12.20.23: Fed Cuts Generally Precedes Large Market Drawdowns

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4768.37

KWEB (Chinese Internet) ETF: $26.81

Analyst Team Note:

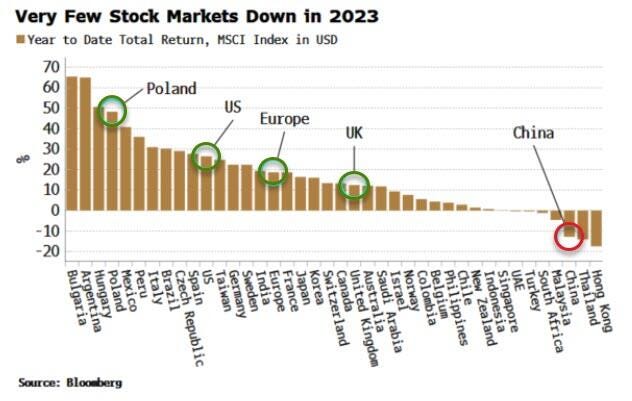

In 2023, despite high interest rates worldwide, most global stock and bond indexes have seen gains, defying expectations.

Historically, top performers in one year often underperform the next, suggesting that 2024 might see a reversal, potentially benefiting Chinese stocks and bonds while Eastern European assets might lag.

Macro Chart In Focus

Analyst Team Note:

In 2023, the "Magnificent 7" stocks—Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Meta—have become a focal point of bandwagon bias in investment, with their collective stock prices surging 71%, significantly outperforming the modest 6% gain of the remaining 493 stocks in the S&P 500.

This disparity has elevated their combined contribution to nearly 30% of the S&P 500's value, leading to heightened valuations.

Despite these companies being fundamentally stronger than the S&P 500 average, with expected revenue growth of 8% more and forecasted net margins of around 21% (double that of the S&P 500), there's skepticism about whether such high valuations can be sustained or repeated in 2024, particularly if the price growth has outstripped fundamental performance.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The labor market indicators are trending worse - now at the weakest since April 2021...

Despite this, the consumers’ perceived likelihood of a US recession over the next 12 months fell in December to the lowest level seen this year...

Chart That Caught Our Eye

Analyst Team Note:

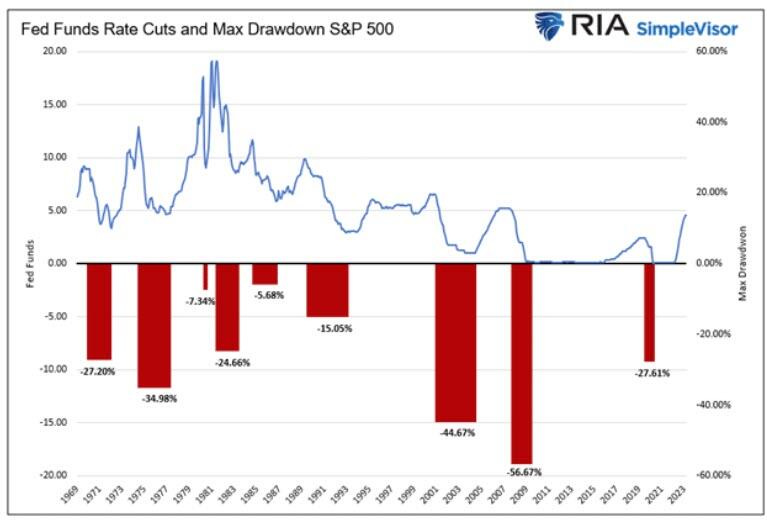

Since 1970, there have been nine instances in which the Fed significantly cut the Fed Funds rate. The average maximum drawdown from the start of each rate reduction period to the market trough was 27.25%.

The three most recent episodes saw larger-than-average drawdowns. Of the six other experiences, only one, 1974-1977, saw a drawdown worse than the average.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.