12.19.22: 300 SPX Points Shaven Off since that "lighter" inflation reading. What a Trap, indeed.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: In markets, there is a price to be proactive. It will require your energy and additional attention.

There is also a price to be passive. In return for doing nothing, you then settle for market-based returns.

While nothing is ever guaranteed, I choose to be proactive. I choose to control my destiny with decisive research and action. For those who have been proactive alongside with me, let’s just say that this Christmas holiday season is just as good as previous years.

Investments is a business. Only those who are prepared in business will survive through any cycle. Those who come in underprepared will ride the wave of “Macro.” When things are good, a rising tide lifts all boats.

When things aren’t so good, the Underprepared become a data point in the “re-shifting” of the landscape.

It is my sincere hope that you take 2023 seriously. The biggest challenges are yet to come.

Those who make it through the end of 2023 will likely survive many more cycles going forward. For some, 2023 will be the last year in which they participate in markets.

If you follow my content closely, I will do my best to ensure that you are in the camp of Survivors. Do not yet think about Thriving. Think about Surviving first.

You think that I perhaps may be exaggerating.

I want you to think again: Am I really?

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3852.36

KWEB (Chinese Internet) ETF: $30.06

Analyst Team Note:

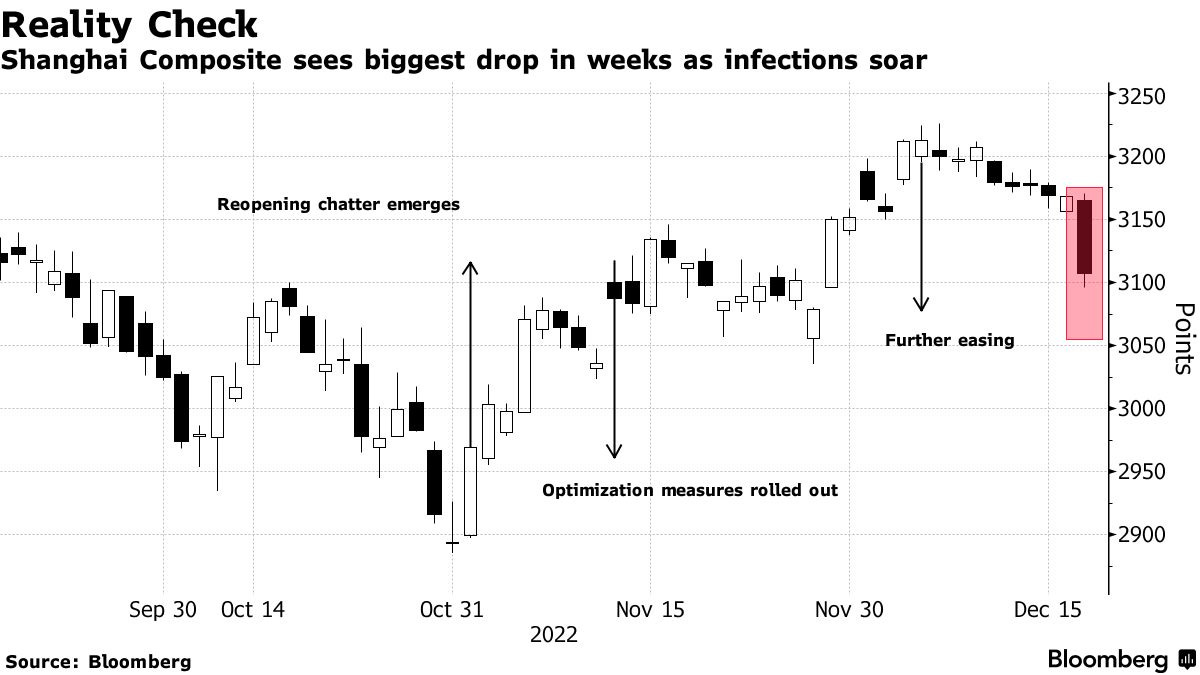

A huge reopening rally in recent weeks has been giving way to more cautious trading, as investors come to terms with mounting economic disruptions from the Covid Zero pivot. On Monday, Chinese top officials pledged at the Central Economic Work Conference (CEWC) to revive consumption and support private businesses.

Per Jefferies, “Although the CEWC delivered some meaningful and practical messages, investors are not too excited as the economy in the next three months is likely to be largely affected by the first and second wave of Covid breakout with the market to cool after a one-month rebound”.

Macro Chart In Focus

Analyst Team Note:

The facility allows banks to trade collateral — usually bundles of loans — for emergency liquidity from the Fed.

Use of the discount window tends to coincide with the darkest days of market turmoil, with banks typically reluctant to tap the facility as it’s generally thought to be a sign of poor liquidity management or financial strain.

According to Bloomberg, “while institutions that do go to the window aren’t immediately named and shamed publicly, rumors of who’s using it and why can be brutal, leading to what’s called ‘discount-window stigma’”.

The uptick in the use of the discount window is interesting because it’s occurring at a time when there’s still lots of liquidity thought to be sloshing around the financial system…

Per JP Morgan, “it’s possible that, regardless of stigma, to raise liquidity, some small banks are finding rates at the window economically more attractive than either accessing the fed funds market… furthermore, the timing of the increase appears to have been somewhat correlated to the crypto market, particularly in November after news of the FTX fallout emerged”.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

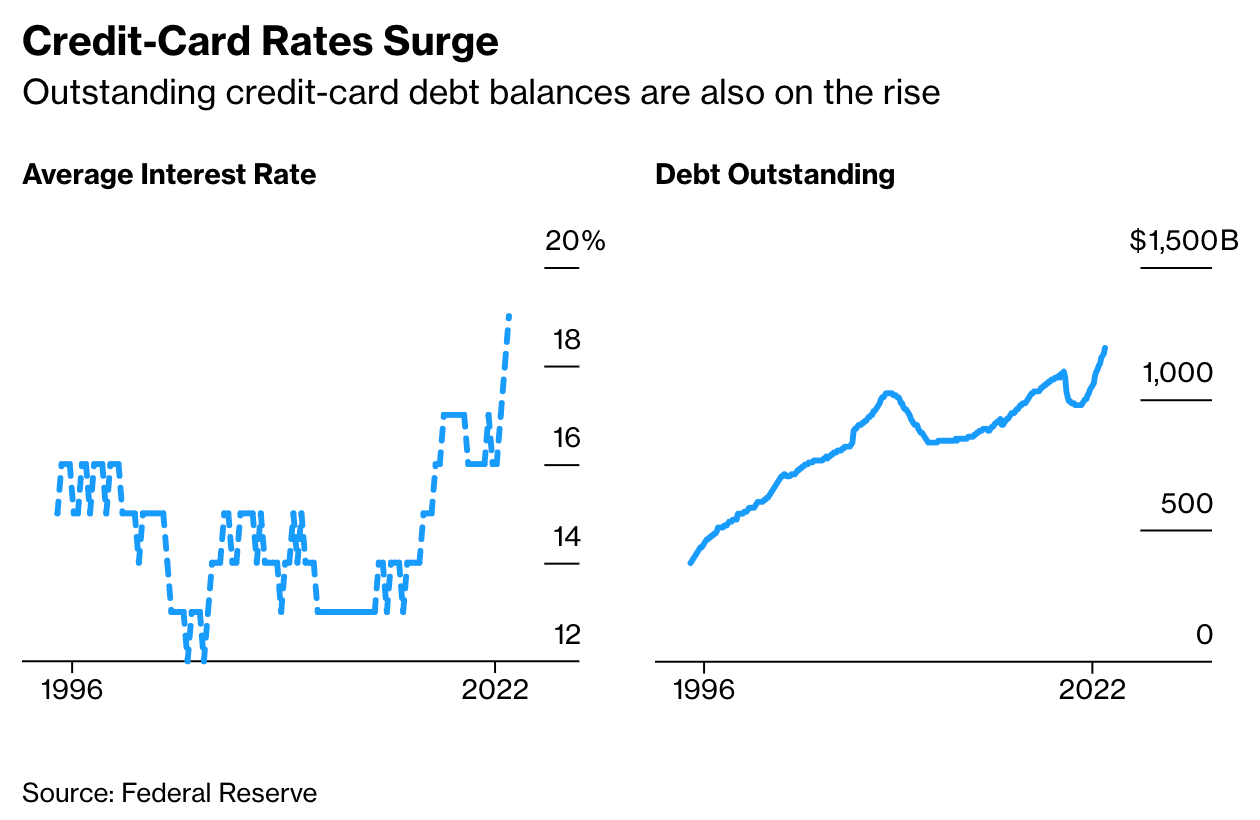

Interest rates on credit cards that averaged 16.3% at the beginning of the year have climbed to just over 19%, according to Bankrate.com, the highest level in data going back to 1985.

American consumers will end the year with about $110 billion more in credit-card debt than they started with, which would be close to an annual record, according to WalletHub, an online personal finance data firm.

Chart That Caught Our Eye

Analyst Team Note:

A primer on the US Dollar…

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs