12.9.23: US adds 199,000 Jobs in November as Unemployment Falls

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4585.59

KWEB (Chinese Internet) ETF: $26.97

Analyst Team Note:

The S&P 500 gained 9.1% in total returns, reversing its third straight month of losses. It was the strongest November since the vaccine-led rally in November 2020 (+10.9%).

All major asset classes rallied as rates dropped and 60/40 stock/bond portfolios posted its biggest monthly gain since December 1991.

The S&P 500 posted positive returns 78% of the time in December since 1936, gaining 2.2% on average (2.0% median).

Even in years with strong November gains (above 1-std. dev. gain, or +5.5%), December was positive 2/3 of the time, gaining 1.1% on average (sample size: 12), slightly better than the average month (positive 63%, 1.0% avg. return).

Macro Chart In Focus

Analyst Team Note:

So far, the consumer is fine.

Debt service and financial obligation ratios have risen but are still below pre-COVID levels. 85% of US homeowners have fixed, low-rate mortgages with higher returns from cash and equivalents. Real wage growth (a strong driver of consumption) inflected positive this year.

Investors worry that spending stops when excess savings run out, but the rundown is more likely to be a gentle slope than a cliff edge.

As long as the labor market remains structurally tight, the rundown of household savings is consistent with balance sheet normalization and a slowdown, not a collapse.

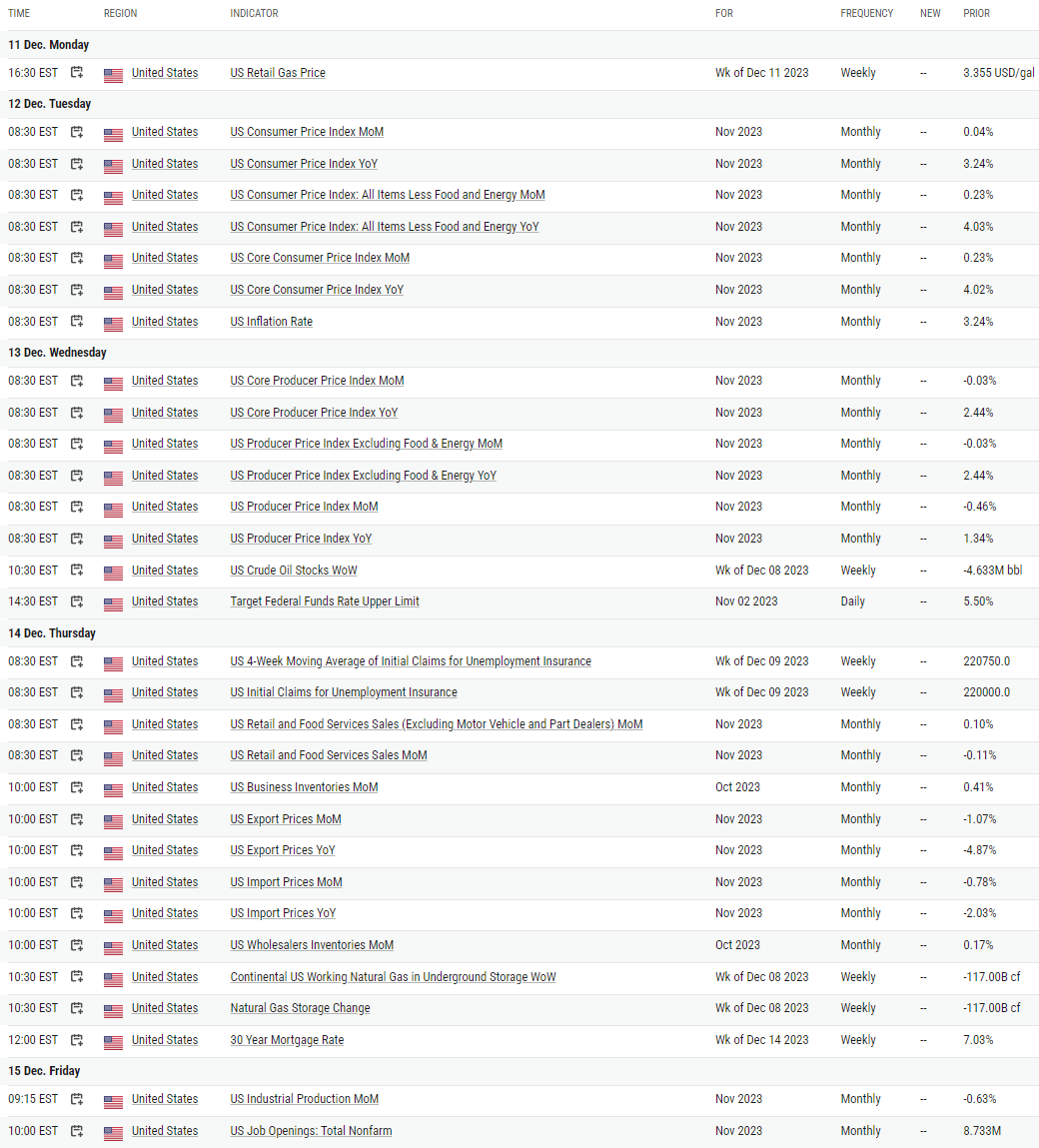

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Nonfarm payrolls increased 199,000 last month following a 150,000 advance in October, a Bureau of Labor Statistics report showed Friday.

The return of striking auto workers helped boost the count by 30,000.

The unemployment rate fell to 3.7% and workforce participation edged up. Monthly wage growth rose more than forecast.

A separate report Friday showed consumers’ feelings about the economy improved in early December, with a gauge of sentiment from the University of Michigan climbing to a four-month high and topping all forecasts.

Chart That Caught Our Eye

Analyst Team Note:

Recent research challenges the traditional advice of diversifying retirement portfolios with a mix of stocks and bonds, suggesting that an all-equity strategy may be more beneficial.

The study, conducted by researchers from the University of Arizona, Emory University, and the University of Missouri, analyzed data from 38 countries over 130 years and found that portfolios split between domestic and international equities outperformed the traditional 60/40 stock-bond mix in terms of wealth generation and capital preservation.

This out-of-consensus view questions the role of bonds in retirement planning, proposing that, despite their stability, they may not add significant value to long-term investment outcomes.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.