12.23.22: 5 More Trading Days of 2022 for the Santa Rally To Appear

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: We wish all of our good friends a Merry Christmas. At some point, we do believe better days will come for long-term Investors and bulls of the market. I’m actively looking for these signs in 2023. In the near-term, we may get a brief break from negativity starting next week (the last few trading days of 2022) if a Santa Clause rally emerges.

Given the intensive turmoil tech is going through, I wrote a piece on this yesterday evening on key areas of interest such as Semis, Tesla, and China. Good times, bad times, anything in between - I’ll keep our Community updated with thoughtful insight and research.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

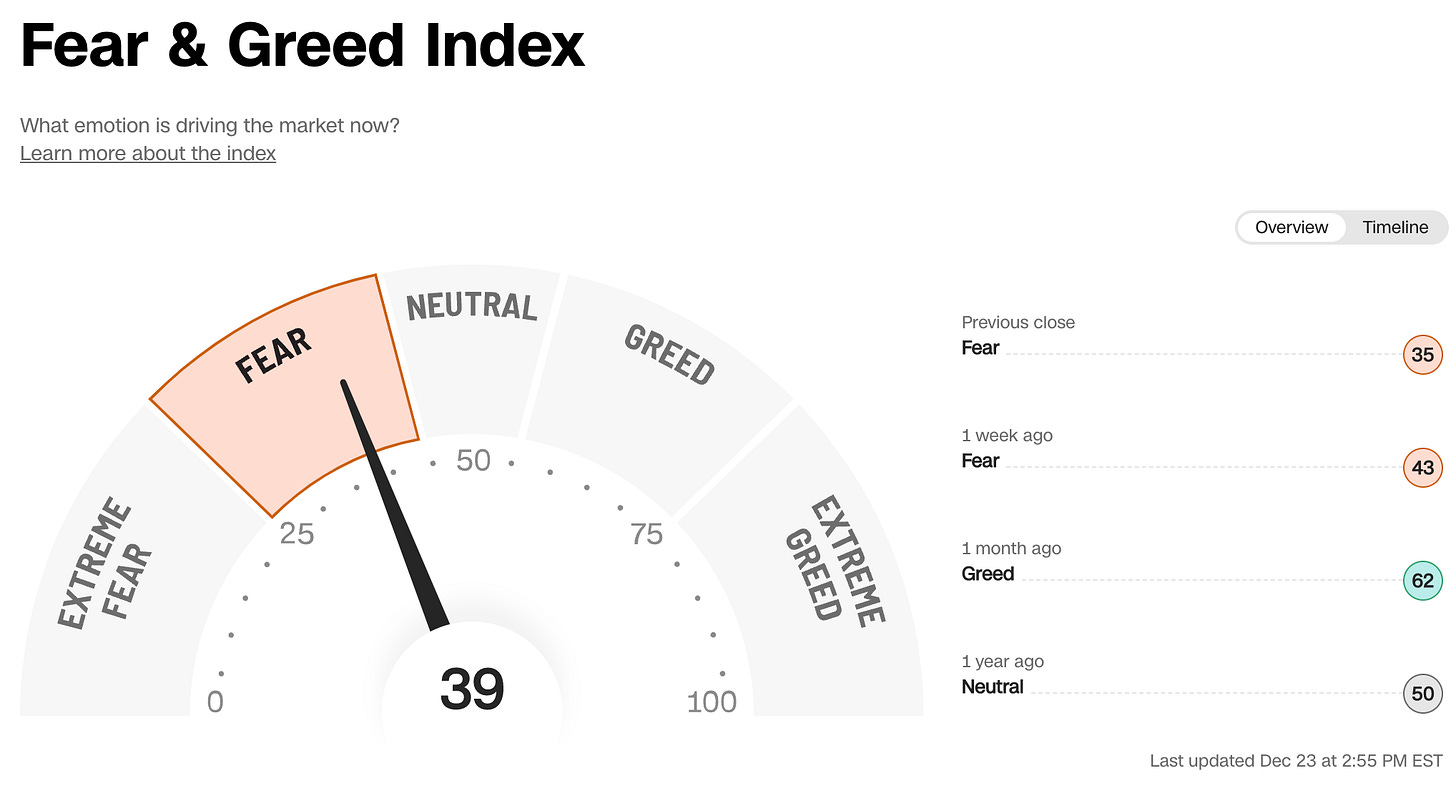

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3822.39

KWEB (Chinese Internet) ETF: $30.68

Analyst Team Note:

Despite the Nasdaq 100 about to finish off the worst December performance since 2002, short interest for the QQQ (which tracks the Nasdaq 100) is at a decade high. A deeper selloff could ramp up pressure on investors positioned long to throw in the towel.

Macro Chart In Focus

Analyst Team Note:

The world is using less cardboard boxes, which is a troubling sign that global trade is slowing down.

Per KeyBanc, “Severe weakness in global box demand is an indication of how weak many parts of the global economy are. The recent history shows a significant amount of economic stimulus would be necessary to provide meaningful box demand, and we do not see that coming”.

Global demand for packaging paper is showing weakness for the first time since 2020. US prices fell in November for the first time in two years and the US, the world’s biggest exporter, reported 21% lower volumes sent overseas in October versus the previous year.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Some quick bulletpoints on the housing market…

In November, home sales in the United States declined by 35.1% on a seasonally-adjusted basis, the largest drop recorded by Redfin since 2012.

Additionally, the median price of homes in the country only increased by 2.6% from the previous year, the smallest increase since the beginning of the COVID-19 pandemic in May 2020.

New listings for homes also fell by 28.4%, the largest decrease aside from April 2020.

Despite the decrease in new listings, the overall supply of homes increased by 4.6% from the previous year, indicating that homes are taking longer to sell.

Chart That Caught Our Eye

Analyst Team Note:

While higher-rated corporate bonds (BB, B+, etc) have traded down noticeably this year, junk bonds (CCC) have collapsed. With more loan prices reaching extremes, companies that run into any sort of difficulty could see their loans plunge quickly, which translates to surging borrowing costs, boosting the chance of corporate defaults.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs