12.22.23: Buy and Hold Outperformed Everything in 2023

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Message from our friends at YCharts: Letters From Larry is brought to you by our friends at YCharts. To kick off 2024, YCharts is hosting a power-packed webinar on January 11th, exploring evolving market themes and potential challenges that lie in the new year. Stay ahead of the curve and get a comprehensive recap of YCharts' 2023 product releases, designed to help you make more informed investment decisions and seamlessly navigate client questions.

Register to secure your spot and get 15% off your initial YCharts Professional subscription when you start your free YCharts trial and tell them I sent you (new customers only)”

Webinar Registration Link: https://ycharts.zoom.us/webinar/register/4417031839191/WN_IJfo69YuQNC4l3q4MenvZw

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4746.75

KWEB (Chinese Internet) ETF: $26.96

Analyst Team Note:

In 2023, the simplest investment strategy of owning the S&P 500 outperformed more complex approaches such as sector-specific investments, trendy options strategies, or a focus on dividends.

Despite initial expectations of modest returns, the S&P 500 surged by 24% this year, with investors heavily favoring broad-market index funds, particularly the SPDR S&P 500 ETF Trust. This trend resulted in record inflows into equity ETFs, especially in December.

Contrarily, tactical investments, including options-linked and dividend-focused ETFs, underperformed, with many investors missing out on the tech-led rally.

Macro Chart In Focus

Analyst Team Note:

In November, the U.S. Federal Reserve's preferred measure of inflation, the core personal consumption expenditures (PCE) price index, showed a modest rise, indicating a trend towards the central bank's 2% target.

This measure, which excludes food and energy, increased by 0.1% from the previous month and showed a 3.2% year-over-year increase, while on a six-month annualized basis, it was slightly below the target at 1.9%.

The report, which highlighted a decline in the overall PCE index and robust income figures, suggests a potential shift in monetary policy towards interest rate cuts in the future.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Economists predict that the Federal Reserve will delay interest rate cuts until mid-2024, a timeline that contrasts with market expectations of an earlier start to the easing cycle.

According to a Bloomberg survey, the median forecast is for the Fed to initiate rate reductions in June 2024, starting with a 25 basis point cut, and then continue with three more cuts later in the year.

This outlook differs from investor expectations, which are betting on rate cuts as early as March 2024, expecting the main rate to end the year around 3.77%. Despite this divergence in views, recent statements by several Fed officials suggest a reluctance to lower rates in March.

Additionally, the survey indicates economists expect inflation to cool more in 2024 and project strong economic growth through 2025, underpinned by resilient consumer spending and private investment, reinforcing confidence in a 'soft landing' scenario where inflation eases without significant job losses or economic downturn.

Chart That Caught Our Eye

Analyst Team Note:

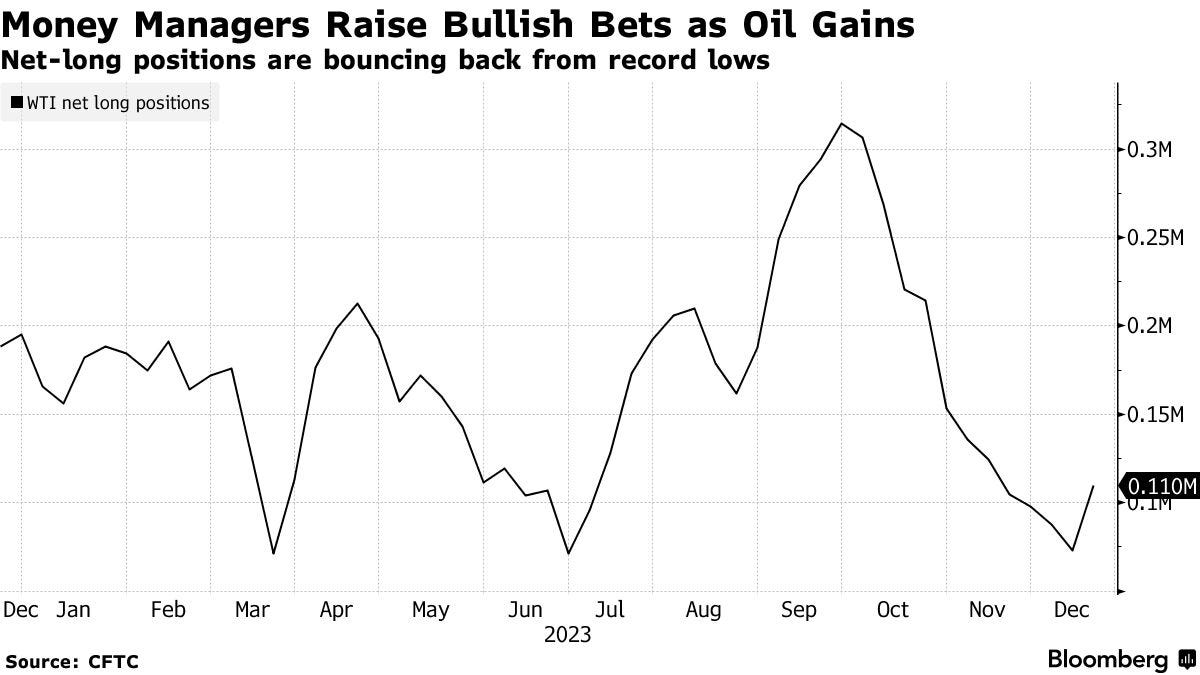

Hedge funds recently became more optimistic about oil for the first time in nearly three months, driven by increased risks of war affecting global energy supplies.

This increase in bullish bets, the first since late September, was primarily due to a notable decrease in short positions. This change occurred alongside oil prices experiencing their largest weekly surge in months, spurred by attacks from Houthi militants in the Red Sea, raising concerns about prolonged disruptions.

The long-term outlook for crude oil is still uncertain, with the U.S. expected to hit record oil production next year and a slowdown in demand growth anticipated.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.