12.7.22: Markets digest recent reversal. Big macro data points looming in coming days and weeks ahead.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Markets have been soft in the past week, but this has been highly anticipated by us in our December Strategy Report and we were looking for some of the froth to come off the equity market at the 4100 region, which has since materialized. Many of our members positioned in TLT ETF in the 90-100 region from our Fall investment reports, and that thesis is now playing out in the way I envisioned it (investors buying treasuries when risk off mode returns, given that inflation has likely peaked). Don’t chase the move in TLT ETF. I talked about it in our Sept-Oct reports. The media is onto this strategy, which means we’re closer to the end of easy money in the trade rather than the start of it (in my opinion).

We have a plan to take advantage of a market reversal if the markets headed much past 4100, but we don’t take transactions on the short side without risk/reward working hugely in our favor. 4100 was not the time to short, even if it looks good in hindsight. The setup is still very much in place, and if you’re looking to find areas of the S&P 500 where betting on downside action could add to your strategy, then this premium piece here could be for you. It is my personal opinion that Investors are spending way too much time thinking about the Fed and not enough time assessing the dramatic impact the high rates have ALREADY had on corporate profits that will be discussed in the quarters ahead.

On China - I will have some thoughts on the recent China strength to share in my upcoming Bi-Weekly report and some considerations to think about. Exclusive actionable research and more awaits you (at the most accessible pricing ever) inside our community if you want to navigate this market using my intermediate-term methodology (looking out 3-6 months as the core timeframe). Feel free to join on Substack. I have a lot of friends on Patreon now. I want to balance out the numbers a bit!

Will be back on Twitter for more insights later. Follow me there.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3941.26

KWEB (Chinese Internet) ETF: 30.35

Analyst Team Note:

Personally (Larry’s analyst Tim) looking into equally-weighted S&P 500 index, which is underweight tech and communication services by nearly 15%. This would be a decent way to stay invested while also mitigating valuation and concentration risks.

Valuations for the equal-weight S&P 500 index is 0.7 standard deviations below historical norms.

Equal-weight S&P 500 has outperformed the market-cap weighted index by nearly 1.2% per year since 1990, and has outperformed by >100% as the dot com bubble deflated in the early 2000s.

Macro Chart In Focus

Analyst Team Note:

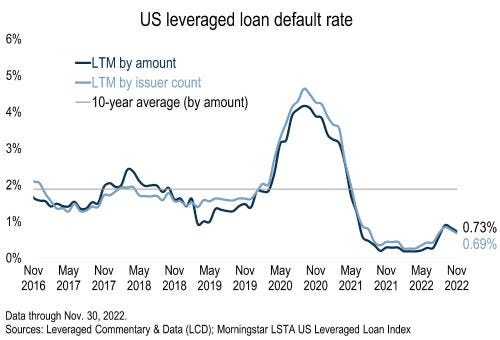

The default rate of the Morningstar US Leveraged Loan Index fell for a second consecutive month in November. The default rate has edged up from a pandemic-era low of 0.18% in April, but remains well below its 10-year average of 1.89% and its historical average of 2.73%.

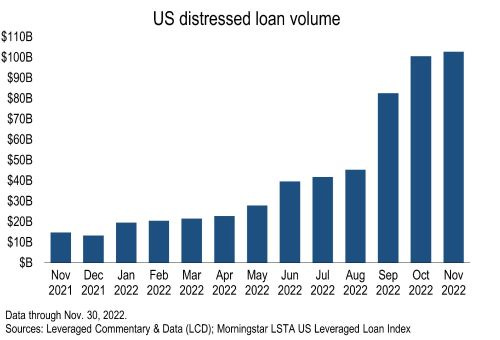

Though actual defaults are still low, distress levels are rising…

The amount of corporate bonds “below 80” is five times higher than at the beginning of the year, at $103 billion.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Interesting piece from Bloomberg today on how the end of China’s Zero-Covid policy would drive up global inflation…

“Assuming China is fully open by mid-2023, Bloomberg Economics estimates energy prices will increase by 20% and the US consumer price index, which they believe may drop to 3.9% by midyear, may jump to 5.7% by year end.”

“A rebounding China would drive up imports of oil, commodities and raw materials, while stoking demand for airline seats, hotel rooms and overseas real estate.”

What Caught Our Eye

Analyst Team Note:

I (Tim) read a great piece today from Peter Tchir over at Academy Securities (highly recommend reading his work) discussing soft, hard, and a ‘squishy’ landing.

“Since we only get snapshots of the economy, we will briefly see what looks like a soft landing. The pendulum swings down as the policies take effect and as company/individual reactions all combine to slow the economy. There are a lot of people that want this situation to occur.

It is easy to believe that it will occur, especially when we visualize the economy through a strobe light where only an instant is captured and something that is in motion is made to look stationary.

The pendulum will keep swinging and head towards a recession. This is similar to the domino theory where the actors (the Fed, policy makers, corporations, and individuals) have already set in motion something that won’t stop at a soft landing.”

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs