2.21.24: Nervous Markets Anxiously Await NVDA Earnings

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4946.84

KWEB (Chinese Internet) ETF: 25.38

Analyst Team Note:

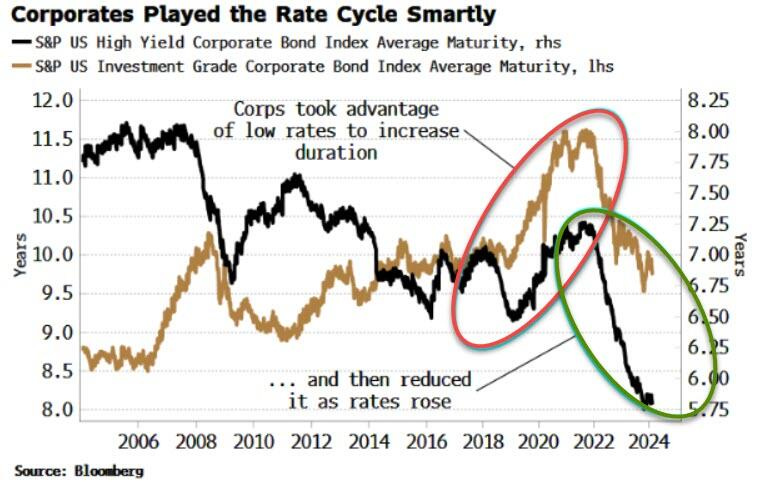

Recent rally in stock valuations, particularly in the technology sector, has been a key factor driving the narrowing of investment-grade credit spreads, signaling an improvement in credit market conditions despite the previous downturn in 2023.

Corporate strategies of managing debt duration and structuring assets and liabilities have also contributed to healthier corporate cash flows.

Macro Chart In Focus

Analyst Team Note:

Capital One's $35 billion bid for Discover Financial Services and Walmart's $2.3 billion acquisition of Vizio boosted global deal values to approximately $425 billion, a 55% increase from the previous year.

Despite ongoing geopolitical tensions and economic uncertainties, the US market's M&A deal values increased 80% YoY.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

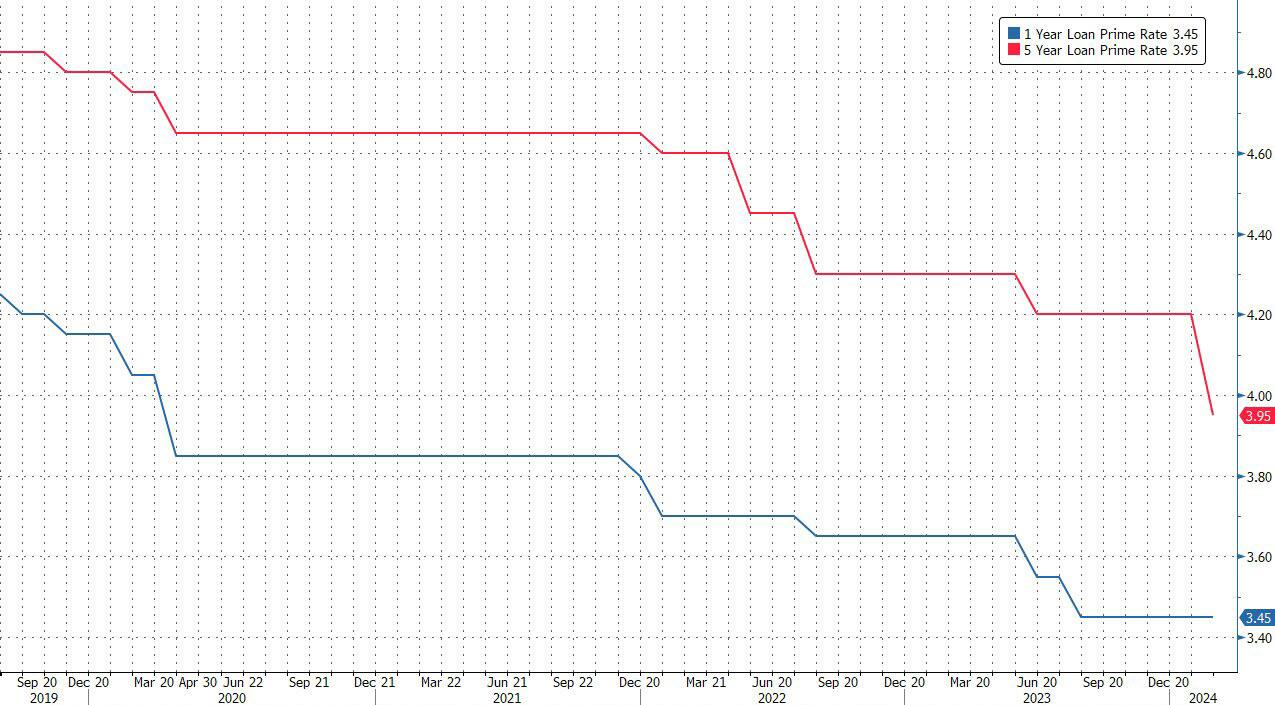

In response to expectations for monetary easing, the People's Bank of China (PBOC) cut the 5-year loan prime rate by 25 basis points to 3.95%, the largest reduction since the loan pricing mechanism's overhaul in 2019, while keeping the 1-year rate steady at 3.45%.

This move, aimed at supporting the real estate market and boosting economic confidence, was larger than many anticipated and comes amid a backdrop of weak loan demand and ongoing challenges in the property sector.

Despite mixed reactions from analysts regarding the cut's potential impact on real estate and loan demand, the adjustment has led to an uptick in market optimism.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.