1.27.23: Bears are on the verge of throwing in the towel. Major test for the market comes next week.

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: January has proven to be an incredibly fruitful month for long-positioned investors. While the market-wide rally has indeed been impressive, we are approaching levels which demand that a soft landing materialize. Or else.

Pull off a soft landing, and market bears must rethink their positioning.

Should a soft landing turn out to be a fairytale, we are now in extremely contested levels. In our part 1 Investment Strategy note, we discuss the market’s risk/reward setup. Take a moment to read it below.

Market participants are playing musical chairs. Do not be caught flat-footed and plan in advance with our Investment Community that has purposefully set globally accessible pricing to help retail investors succeed.

Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check it out.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: $4060.43

KWEB (Chinese Internet) ETF: 36.15

Analyst Team Note:

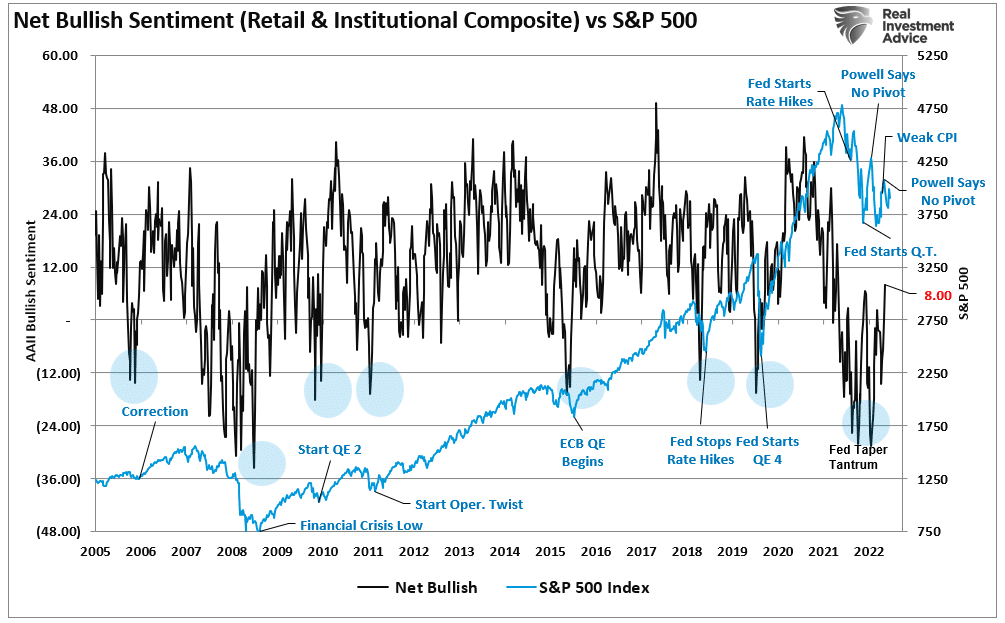

“In good times, skepticism means recognizing the things that are too good to be true; that’s something everyone knows. But in bad times, it requires sensing when things are too bad to be true. People have a hard time doing that. The things that terrify other people will probably terrify you too, but to be successful, an investor has to be a stalwart. After all, most of the time the world doesn’t end, and if you invest when everyone else thinks it will, you’re apt to get some bargains.” - Real Investment Advice

Macro Chart In Focus

Analyst Team Note:

Consumer spending fell 0.2% in December from the prior month, the Commerce Department the second straight monthly drop following solid spending increases during several months last year.

“Going into the new year, we estimate that there are $1.0tn in excess savings, which are being run down at a little under $90bn per month.” By the end of the year, it’s possible that all excess savings are spent…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

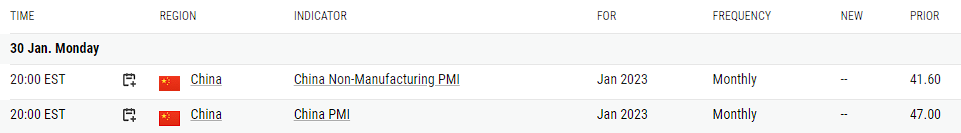

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The BEA reported that in Q4, US GDP rose by a stronger than expected 2.9%, a modest drop from the 3.2% in Q3 and well above consensus estimates of 2.6% (where the range was from 1.2% to 3.9% from 73 economists).

However, there’s more than meets the eye…

Per ZeroHedge:

Personal consumption accounted for 1.42% - or half - of the bottom line 2.880% GDP number; this was below last quarter's 1.54% and came in below expectations; on an annualized basis PCE was 2.1%, well below the 2.9% expected, and down from 2.3% in Q3.

The change in private inventories was a surprising boost to the bottom line, adding 1.46%, a reversal from the declines in the prior three quarters (in Q3, it dropped -1.19%). It appears that the inventory destocking/liquidation is now over.

Chart That Caught Our Eye

Analyst Team Note:

More Americans are falling behind on their car payments than during the financial crisis. In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills rose to 5.67%, up from a seven-year low of 2.58% in April 2021. That compares to 5.04% in January 2009, the peak during the Great Recession.

Higher interest rates are also making it even more difficult to make the monthly payments. The average new auto loan rate was 8.02% in December, up from 5.15% a year earlier.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.