2.3.23: Bulls wrap up a generally strong week, with a Cliff Hanger development in the end.

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: There are now two Teams: Team Jim Cramer and Team Michael Burry.

The 2 teams are headed off for a historical, epic battle in the coming 4-6 weeks as the U.S. takes in further economic data that will give clues to the trajectory of inflation and therefore the future of Fed policy.

Both teams won’t budge in their views. And both teams are now more vocal than ever on social media (Substack, Twitter, and Youtube).

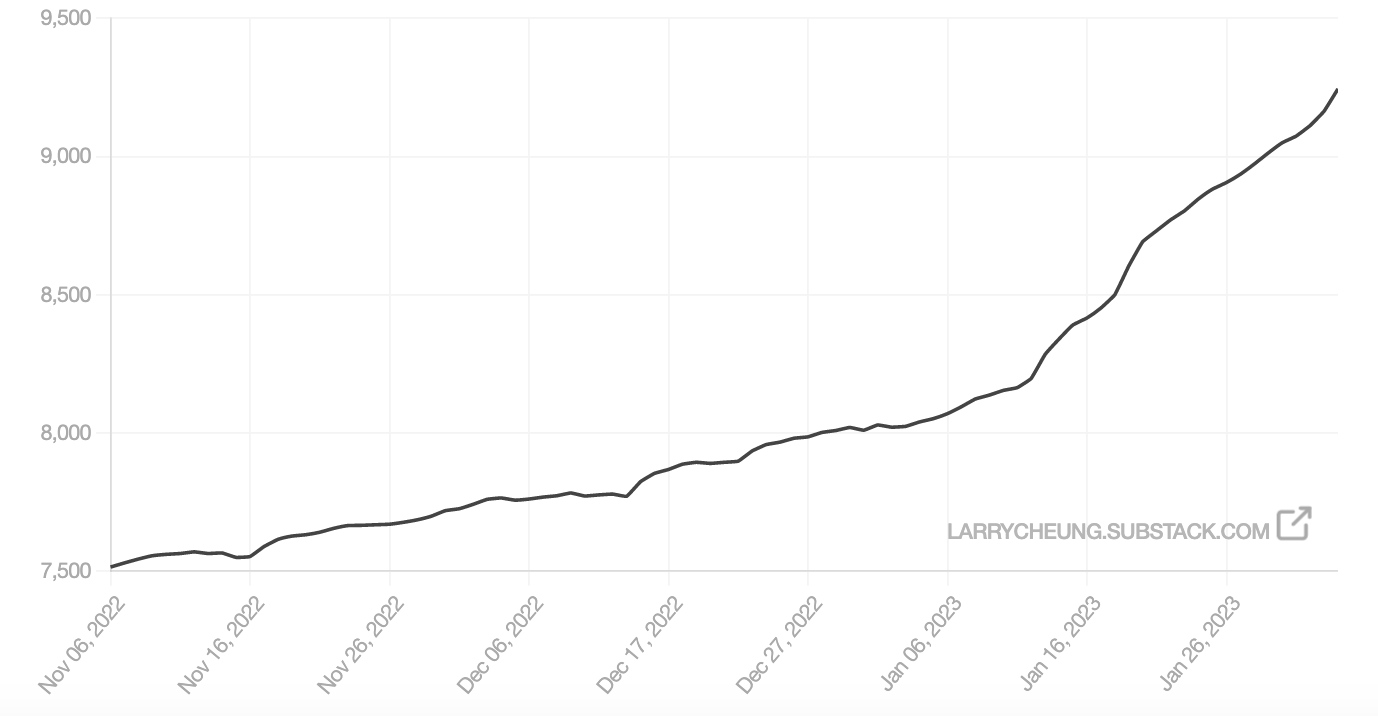

My work on Substack/Patreon is reaching more and more people and I fully intend to help you navigate the path ahead. Our latest research note to Substack/Patreon members here provides guidance on what companies/ETFs/themes may produce strong risk-adjusted returns as the 2 Teams battle it out.

The Number of Readers in our Community is growing exponentially.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check it out.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4179.76

KWEB (Chinese Internet) ETF: $34.45

Analyst Team Note:

A “golden cross” occurs when the 50-day moving average (MA) moves above the 200- day MA.

The SPX has generated 14 golden crosses associated with 13 out of these 15 recessions (the 1929-1933 recession saw two golden crosses). SPX returns are strong after these signals across all time periods with the best returns 195-days after the signal. The SPX is up 92.9% of the time on an average return of 22.0% 195 days after the signal and is also up 92.9% of the time on an average return of 21.9% 260 days after the signal.

12 out of the 14 recession golden crosses showed 260-day signal returns of 10% or more for the SPX with only one signal generating a negative return for this period (the 1938 signal).

Per Larry’s recent note:

We entered FOMC with SPX at 4070, and after a bit of tug of war with an initial drop to 4050 mentioned target, the market ended up rallying around 4120. Fast forward to today, we are above 4150 or so - flirting with 4200.

In my note yesterday, I discussed my view that the SPX has around 200 points of upside and up to 500 points of downside.

The FOMC does nothing to change that view. In fact it strengthens it as Jerome says that we’re not even at restrictive territory yet!

With the SPX now above 4150, my mental risk/reward (R:R) is now 150 points of upside left and 600 points of potential downside from here, compared to 200:500 yesterday. I think a disaster is waiting to happen for folks who are buying at the wrong levels.

Macro Chart In Focus

Analyst Team Note:

The US labor market continued to stay hot in January as hiring surged and unemployment fell to a 53-year low, defying recession forecasts and adding pressure on the Federal Reserve to keep raising rates.

Nonfarm payrolls increased 517,000 last month after a 260,000 gain in December. The unemployment rate dropped to 3.4%, the lowest since May 1969.

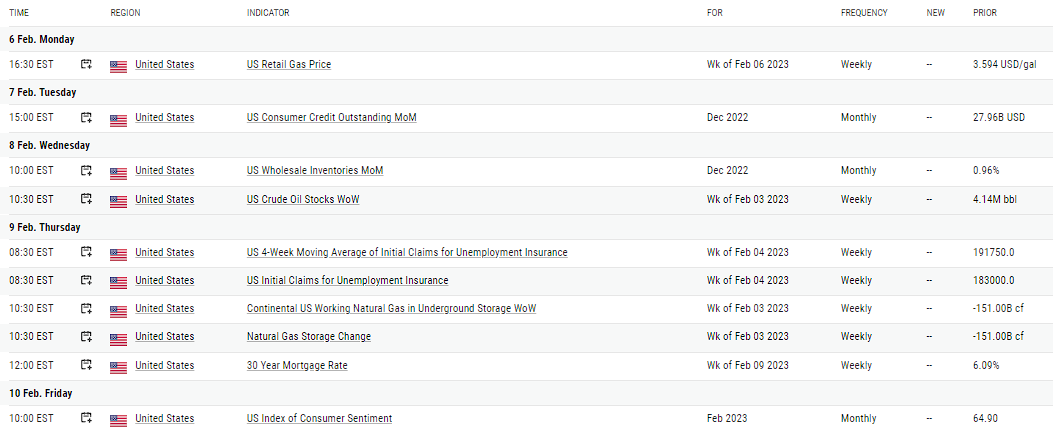

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A gauge of US services snapped back in January after an end-of-2022 slump, suggesting a resurgence in consumer demand that leans against concerns of an imminent economic slowdown.

The ISM’s non-manufacturing index rose 6 points to 55.2 in the largest monthly advance since mid-2020. Readings above 50 signal economic growth and the January figure topped all estimates in a Bloomberg survey of economists.

Chart That Caught Our Eye

Analyst Team Note:

“The Big Picture: spread US IG BBB bond yield vs T-bills lowest (60bps) since Jan'81…so rare & such “greed” preceded tops & crashes; we are bullish bonds H1’23 but once recession starts, yield curve steepens, and only if credit (homebuilders, semis, banks) continues to rally can we be sure bull has begun, landing soft.” - Michael Hartnett, BofA

Sentiment Check: Don’t Capitulate

Make sure to check Larry’s most recent market updates via his personal newsletter.

Thanks for reading Larry's Analyst Team! Join our email community for market updates like these each week.