12.6.23: 125 bps of Rate CUTS Expected in 2024

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4567.18

KWEB (Chinese Internet) ETF: $26.77

Analyst Team Note:

The issue of "zombie" companies, which are businesses unable to generate sufficient profits to cover their interest expenses but continue to operate due to low interest costs, has been a concern in the post-crisis decade.

These companies are seen as a form of malinvestment, absorbing capital that could be more effectively used elsewhere.

A chart by Bloomberg categorizes zombies in two ways: those failing to cover interest costs for one year and those in this situation for at least three consecutive years.

According to this definition, over a fifth of U.S. companies currently fall into the zombie category, highlighting a significant portion of the market potentially engaged in inefficient capital usage.

Macro Chart In Focus

Analyst Team Note:

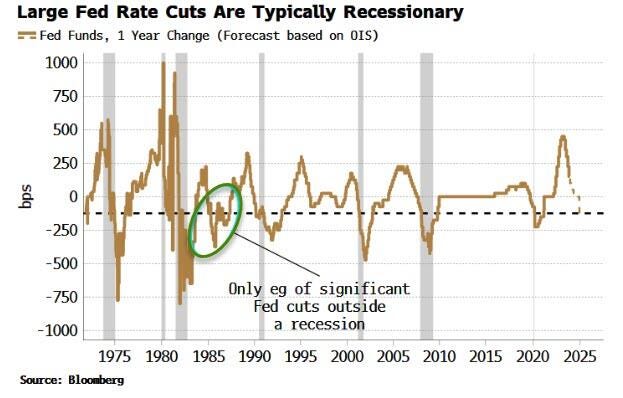

The current market expectations for significant Federal Reserve rate cuts in the next year, totaling around 125 basis points, are unusual unless a recession is imminent, which has only happened once outside of a recessionary period since the 1980s.

Despite these expectations, signs of an imminent recession are not evident, with the S&P 500 close to its all-time high and credit spreads tightening.

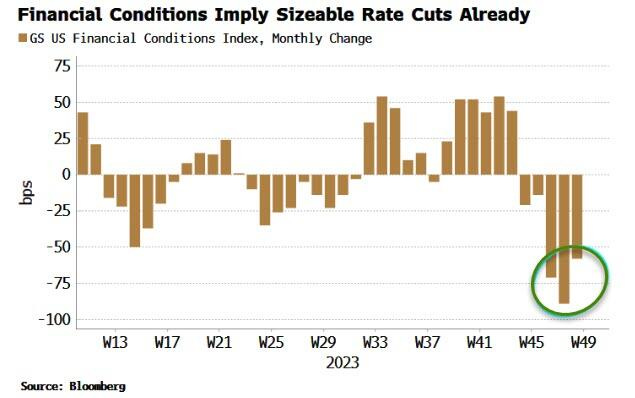

However, the Goldman Sachs Financial Conditions Index suggests that recent easing in financial conditions could equate to an effective rate cut, increasing the likelihood that the Fed might hike rates to prevent inflation re-acceleration, countering the market's expectation of rate cuts.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In October, U.S. job openings decreased to 8.7 million, the lowest since early 2021, indicating a cooling labor market, which aligns with the Federal Reserve's efforts to control inflation by keeping interest rates high.

This trend is seen as progress towards a 'soft landing' with a balanced labor market, as job vacancies have dropped from last year's peak of 12 million and the unemployment rate remains historically low.

The Fed is expected to maintain current interest rates, seeking to reach their 2% inflation target. Additionally, the quits rate is stabilizing, and layoffs remain low, suggesting less pressure on wages and a more balanced demand-supply dynamic in the job market.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.