2.13.23: Markets Are Priced For Softer Than Expected Inflation. Will Bulls get their Wish?

For Public: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Good luck to the folks on inflation CPI day tomorrow. We’ve published a Pre-CPI note here on the latest inter-market data, and will follow up with a Part 2 in the coming days after the report is digested by market participants.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4090.46

KWEB (Chinese Internet) ETF: $31.71

Analyst Team Note:

Current Q4 earnings for 345 S&P 500 companies, representing 81% of earnings, are tracking a 1% miss compared to the historical average of a 4% beat. The weak guidance and margin compression resulted in a 2023 earnings growth forecast of just 1% YoY compared to the June forecast of 10% YoY, which is a typical pattern in the early stages of an earnings recession where sales slow faster than costs leading to an initial decline in earnings.

In our view, the next stage, which is likely in a soft or hard landing, will result in a more dramatic deterioration in earnings as companies can't cut costs fast enough.

Macro Chart In Focus

Analyst Team Note:

“Credit spreads are looking increasingly detached to rising leverage, tight global liquidity and recession risk...

Since peaking out in October, spreads have been tightening, but this is increasingly at odds with many other indicators.

The global liquidity environment remains very tight, which pressures spreads wider. Similarly, personal savings have been rising, which at the margin is bad for companies as income is diverted away from them.

Credit markets are also complacent on the risk of a recession. We can look at how various assets have behaved in previous ones and compare it to how they have performed in this cycle to infer an implied probability of a recession.

While the yield curve is “certain” a recession is on the way, and even rose-tinted equities see a slump occurring as better than evens, credit spreads are implying only a one-in-six chance of a downturn. But the likelihood of a recession from multiple angles suggests the risk is much higher.” - Bloomberg Macro

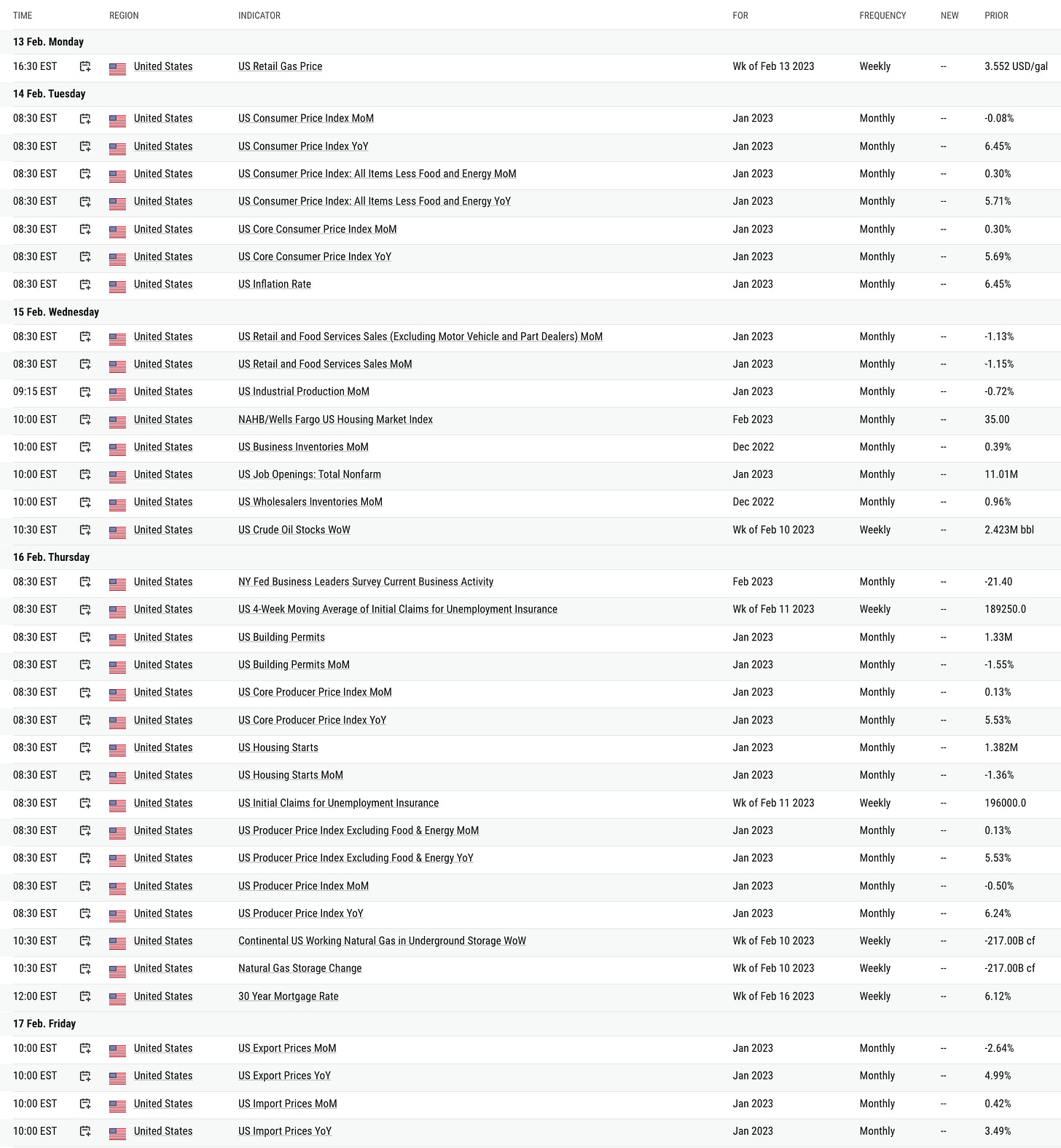

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

Despite the FOMC reiterating that there is no pivot coming to monetary policy anytime soon, investors are expecting that rate cuts will come as soon as July of this year…

The reasoning may be:

Economy avoids recession

Employment remains strong, wages support consumers

Margins won’t compress as much as expected

Fed backs off as inflation falls.

Here’s the issue.

If the economy and employment remain strong, and we skirt a recession, there is no reason for the Fed to begin cutting rates. While the Fed may stop hiking rates, if the economy is functioning normally and inflation is falling, there is no reason for rate cuts.

As discussed numerous times before, the Fed wants tighter financial conditions, and any rally in the equity markets is a loosening of financial conditions.

Chart That Caught Our Eye

Analyst Team Note:

The deterioration in bank lending suggests that a mild recession is still in the books for later this year. The Fed’s Loan Officer survey found that banks have tightened standards for commercial and industrial loans, as well as for major categories of commercial real estate loans, residential mortgage loans, and consumer loans.

At the same time, demand for bank loans has fallen further, with a net 89% of banks reporting weaker demand for residential mortgage loans and a net 60% reporting less demand for commercial real estate loans.