2.28.24: Bank Lending Standards Loosen as Markets on a Hot 2024 Start

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5066.64

KWEB (Chinese Internet) ETF: $25.52

Analyst Team Note:

The S&P 500 is statistically expensive on 19 of the 20 metrics tracked by BofA and is trading at its 95th percentile based on trailing PE, based on data since 1900.

In the long-term, valuation is almost all that matters but near-term factors like sentiment and earnings surprise matter over the next quarter/ year and have been the biggest drivers of 2023/2024 gains so far.

Macro Chart In Focus

Analyst Team Note:

The market rally could continue to rally based off net loosening in bank lending standards.

In the seven times since 1950 when the US economy did not crash into a recession within a year of the first Fed rate cut, the S&P500, almost without fail, delivered positive returns on a 3/6/9/12-month horizon from the date of the first cut with average returns of 10%/12%/14%/15% respectively.

The returns going into the rate cut, though, were much more varied, ranging from -8% to 10%.

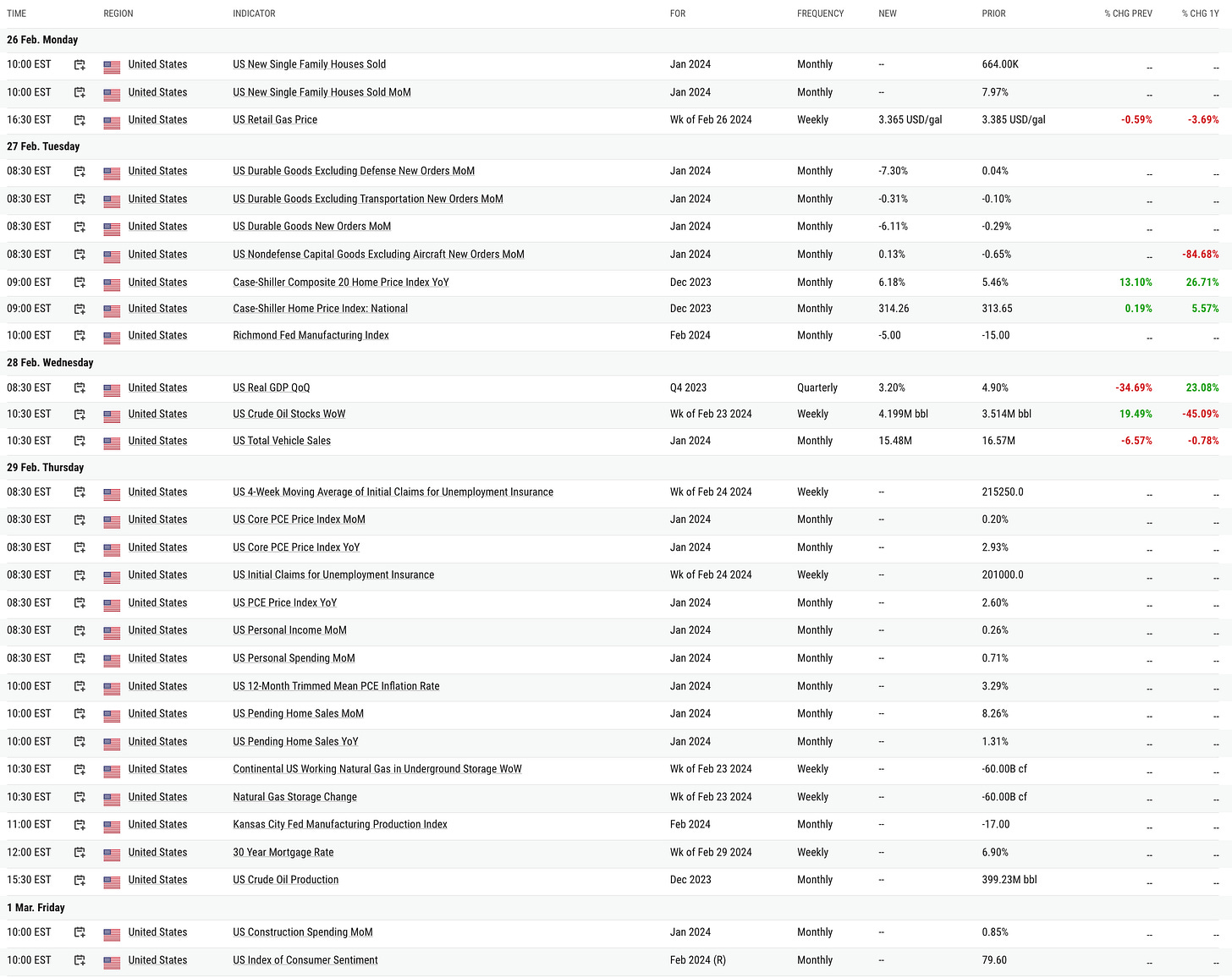

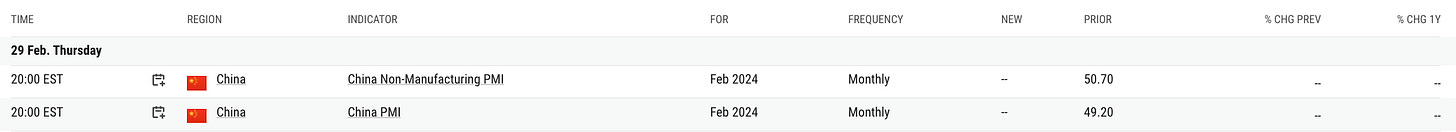

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The US economy grew at a slightly reduced pace of 3.2% in the last quarter of the previous year, adjusted down from an initial 3.3%, with a notable increase in household spending and investment overshadowing a downward revision in inventories.

Consumer spending, nonresidential and residential investments, and government spending all saw upward revisions, showing stronger domestic demand and a more robust economy than anticipated.

Inflation rates were also adjusted upwards, with the personal consumption expenditures price index rising at a 1.8% annual rate.

Chart That Caught Our Eye

Analyst Team Note:

In response to liquidity crises triggered by the failures of Silicon Valley Bank and Signature Bank, the Federal Reserve established the Bank Term Funding Program (BTFP) to aid banks in meeting depositor demands without incurring losses from forced sales of securities.

The program, allowing banks to pledge Treasuries and agency mortgage-backed securities for up to one-year loans, saw borrowing peak at around $100bn between March and June 2023, before stabilizing.

Towards the year's end, BTFP borrowing ticked back up, partly due to expectations of the program's conclusion and arbitrage opportunities.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.