2.19.24: Shorting Chinese Stocks Increasingly Crowded

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5005.57

KWEB (Chinese Internet) ETF: $25.41

Analyst Team Note:

Of the non-U.S. G20 countries, only China and Japan have greater profits than the Magnificent 7 when their listed companies are combined.

The Magnificent 7′s combined market cap alone would make it the second-largest country stock exchange in the world, double that of Japan in fourth.

Microsoft and Apple, individually, have similar market caps to all combined listed companies in each of France, Saudi Arabia and the U.K.

Macro Chart In Focus

Analyst Team Note:

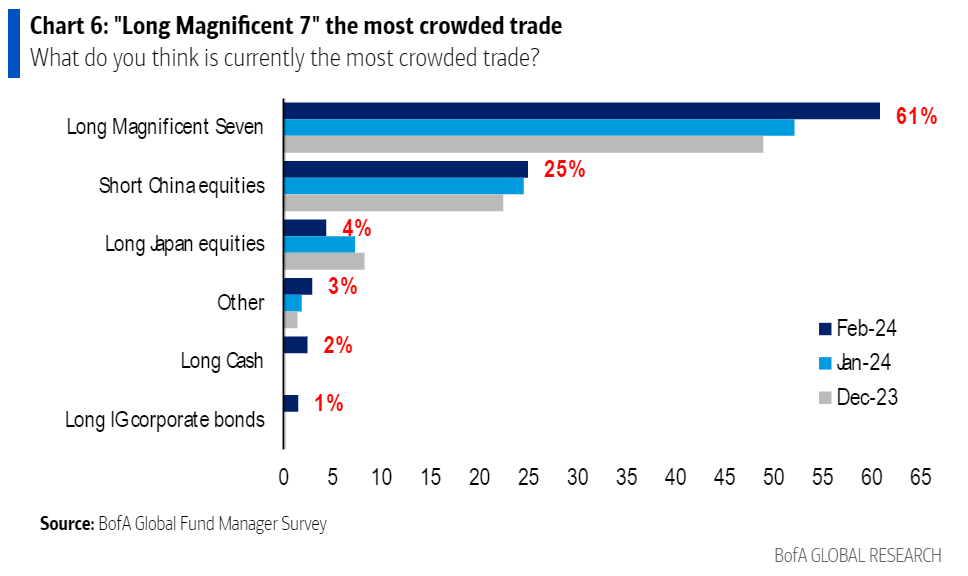

Global money managers are increasingly wary of Chinese markets due to the property crisis, deflation, slowing growth, and rising youth unemployment, leading to a nearly 7% slump in the MSCI China index this year.

Despite a surge in funds focused on Chinese stocks, driven possibly by state-backed investors, skepticism remains high, with calls for more efficient capital deployment and policy measures to stimulate the economy.

According to BofA’s Fund Manager Survey, shorting Chinese stocks is the 2nd most crowded trade behind the Mag7.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Despite the strong post-Covid recovery of the US economy, Biden's approval ratings haven't improved in tandem with the recent upswing in consumer sentiment, a disconnect attributed to factors like lingering inflation effects and partisan sentiments.

While consumer spending has been strong, supported by a resilient job market, challenges like potential increases in unemployment, high inflation impacting purchasing power, and slowing economic growth could impact Biden's reelection prospects.

Chart That Caught Our Eye

Analyst Team Note:

The U.S. is expected to pay an additional $1.1 trillion in interest over the coming decade.

Interest costs are projected to reach 3.9% of GDP by 2034.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.