2.1.24: Powell dismisses expectations for rate cut in March

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4879.89

KWEB (Chinese Internet) ETF: $23.67

Analyst Team Note:

New York Community Bancorp plummeted by a record 38% after the bank announced a dramatic increase in its provision for loan losses to $552 million and a reduction in its dividend, signaling deeper concerns within the commercial real estate sector. e

The provision for loans was more than 10 times what analysts had estimated and was greater than the firm’s total provisions for the prior decade.

The KBW Regional Banking Index dropped 6%, its worst day since a deposit run toppled Silicon Valley Bank last March.

Macro Chart In Focus

Analyst Team Note:

Fed officials continue to signal the end of their aggressive rate hike campaign and now emphasize a cautious approach towards easing monetary policy.

Chair Jerome Powell underscored the Fed's patience and data dependency, dismissing immediate expectations for rate cuts, particularly by the March meeting.

Powell's remarks highlighted the Fed's focus on avoiding premature policy shifts that could necessitate reversing course amidst a still-solid economy and concerns over potential inflation figure revisions.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

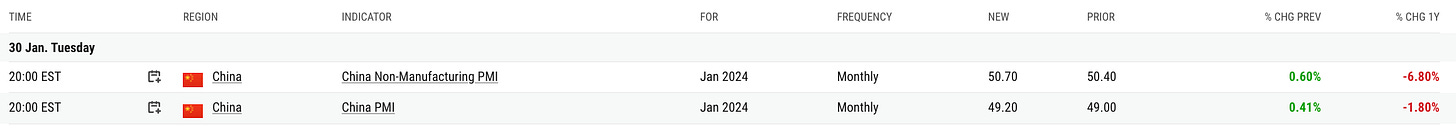

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China's Caixin manufacturing purchasing managers index remained in expansion territory for the third consecutive month in January, indicating ongoing improvement in the manufacturing sector despite challenges in employment and deflationary pressures.

This contrasts with official data that shows a continued contraction in manufacturing activity.

Amidst broader economic concerns, including a significant stock market downturn and a prolonged property crisis, there are calls for increased government support to stimulate the economy.

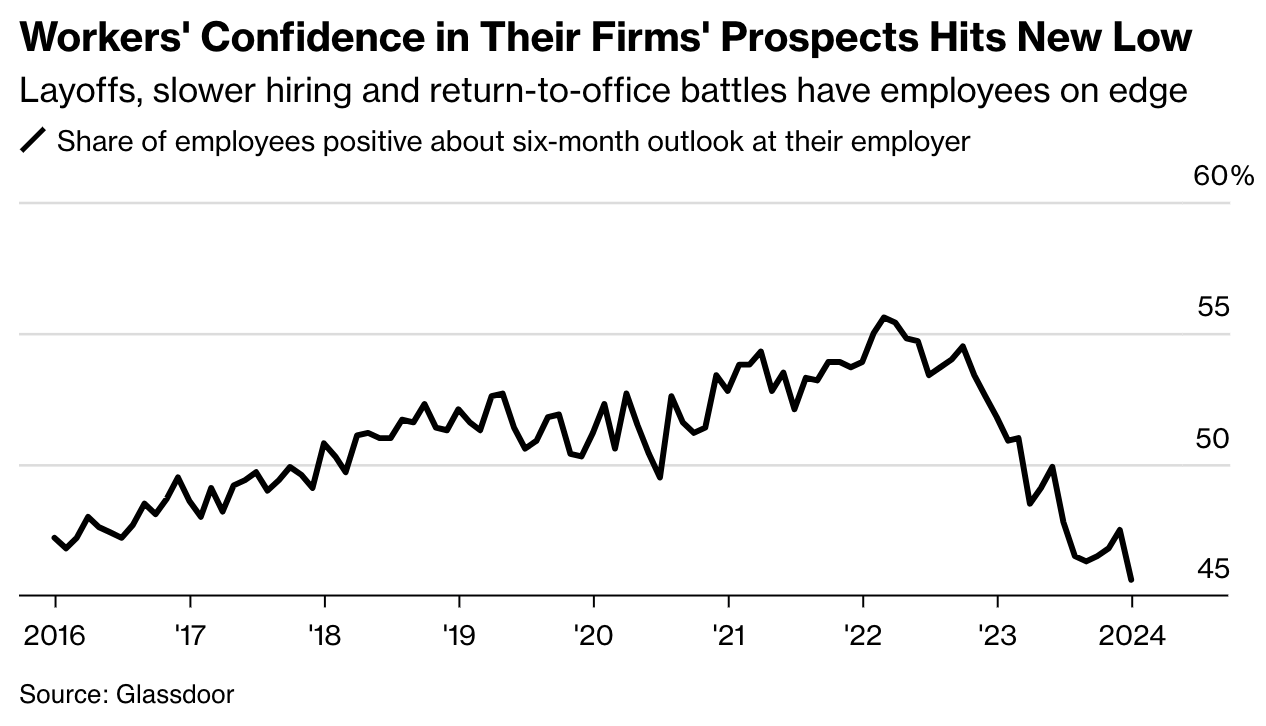

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.