12.11.23: Corporate Earnings Expected to Decline in Q4

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4604.37

KWEB (Chinese Internet) ETF: $26.69

Analyst Team Note:

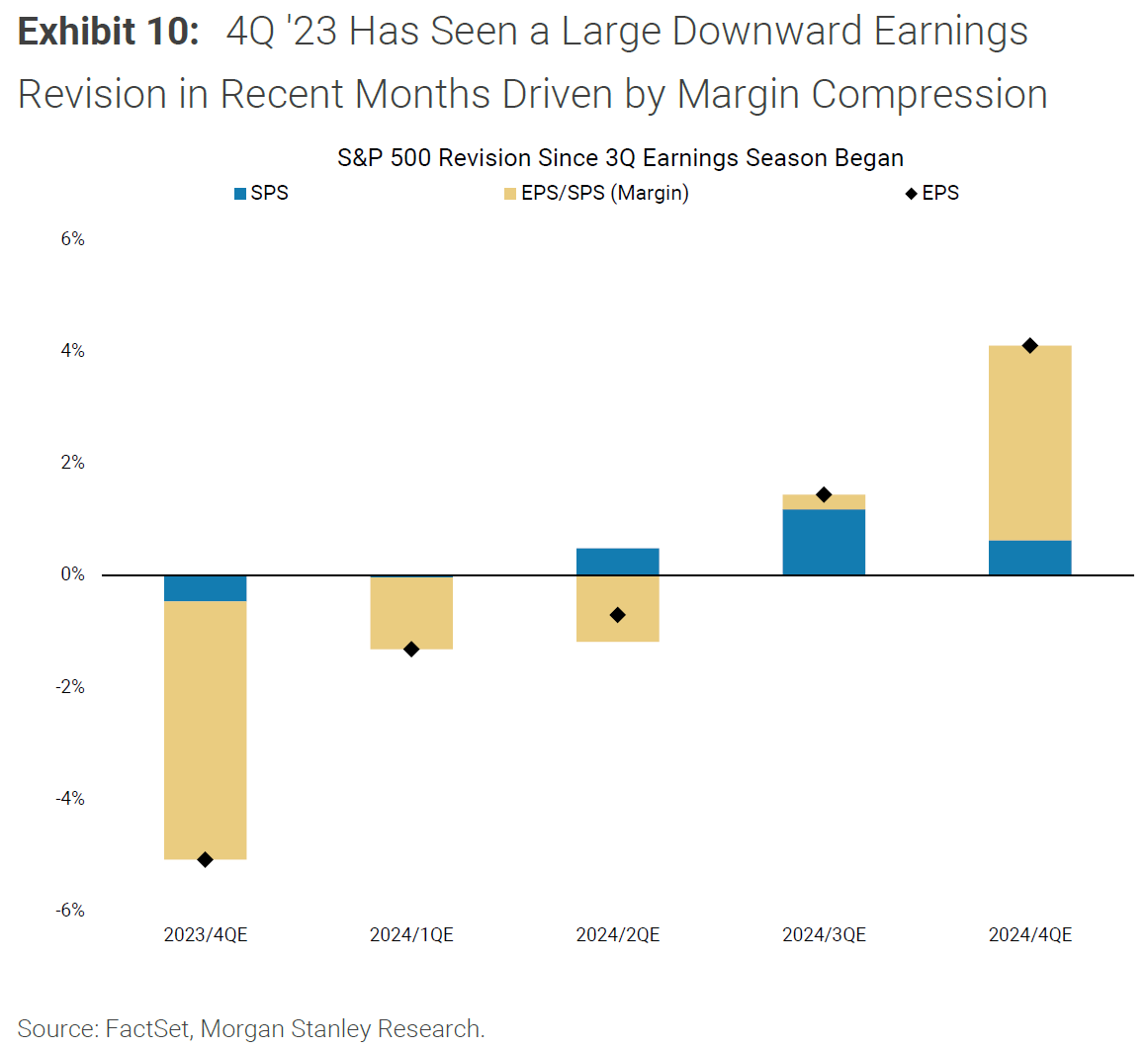

Per Morgan Stanley, US company earnings are likely to weaken in the fourth quarter before a rebound in 2024.

Estimates for fourth-quarter S&P 500 profits have fallen 5% since the previous reporting season began.

Typically, consensus estimates for the current year’s EPS decline by nearly 5% through the course of the year and, if that precedent holds, US corporate EPS should fall to around MS’ estimate of $229 by the end of 2024.

Data compiled by Bloomberg show the same trend of falling estimates for the fourth quarter, with Wall Street now expecting YoY earnings growth of 1.5% in the period.

Macro Chart In Focus

Analyst Team Note:

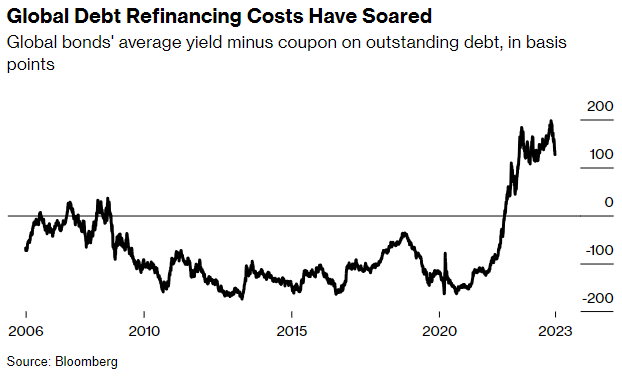

The greater the rate, the greater the hit to companies and households from a sweeping repricing of debt, as loans and bonds with ultra-low rates expire and new ones are taken out at much higher cost.

The amount of maturing US corporate debt is set to double in the next two years, to about $1 trillion in 2025, and triple in the euro zone, to the equivalent of more than $400 billion, data compiled by Oxford Economics show.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The Federal Reserve is expected to cut interest rates in 2024, with economists predicting a total reduction of about 100 basis points starting from June, according to a Bloomberg News survey.

This anticipated move follows a period of steady policy and cooling inflation from multi-decade highs last year.

The motivation behind these rate cuts is crucial: if they are in response to a cooling economy and falling inflation, it suggests a successful "soft landing" without a downturn.

However, if the cuts are due to a deteriorating economy and looming recession, this could indicate rising unemployment and declining corporate profits.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.