1.23.23: Liquidity keeps Markets Afloat despite economic pain on the ground

Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: We just recently released a new strategy note where we provide insights on consumer behavior from Netflix’s latest earnings as well as whether the Fed’s QT plan has actually been counterbalanced by the Debt Ceiling discussion. Make sure to take a look.

Knowing when this liquidity push is likely to run its course will help you determine how long to play this game of musical chairs. 🪑 You do not want to be the last person to realize too late when the music stops.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳 (As of last week)

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3898.85

KWEB (Chinese Internet) ETF: $33.94

Analyst Team Note:

“The percentage (%) of stocks above 200-day moving averages (MAs) provides a longerterm indicator of market breadth. Bearish divergences for this indicator in late 2021 preceded the 2022 correction. Upside breakouts from 2022 bottoms for the % of stocks above 200-day MAs in late 2022 and entering 2023 are positive and a potential bullish leading indicator for US equities.” - Bank of America

Per Larry’s Mid-January Strategy Note:

Macro Chart In Focus

Analyst Team Note:

"Over the last 40 years, EPS has followed a fairly defined rising trend and only taken serious declines during recessions. EPS now appears far above that long-term trend. One thought–headline earnings have been inflated (as have all other prices) and so as inflation eases, we will start to see some recalibration lower in these estimates.” - Goldman Sachs

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

The labor market remains stronger than normal, even as the overall economy slips into a growth recession. However, in the last 12 months, GDP has grown 1.4% while payrolls have grown 3.0%, implying a sharp drop in productivity.

Productivity usually only drops on a sustained basis in recessions.

“We have services inflation still being very persistent while product inflation is rapidly declining. Services inflation is a very sticky part of the economy, as organizations cannot easily lower average selling prices of their services, lower salaries, and renegotiate vendor supply pricing downward. Once staff have gotten a raise, you can’t easily cut their wages (without turmoil in the office). The only way to lower wages is to fire staff, and then re-hire at lower wages. It’s very challenging to lower wages of existing staff.” - Larry’s Mid-January Note

Chart That Caught Our Eye

Analyst Team Note:

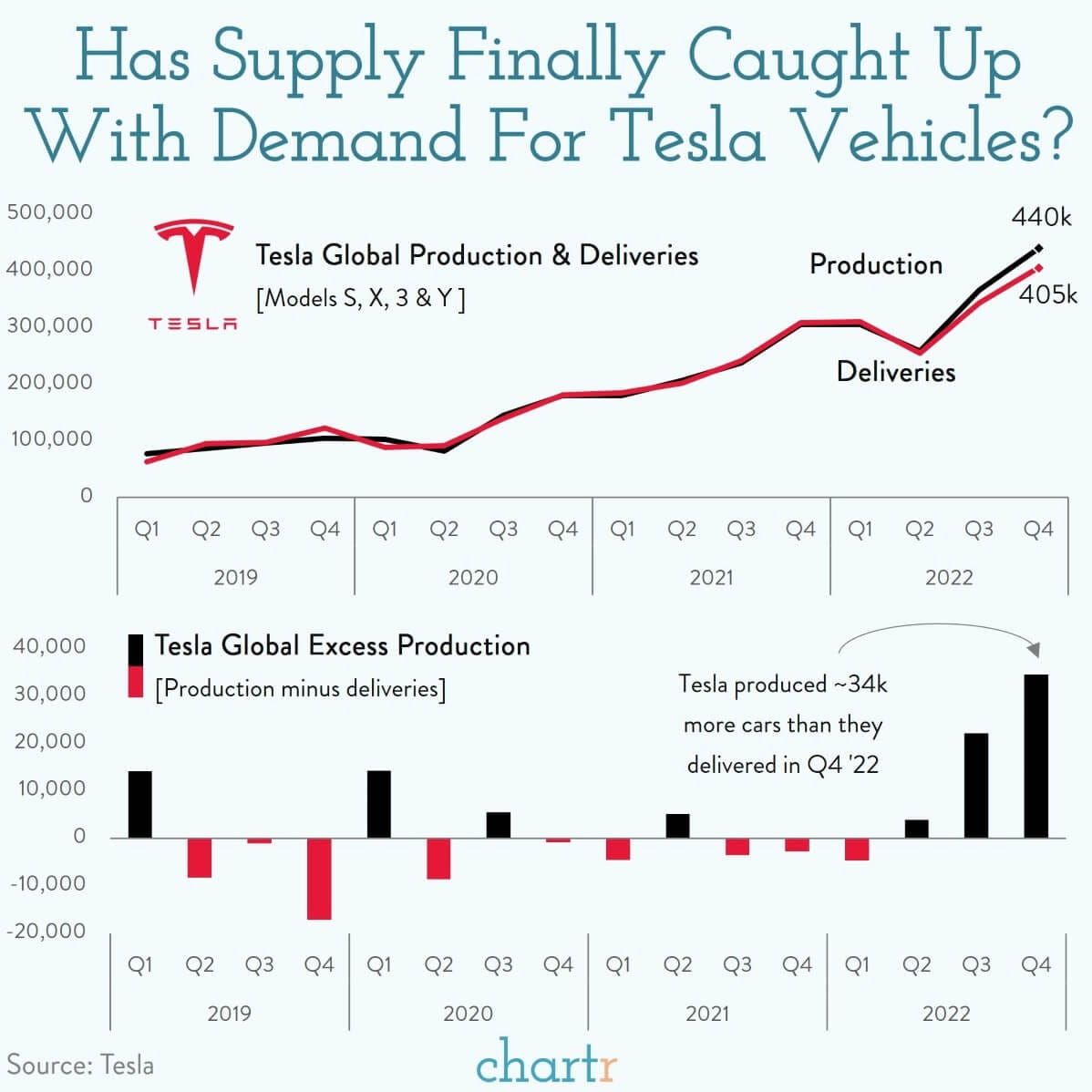

Tesla has dropped prices by up to 20% in the US in an effort to increase demand after missing delivery targets last quarter. The lower prices mean that some of Tesla's most popular lines, like the Model Y SUV, now qualify for the $7,500 EV tax credit. The cuts are not just happening in the US, but also in China, the UK, and Germany, with prices being slashed by 13% and 17% respectively.

This may be an indication that Tesla is facing a supply and demand issue, as they have produced more cars than they have delivered for two quarters in a row. The scale of the price cuts suggests that Tesla is recognizing a need to be more price competitive in order to maintain its market share, which fell from 71% to 65% in the US at the end of 2022.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs.

Make sure to check Larry’s most recent market updates via his personal newsletter.

Thanks for reading Larry's Analyst Team! Join our email community for market updates like these each week.