12.13.23: Fed Expected to Continue Rate PAUSE for Third Straight Meeting

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4643.70

KWEB (Chinese Internet) ETF: $27.16

Analyst Team Note:

“If the SPX can decisively surpass the 4595-4637 area, it would confirm a bullish cup and handle from early 2022 with upside potential beyond the all-time high at 4819 toward a measured move in the low 5200s and the big base pattern count in the 5600s. Rising 40-week and 200-week MAs underpin this bullish longer-term technical setup.” - BofA

Macro Chart In Focus

Analyst Team Note:

The Federal Reserve is expected to keep interest rates steady at 5.25% to 5.5% for a third consecutive meeting, while also signaling reluctance to implement rate cuts in the near future.

The Fed's upcoming policy meeting will include updated economic projections, with Wall Street analysts anticipating potential modest rate cuts in 2024 and 2025, although opinions vary.

Chair Jerome Powell is expected to maintain a cautious tone in his press conference, emphasizing the need for further data before considering rate reductions, and aligning with the Fed's broader goal of achieving a stable inflation rate.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

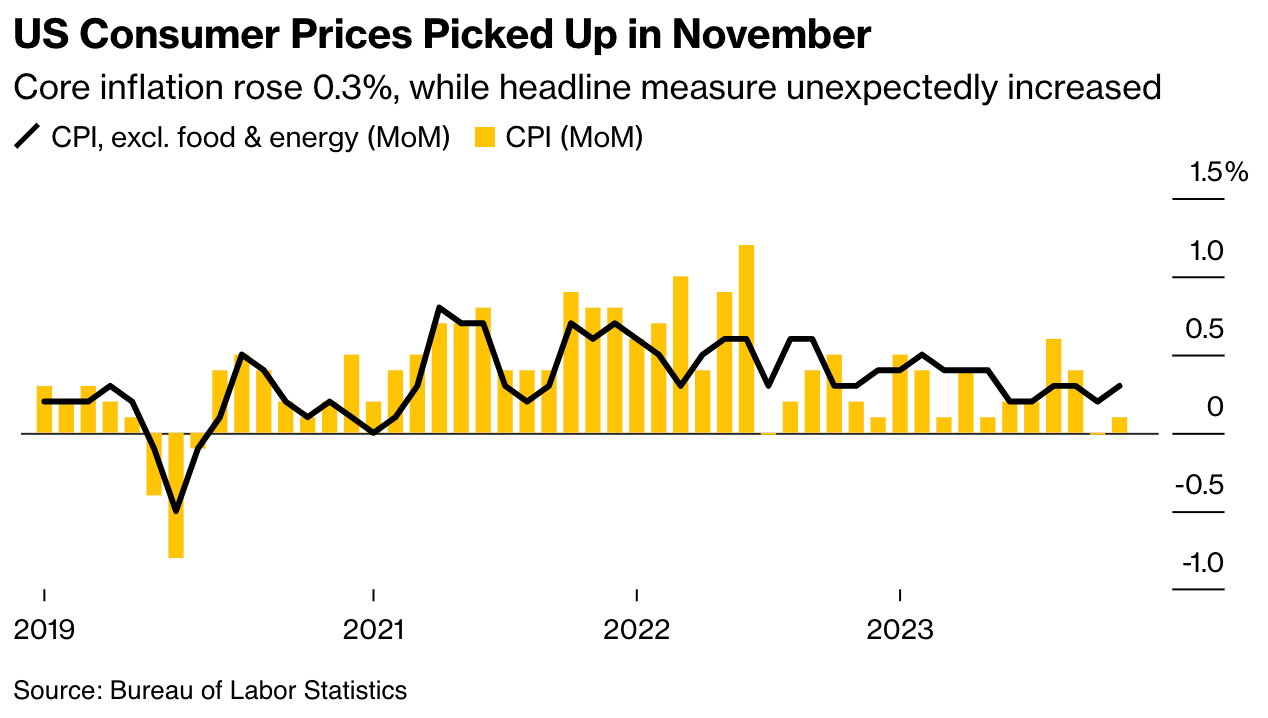

In November, U.S. consumer prices increased, driven mainly by rising housing and service-sector costs, indicating persistent inflation that challenges the possibility of interest rate cuts by the Federal Reserve.

Core CPI, excluding food and energy, also saw a monthly acceleration, reflecting ongoing inflation pressures in the service sector despite a general trend of inflation easing from multi-decade highs.

This situation, coupled with a strong labor market fueling consumer spending, suggests that the Fed is unlikely to ease its policy soon.

The data, showing a mix of increases in rents, medical care, and motor vehicle insurance, along with declines in apparel and furniture costs, led to adjustments in market expectations around the Fed's future rate cuts, with a focus on whether cuts will respond to decreasing inflation or a potential recession.

Chart That Caught Our Eye

Analyst Team Note:

During COVID, PE firms were initially willing to support their struggling portfolio companies with additional capital injections. However, with rising interest rates, these firms have become more selective in their support, leading to an increase in debt-for-equity swaps.

The shift in strategy reflects a greater focus on the long-term viability of investments and a change in the creditor landscape from commercial banks to private lenders, who are more willing to take control of companies in distress.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.