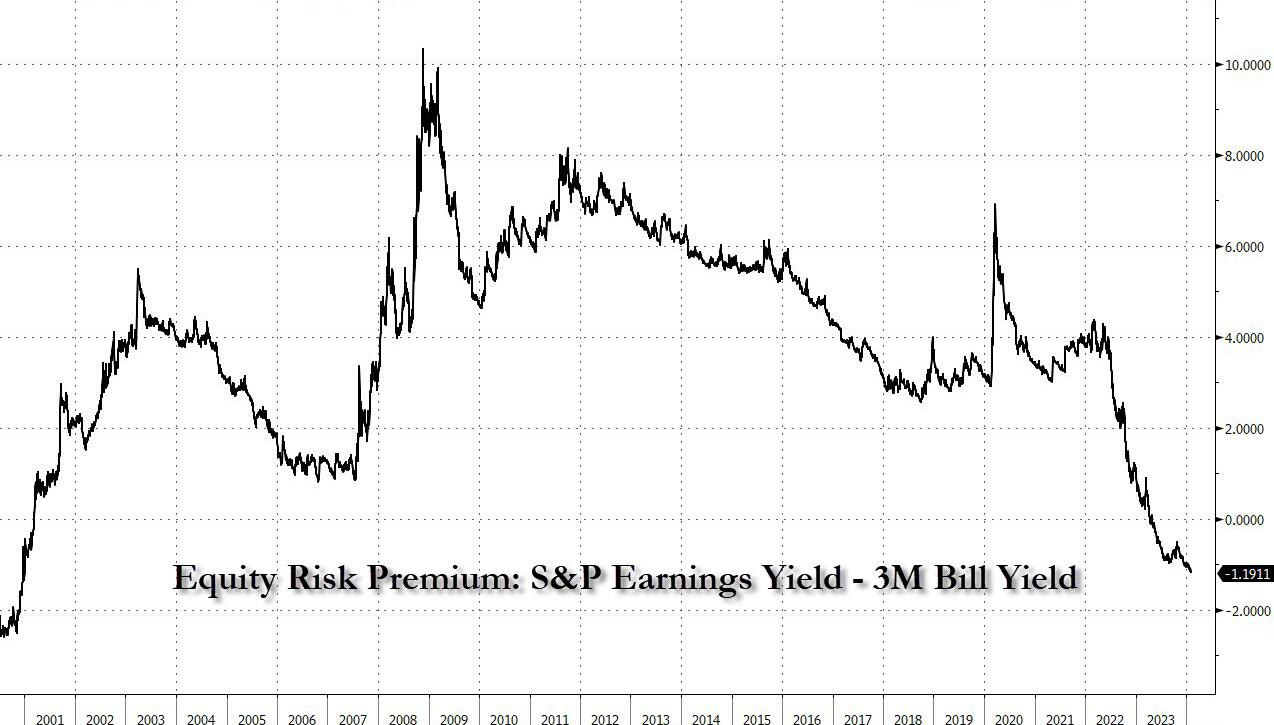

Chart That Caught Our Eye

Analyst Team Note:

From One River Asset Management - “The equity risk premium (ERP) is at 23-year lows. The S&P 500 earnings yield minus 3mth T-bill yields has not been this low since 2001. So, in at least one sense, the market is above fair value. But at the height of the dotcom bubble, the ERP was lower than now. So, all this tells us is that the market is overvalued, and we should not be surprised to see it become more so. No one knows whether the dotcom ERP lows represent an absolute limit. All we know from the past is that when markets move to extreme over/under-valuations, wild moves in price can happen.”

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.