2.14.24: Sentiment Highest in Two Years as Probability of Rate Cuts Decline

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5000.62

KWEB (Chinese Internet) ETF: $25.19

Analyst Team Note:

Fund manager sentiment is at its highest in almost two years.

Sentiment is generally a contrarian signal.

Macro Chart In Focus

Analyst Team Note:

After a hot January inflation print, fed fund futures expectations has moved higher, removing 17bps of cuts from 2024 and is pricing only 35% probability of a cut by May (from 64% prior to the inflation data release).

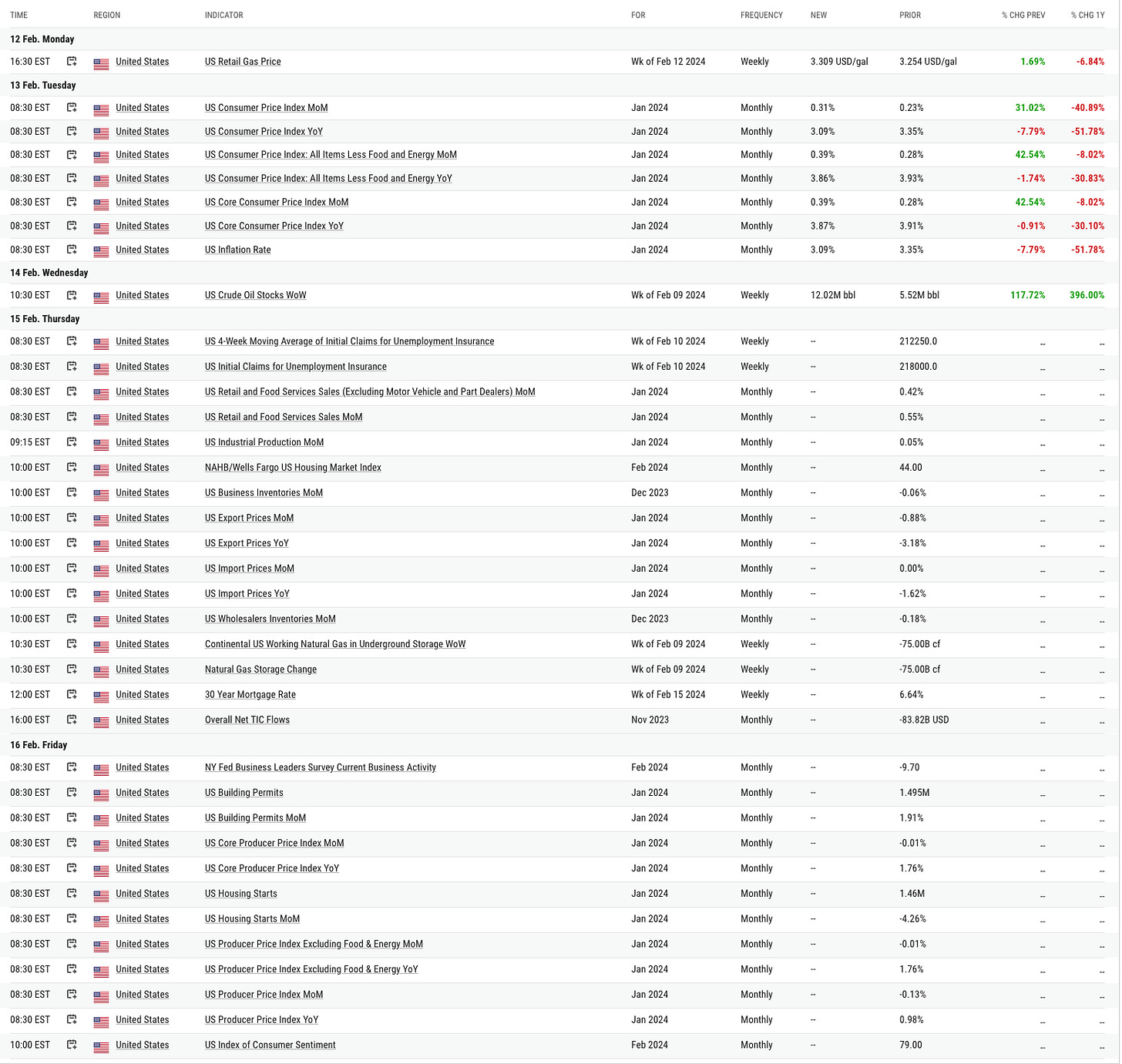

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

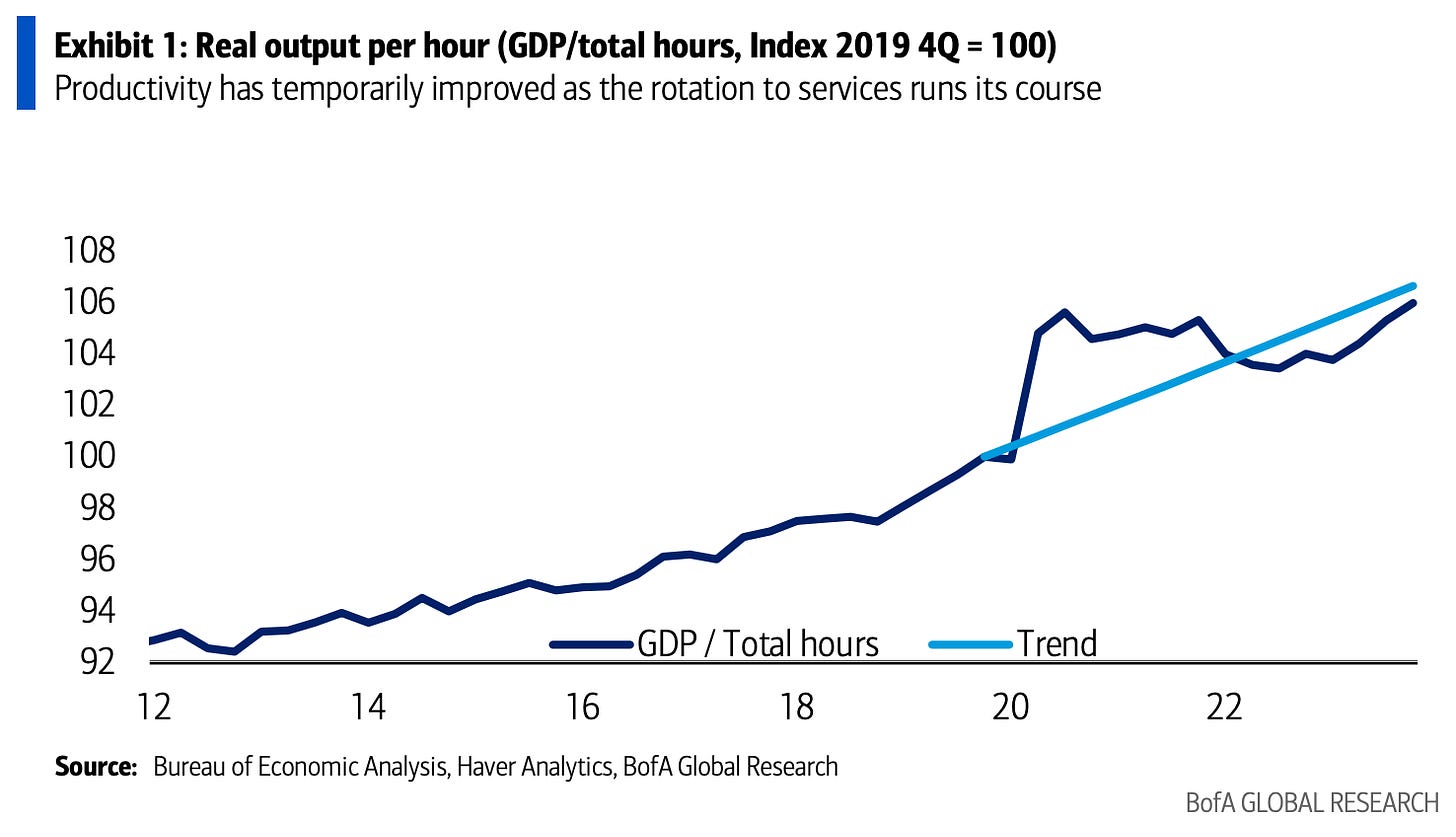

Over the past three quarters of 2023, labor productivity has shown significant growth, with annualized increases of 3.6%, 4.9%, and 3.2% in the second, third, and fourth quarters, respectively.

`This trend led to optimistic speculations about the U.S. entering a period of higher trend productivity growth, which is crucial for enhancing living standards.

Recent improvements may just be part of a normalization process following the COVID-19 pandemic's impact on demand dynamics. The pandemic initially shifted demand towards goods, leading to a surge in productivity as nonfarm payrolls dropped and goods consumption soared.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.