2.24.23: A Reset in Investor Sentiment Has Occurred, as we have patiently waited for

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: We’re not going to go over my bearish opinions on markets at peak euphoria in 2023 that I’ve shared constantly publicly and privately on Youtube, Twitter, Instagram, and Substack. They have now been largely validated.

I know many investors are now concerned, and that means your concern is my concern. I would be personally surprised if members find themselves wrongly positioned after our specific opinions provided. But falling markets provide many people discomfort, and I fully understand this.

Trust that as markets get more challenging, I will be here to provide you best-in-class thinking and strategy. Be a part of my growing Tribe on Substack/Patreon. I want to help you!

We successfully discussed 4200 as formidable resistance for U.S. SPX. I will be assessing whether this latest selloff is the start of something more sinister, or just a speed bump along the way to a “Soft Landing".

As a broader mission - I will help do my best to help everyone navigate this bear market. Please be long-term, and please be patient. I am unable to help those who lack these 2 critical personal qualities.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4012.32

KWEB (Chinese Internet) ETF: $30.03

Analyst Team Note:

Investors are dumping both equities and cash alike in favor of bonds. Global equity funds lost $7 billion in outflows in the week through Feb. 22, while $3.8 billion left cash funds. At $4.9 billion, bonds drew additions for an eighth straight week in the longest such streak since November 2021,

Macro Chart In Focus

Analyst Team Note:

According to many sell-side/buy-side analysts, the dollar's rally may be over after reaching generational highs last year and causing significant disruptions to the global economy. Many believe that the dollar's multi-year decline has started, as the bulk of Federal Reserve rate increases is over and virtually every other currency will strengthen as their central banks keep tightening.

The relief a weaker dollar would bring to the world economy cannot be overstated, with import prices for developing nations falling, helping to lower global inflation, and boosting the price of risk assets like gold, equities, and cryptocurrencies.

However, no one is betting that the dollar's decline will be a straight line as US rates continue to rise and the threat of a global recession and geopolitical risks foster demand for havens. It’s also worth noting that some of the benefits of a weak dollar, like boosting the price of risk assets, is not what the Fed wants right now.

-The Sell Side

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The Fed's January 2023 Senior Loan Officer Opinion Survey showed that respondents reported tighter lending standards and weaker demand for business and consumer loans. Banks tightened lending standards on C&I loans to firms of all sizes, with a net percentage of 44.8% of banks tightening standards for large firms, close to the peak tightening of standards that occurred during the four recessions the US has incurred since 1990.

This tightening of standards included tighter loan collateralization requirements, lower maximum maturities and credit line sizes, among other items. Additionally, significant net shares of banks reported tightening lending standards for consumer loans, including auto loans, credit cards, and other forms of consumer lending, with banks citing decreased customer investment and financing needs as factors softening loan demand.

Overall, the tightening of lending standards suggests a potential cooling of lending activity and a headwind for economic growth.

Chart That Caught Our Eye

Analyst Team Note:

Short-term gain, long-term pain: fiscal stimulus panic (energy price caps/rebates, bailouts, nationalization) v successful in averting recession in early-2020s…

but deficits rising again… UK Jan’23 fiscal deficit up to 5.2% of GDP, due to higher energy subsidies; EU energy bailouts > $750bn past 12 months…

US Federal deficit up to 6.1% of GDP (was 3.9% of GDP Jul ’22) due to fiscal infrastructure spend; at peak of 2000 expansion, US ran fiscal surplus, peak of 2007 expansion deficit was 1% of GDP, peak of last expansion deficit was 2.5% of GDP, in latest one deficit was 4% of GDP (Chart 7)…clear secular deterioration…

US government debt to rise >$21tn next 10 years = $5.2bn every day, $218mn every hour…

the great irony of inflationary 2020s will be in next recession Fed forced to resort to YCC to bail out US government…and that’s when the next great bull market in risk begins

From BofA’s Michael Hartnett

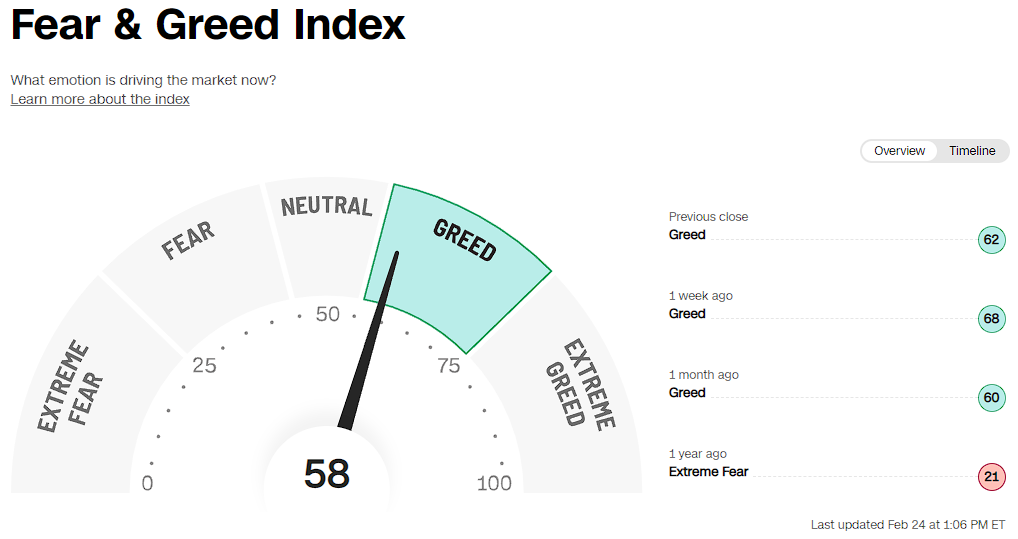

Sentiment Check

Strategist Larry’s Latest Popular Tweet (Follow):