2.1.23: Powell give markets the Green Light for near-term speculation. Near-term is the key phrase.

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers (From Larry): Ahead of today’s FOMC, I’ve proactively sent additional inter-market data and will do a post-FOMC follow up tomorrow as part of my February Investment Strategy Part 2. In the days before January concluded, I released February Strategy Part 1, where my views for further near-term market strength is playing out.

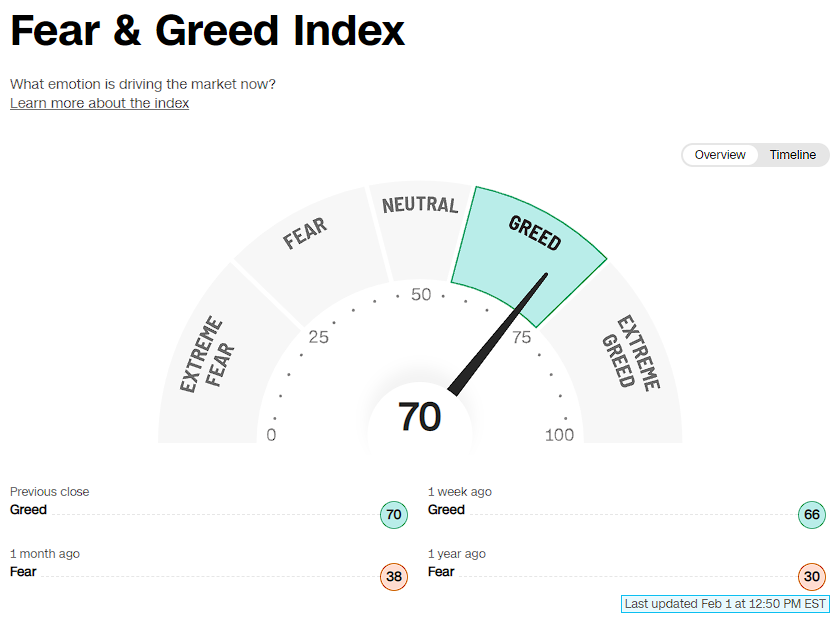

My bias/view on markets on longer time frames has been bearish, but my execution plan provided inside the Community has kept me and members in markets heading into and after FOMC given that certain downside thresholds did not trigger. Now, I do not agree with today’s valuations but it will take some time for this froth to play its course.

I will discuss more execution and strategy in Feb. Part 2 released tomorrow.

We have Apple, Amazon, and Google earnings tomorrow after the market. Fundamentally speaking, those earnings reports are more important than today’s FOMC event.

Inside our Community, I wish to help you capture as much of the market’s upside remaining as safely as possible with thoughtful strategy and risk management. Read my piece below.

Side Note: There are many impersonators on social media always randomly messaging my followers. Please recognize that it’s not me unless it’s my official handles on Twitter and Instagram.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check it out.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4076.60

KWEB (Chinese Internet) ETF: $33.87

Analyst Team Note:

From BofA… Five of six cyclical sectors saw big outflows last year, worth $22bn in total. In energy and tech, flows tell the opposite story of returns.

Tech buyers unfazed: Technology was the second worst performing sector in 2022, down -28%. It was also the only cyclical sector to avoid outflows as investor sentiment turned positive in Q4, driving fresh inflows.

Energy buyers in hiding: Despite stellar returns in 2022 (+65%), energy sector ETFs still saw -$1.6bn in outflows. We have a favorable view based on valuation, light positioning, and strong commodity & equity fundamentals.

Financials get no credit for quality…yet: The sector is cheap, under-owned, and high quality. Yet, financials saw -$9bn in outflows.

Macro Chart In Focus

Analyst Team Note:

While the Fed believes they are going to get to a 5.25% terminal rate and maintain that rate for a while, the market is currently projecting that rates likely top out at 5% at the highest. By the end of 2024, the market believes the fed funds rate will only be 2.8% —that is about 150 bps lower than what the Fed expects (4.3%).

Not much credibility…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

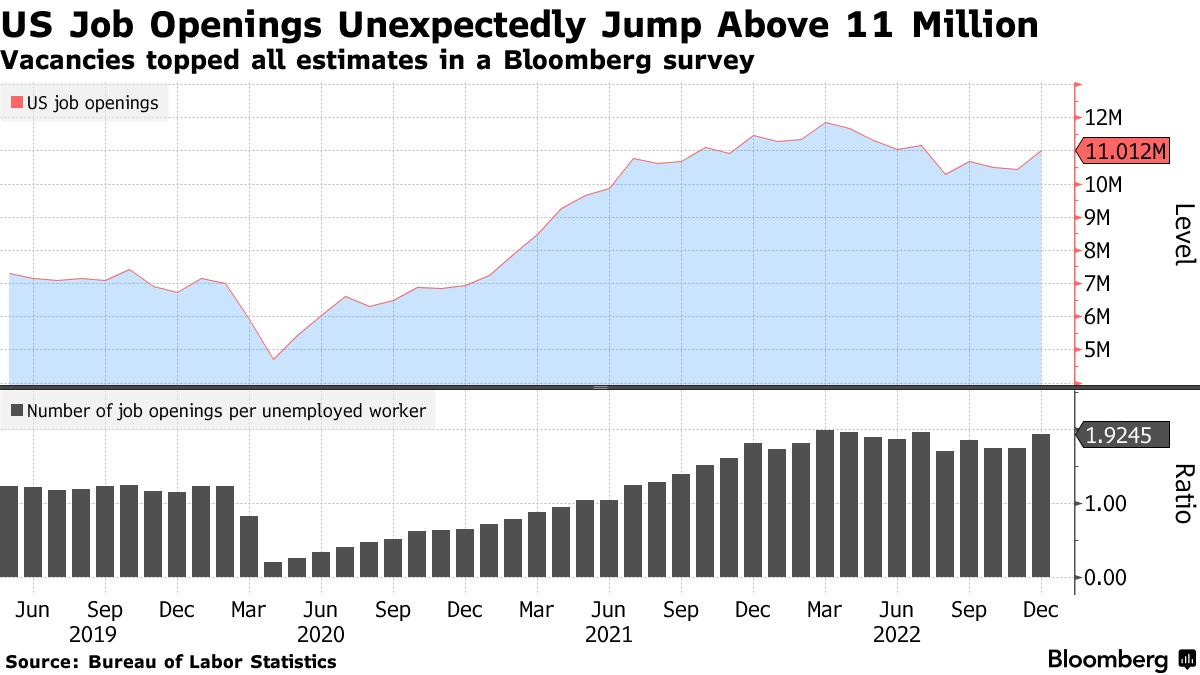

The number of available positions climbed to a five-month high of just over 11 million in December from 10.4 million a month earlier. The increase was the largest since July 2021 and mostly reflected a jump in vacancies in accommodation and food services.

The figure exceeded all economists’ estimates in a Bloomberg survey that had a median projection of 10.3 million.

Chart That Caught Our Eye

Analyst Team Note:

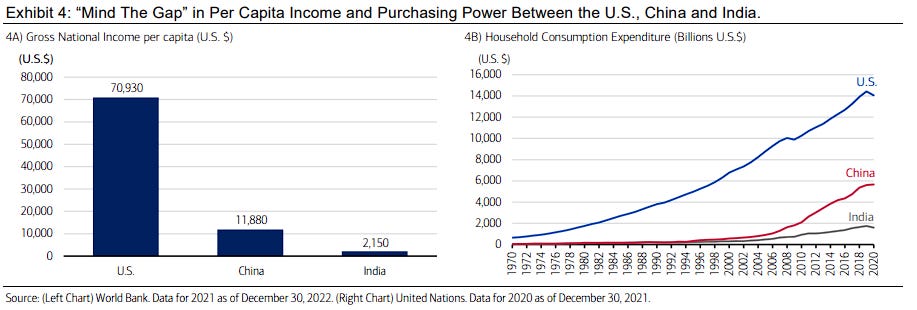

“Exhibit 4B shows the rise in household consumption expenditures for the three countries for comparative purposes. Despite the rise in consumption of the elusive emerging market consumer, even combined, China and India together account for only half the consumption base that the U.S. offers. It’s not about how many people a nation has but rather the purchasing power of the population.

The bottom line is, contrary to various media headlines hyping head count, less (population) can be more (higher per capita incomes). We believe the China reopening story, regardless of the demographics-in-decline backdrop, offers investors a unique opportunity in 2023.” - BofA Chief Investment Office

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.

Strategist Larry’s recent popular Tweets