2.22.23: NVDA Earnings Optimism Potentially May Pause Bearish Sentiment. If it doesn't, then markets have much further to fall.

For Public: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I will be digesting the market’s internals and will send Members a note later this week if I see anything critical. For now, my views stay unchanged from my most recent private Strategy note sent to my Community. Join our Community, and navigate what we believe will be a very challenging year for markets.

In the meantime, there is a development happening with the ongoing U.S. Food Crisis (that impacts 42M Americans) which I believe merits your attention. More detail in my latest Youtube video. Share with friends and family to get the message across.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3997.34

KWEB (Chinese Internet) ETF: $30.16

Analyst Team Note:

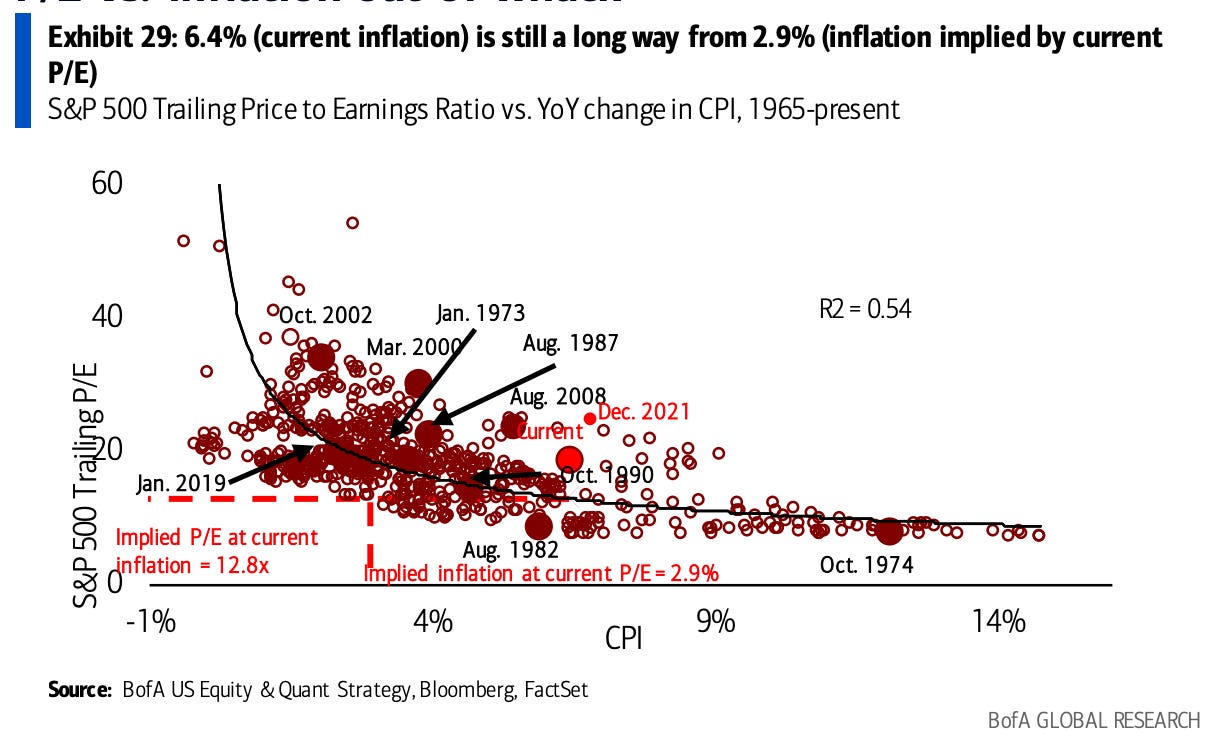

As seen in the charts below, market valuations are implying an inflation rate much lower than reality. The Rule of 20 states that the markets are overvalued when the S&P 500’s trailing P/E + CPI YoY is over 20. Markets usually bottom when this combined number is under 20.

Macro Chart In Focus

Analyst Team Note:

The MSCI All Country World Index's average pairwise correlation reading in January was at its lowest level since October 2021, while the variance in one-month returns spiked to an above-average level, coming off pandemic lows.

In 2022, equity returns worldwide have been driven by fears of recession and increased interest-rate volatility, making it a macro-driven year. However, the falling correlations among individual stocks over the past few weeks suggest that the environment for stock selection and active strategies is improving. This change indicates that stock moves are more likely to be due to specific fundamentals rather than macro news.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Interesting chart from Bloomberg showing the 100 most common relocations in 2021.

Chart That Caught Our Eye

Analyst Team Note:

Investors are not seeking safety in US Treasuries and gold despite high geoplitical tensions due to the Ukraine war, as investors are seemingly more concerned about the Federal Reserve tightening money supply, which weakens the case for holding either Treasuries or gold. Although there has been much talk on Twitter about World War III, Google search data suggests that people are not particularly interested in the conflict in Ukraine, and for now, the changing perception of the US economy is the main concern for investors.