12.16.22: Christmas has been Cancelled by Jerome.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Okay, so I tried to help the good folks (and believe that my efforts have been immensely successful) get defensive with risk-reduction precisely at the local swing highs that now seem like history. Based on my research, I’ve done my best across multiple research notes to provide very thoughtful warning as SPX got close to 4100 (and above). To help the folks, I even released my December 1st Half Strategy to the public.

Yet, I see this on Yahoo Finance - that many folks tried to aggressive buy the rebound at the highest levels during the recovery and are now getting smothered by the Institutions that sold into the rally.

I can only do what I can control, and to that extent, I believe we have done an incredible contribution to the good people who follow my work.

I’ll be back with more commentary later - I will be studying markets this weekend. Check out the exclusive December strategy report I shared above to get prepared for this moment. It’s literally the opposite of what most folks were advised to do during the run-up. Hurts me very much to read this from Yahoo Finance - read it yourself!

Next week, the drama continues. Put a Strategist by your side and stop letting the market sing misleading sirens to you every single day of the week!

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3895.75

KWEB (Chinese Internet) ETF: $29.95

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

A hot question is exactly what the Fed needs to see on the inflation front to pause policy. It is complicated by the fact that goods prices are starting to drop even as service price inflation and wage growth remain very strong.

Per BofA:

Goods prices spiked higher when supply chains were broken but are now in the process of reversing some of that spike.

A reversal of a spike does not mean sustained low inflation—it is a one-off event.

By contrast, a cooling off of the job market would mean a sustained slowdown in service price inflation.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Delinquencies are ticking up as consumers are blowing through pandemic savings. Historically, credit card loss rates are highly correlated with unemployment. Banks and credit card issuers will probably experience major increases in credit losses in 2023 as the labor market cools.

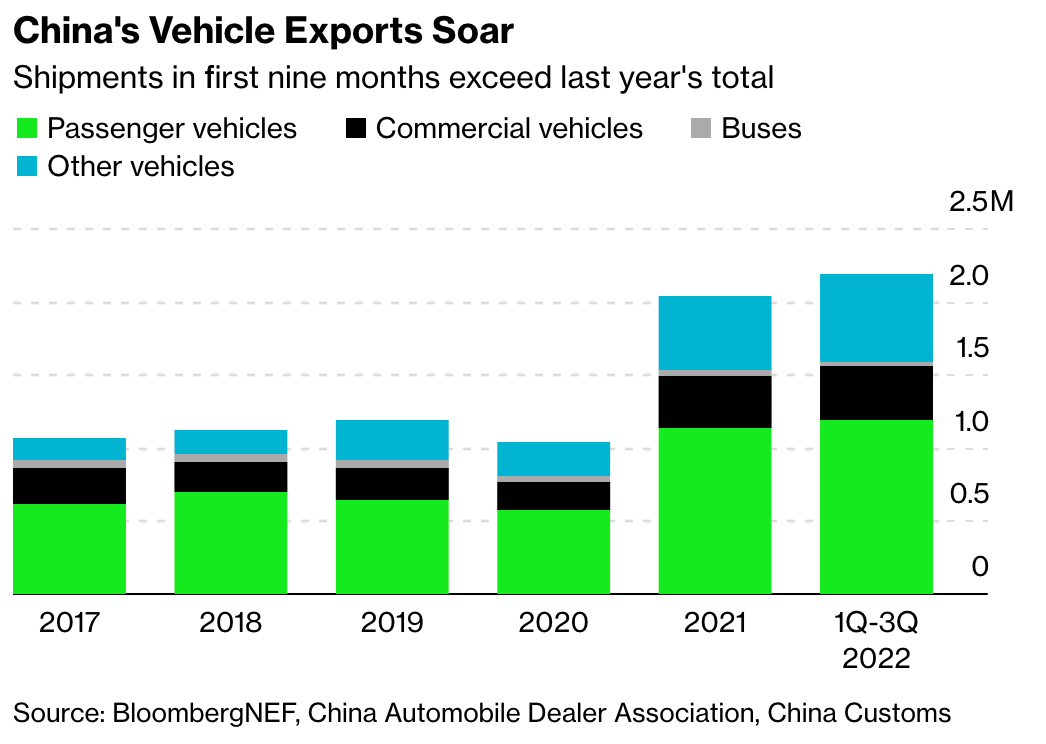

Chart That Caught Our Eye

Analyst Team Note:

In the first three quarters of the year, a total of 2.2 million passenger cars, trucks, buses, and other vehicles were exported from China, with electric vehicles (EVs) being the biggest contributor to the surge.

China's dominance in EV battery and materials supplies, as well as its lower production costs and established supply chain, have contributed to the growth in EV exports. Western automakers are also using China's production capabilities to produce EVs for customers worldwide as demand for the technology grows.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs