1.29.24: Credit Markets Resurging as Yields Decline

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4890.97

KWEB (Chinese Internet) ETF: $24.48

Analyst Team Note:

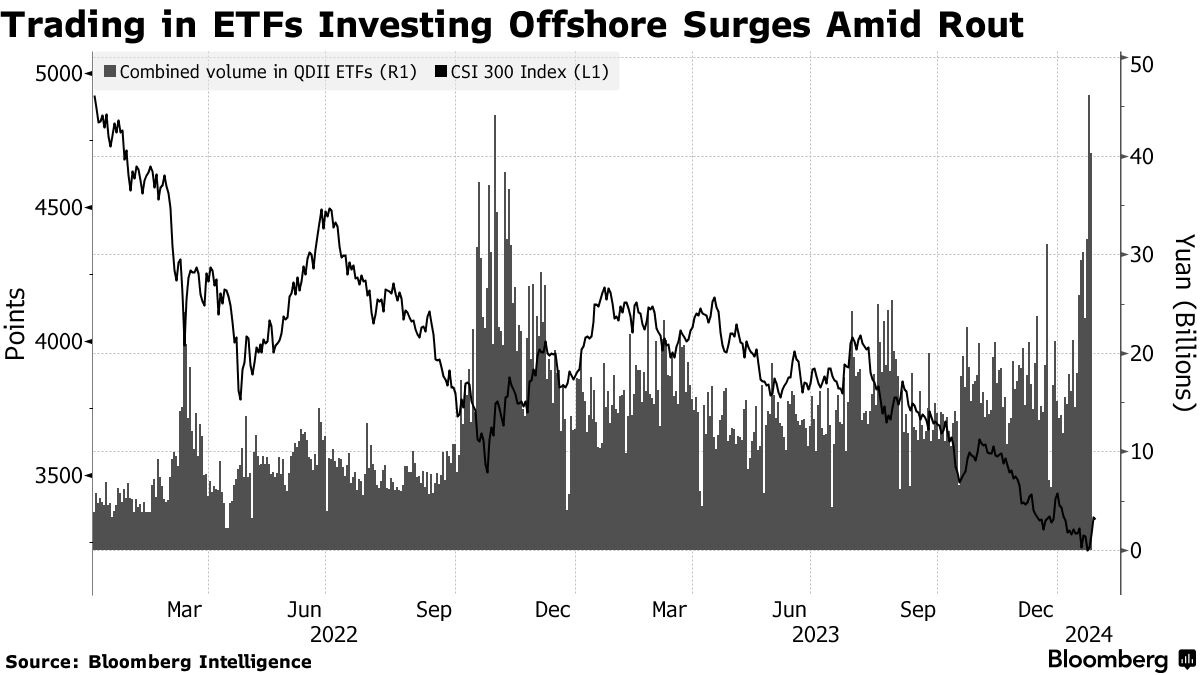

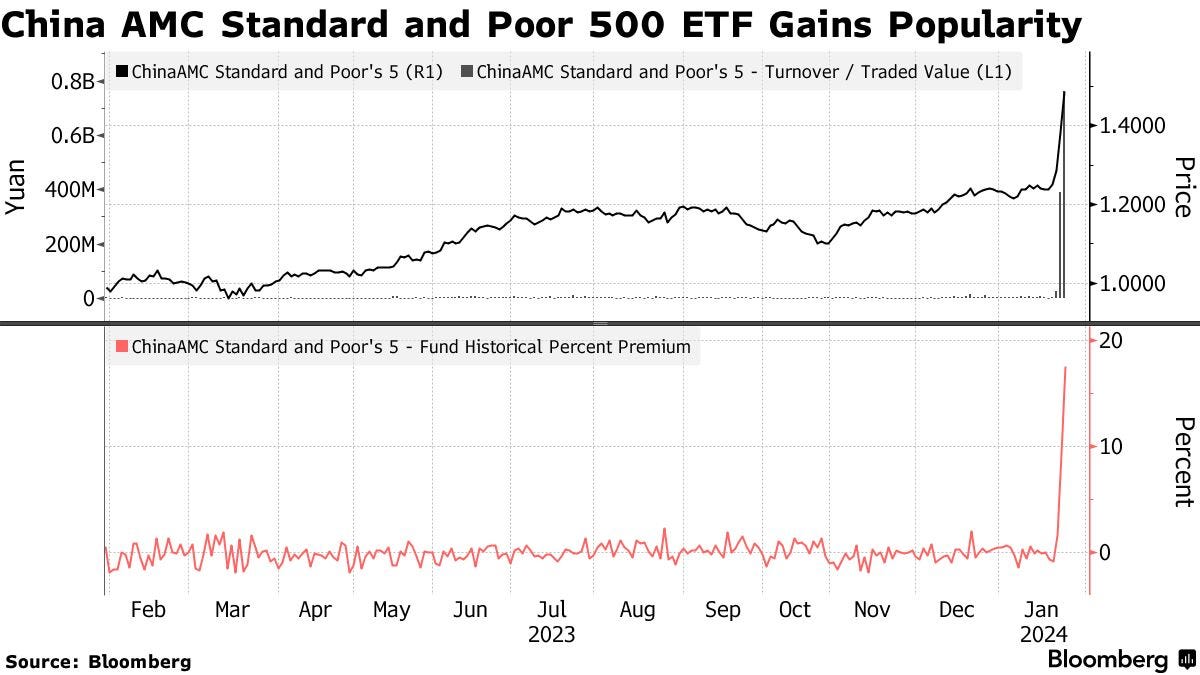

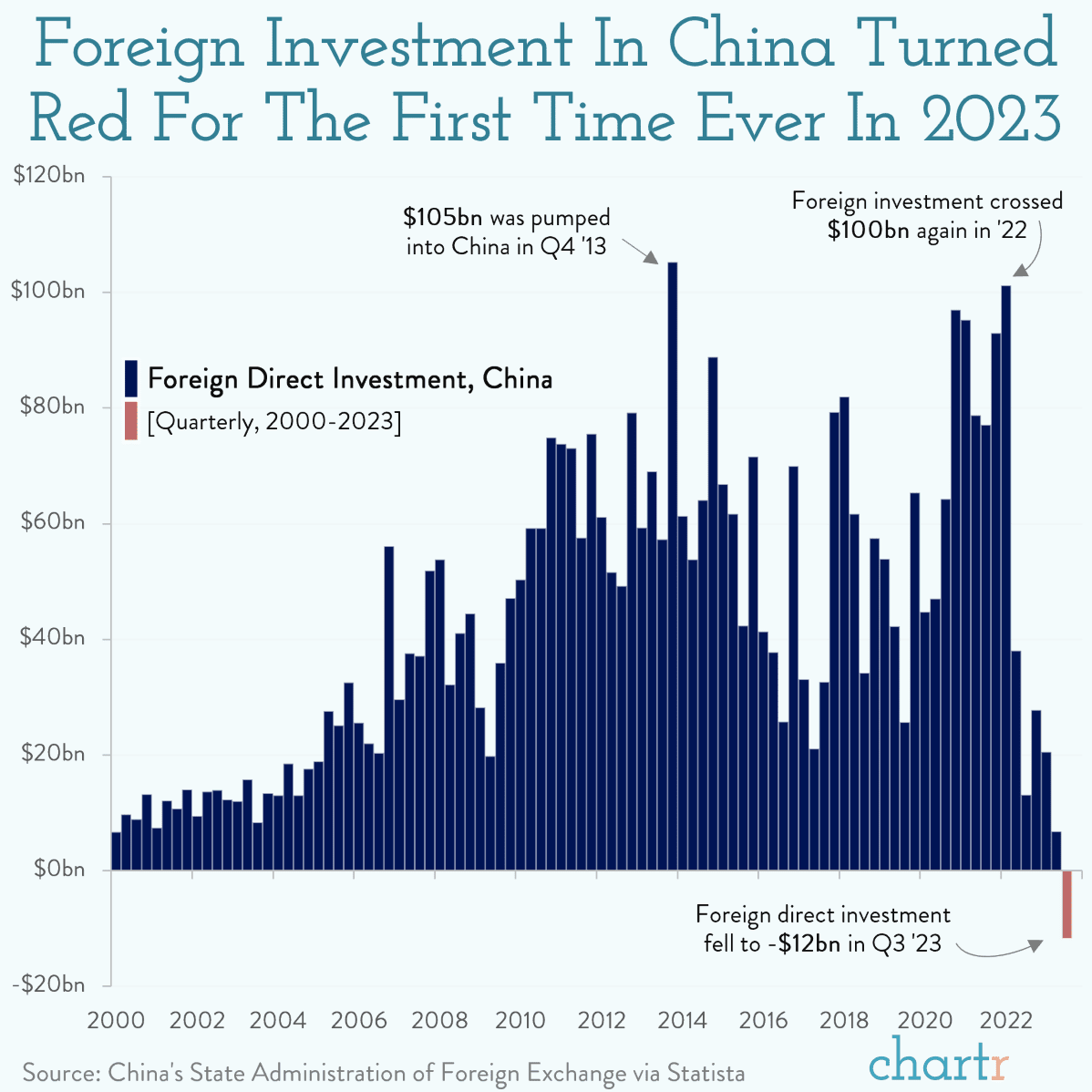

Chinese investors are showing strong interest in overseas equities, leading to significant premium distortions in ETFs tracking foreign assets.

Some Chinese traders are willing to pay up to a 40% premium for exposure to foreign stocks through ETFs, causing trading halts and purchase limits.

Capital is flowing into these ETFs due to weak performance in mainland shares and a desire for profits elsewhere.

However, experts warn that the substantial premiums may not be sustainable, and investors could face losses if these premiums disappear, creating a risk similar to what they sought to escape in the Chinese market.

Macro Chart In Focus

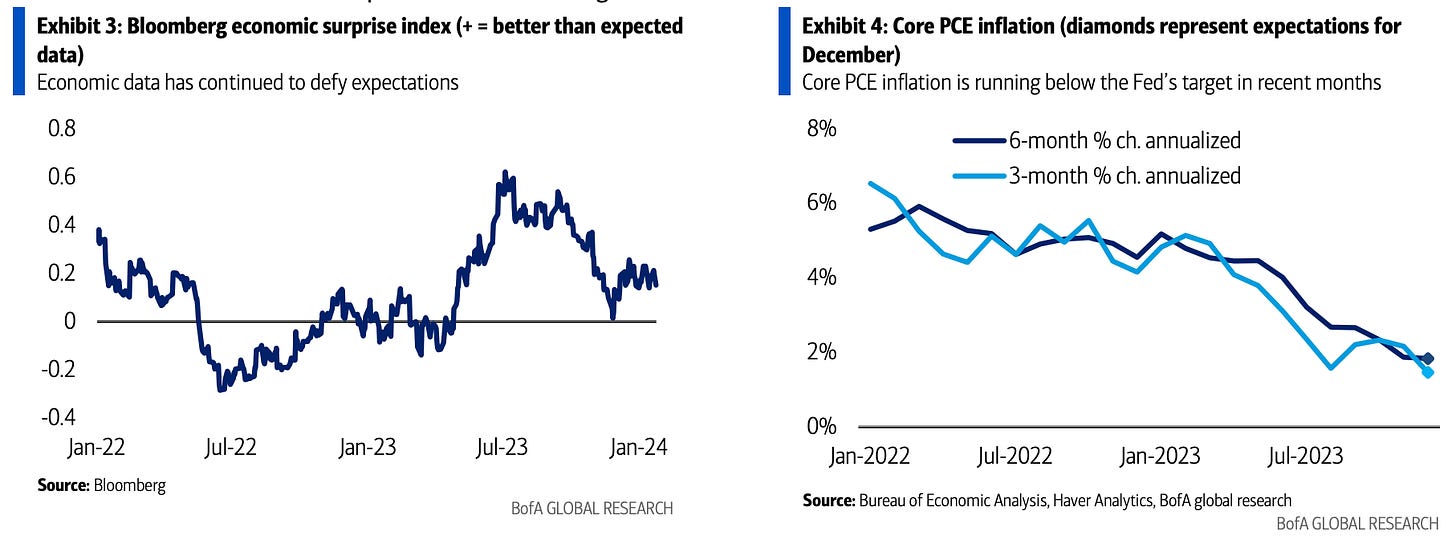

Analyst Team Note:

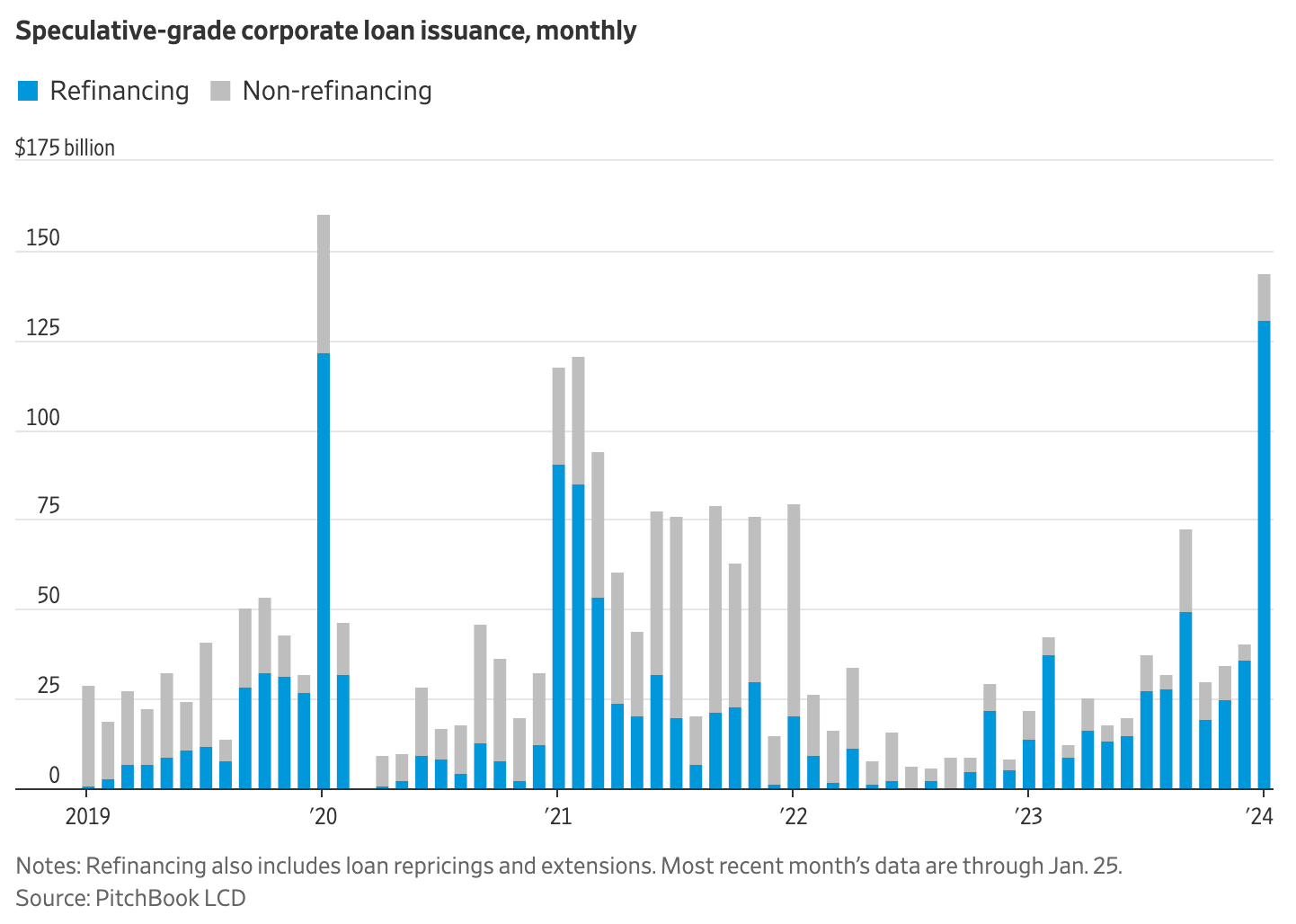

Credit markets in the United States are experiencing a resurgence, with Treasury yields falling from their highs and borrowing conditions easing for both businesses and individuals.

The corporate loan market is witnessing a surge, particularly in speculative-grade loans, with companies taking advantage of the favorable conditions to refinance existing debts and raise new capital.

Additionally, consumer confidence is bolstered by falling rates, leading to increased borrowing for mortgages and a spike in asset-backed securities issuance.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

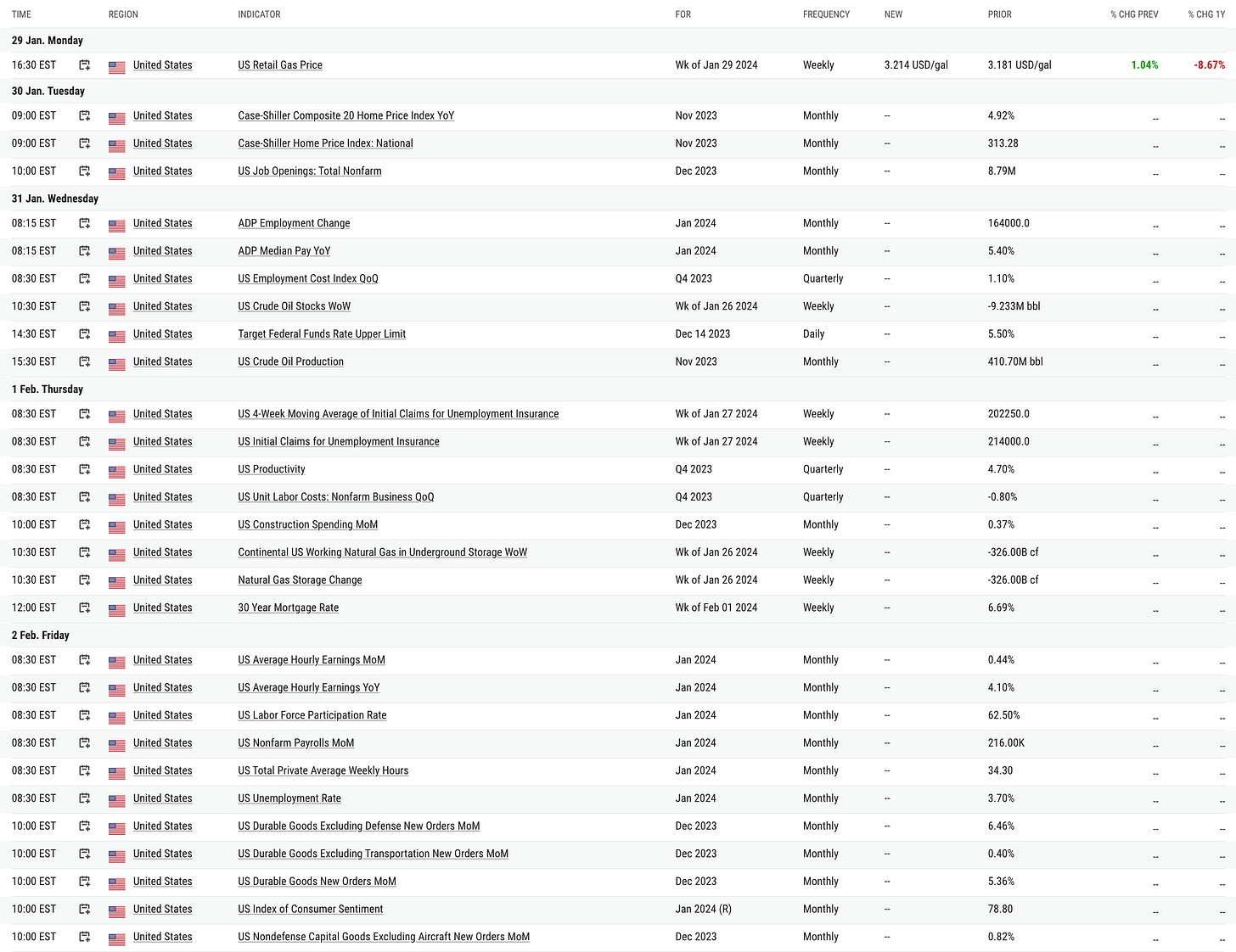

Analyst Team Note:

The Fed’s stance after this week’s meeting is expected to be cautious about specifying the timing for policy normalization, though there is a possibility of a shift in forward guidance, signaling a more neutral stance that could either lead to rate increases or cuts.

This change could reflect the end of the tightening cycle, despite concerns over the strong Q4 GDP growth potentially necessitating further action to align services inflation with targets.

The meeting will also likely involve discussions on adjusting the pace of balance sheet reduction, with no immediate decisions expected.

Chart That Caught Our Eye

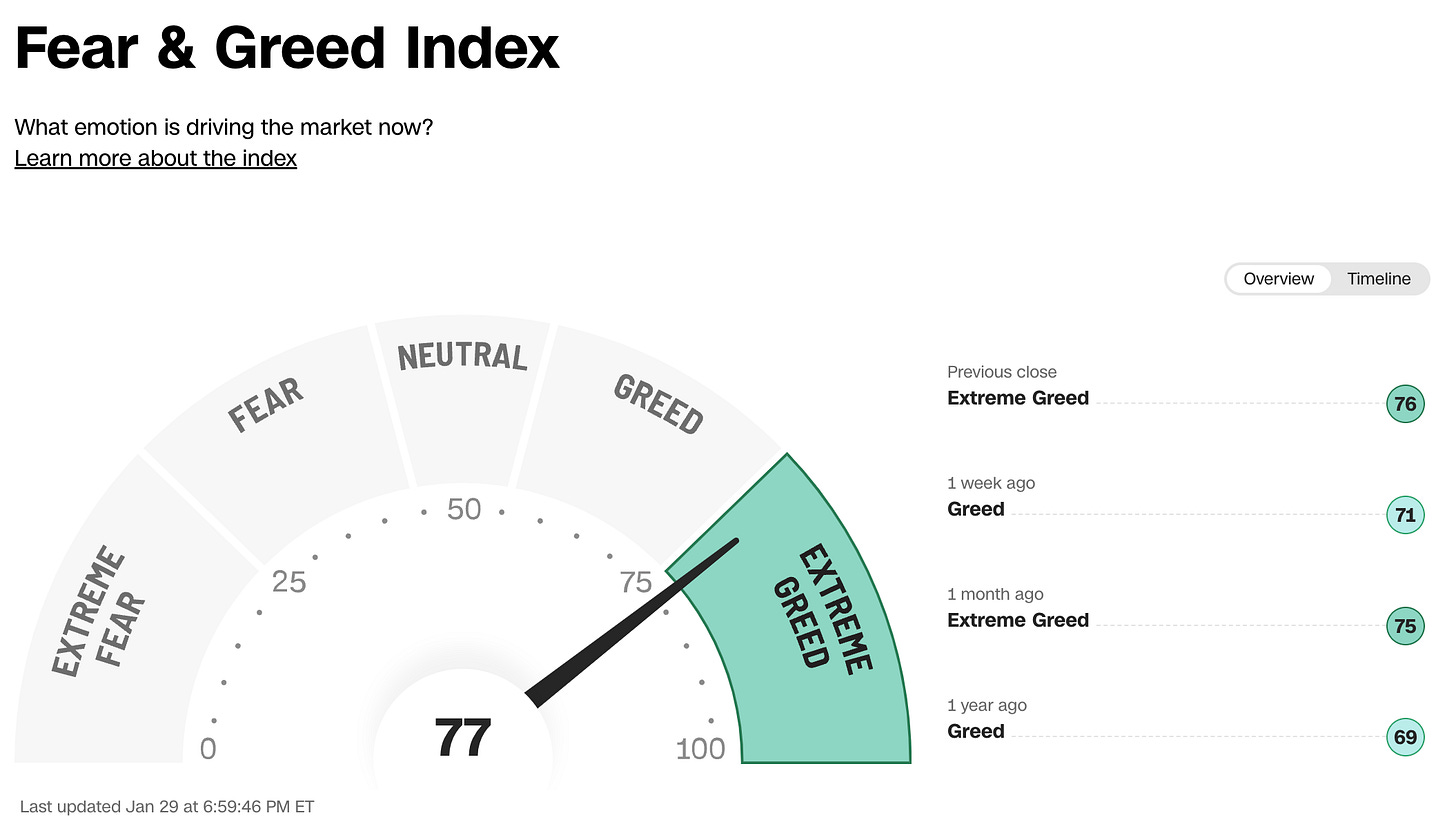

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.