2.26.24: Cheaper For Companies to Sell Equity than Debt...

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5069.53

KWEB (Chinese Internet) ETF: $25.80

Analyst Team Note:

For the first time in over two decades, it’s cheaper for blue-chip companies in the US to sell shares than to borrow in the debt markets, according to Bloomberg.

The trend of companies potentially shifting from relying on debt to favoring equity financing could have significant implications, given that the global stock market has been contracting for over two decades.

In the US, the number of publicly traded companies has halved from around 7,500 to 4,000.

While debt has traditionally been preferred due to its cost advantages and tax benefits, the rising interest rates and high share prices are making equity issuance a more attractive option for some companies.

Macro Chart In Focus

Analyst Team Note:

“The bottom line is that the Fed sees risk management considerations as heavily influencing the timing of rate cuts. The Fed sees risks from easing too quickly as outweighing downside risks from maintaining a restrictive stance for too long. The Fed would prefer to avoid backtracking once it starts.” - BofA

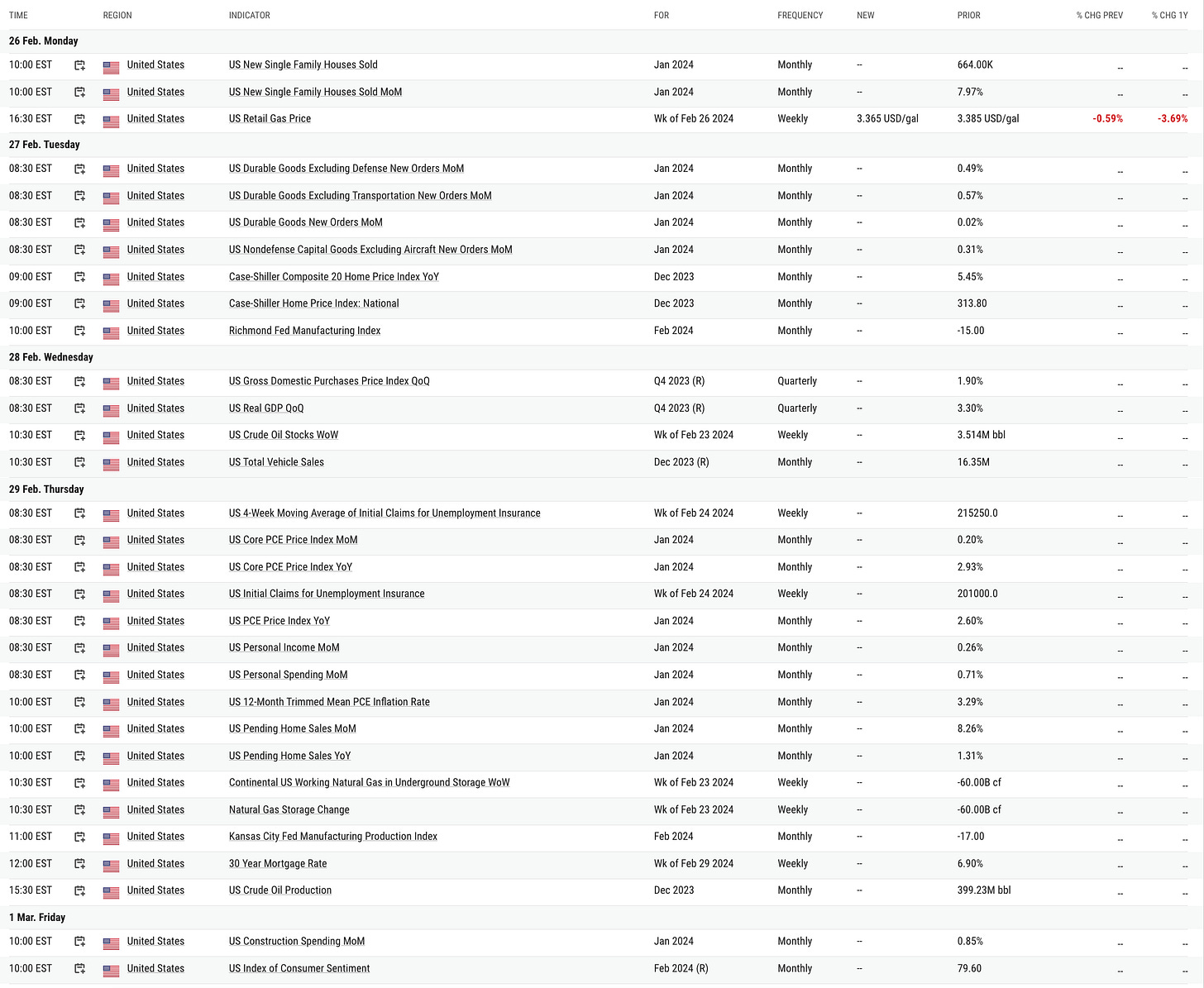

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A study by IMF and Harvard researchers, including Lawrence Summers, found that the disconnect between the strong performance of the US economy and the persistently low consumer sentiment is due to elevated borrowing costs not accounted for in traditional inflation measures.

Despite low unemployment and growing economic indicators, the increased cost of financing—exacerbated by the Fed's interest rate hikes since March 2022—has significantly impacted consumers' financial well-being.

This impact is particularly felt in areas like credit card debt and car financing, which are not reflected in CPI.

The paper proposes that including these borrowing costs in inflation measures could explain much of the discrepancy between official economic indicators and consumer sentiment.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.