11.9.22: Crypto Contagion Affects Tech Sentiment. U.S. CPI Data Released Tomorrow.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: My good friends, this is a challenging time for nearly everyone - employees, employers, and investors alike. I’m more concerned about the real economy than the stock market. My fear is that the stock market will recover faster than the economy itself, but many people may not be able to participate. In the meantime, the real-economy is in serious trouble.

This is the time to double-down on yourself, your skillsets, and your knowledge.

You are not replaceable. But only you can prove that to your Employers.

Just remember: Tough times don’t last. But tough people do.

It is certainly challenging out there, but I want you to know I’m rooting for you. Make sure to follow my latest public thinking on Youtube, Twitter, and Instagram. I’ll keep doing my part to providing you the best investment research as possible for intermediate-term & long-term investing.

A sincere thank you for being a part of my Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable. Make sure to be on our main email list “Letters from Larry ” as well - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3748.57

KWEB (Chinese Internet) ETF: $22.48

Analyst Team Note:

A word on the crypto implosion we’ve seen over the past couple days…

“What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking. A cascade of margin calls is likely underway.” - J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

We’re seeing the unwinding of the absurd sectors of the financial markets from SPACs to crypto (FTX/BNB fiasco). This is likely just the beginning as we still have a lot more liquidity to flush out of the system.

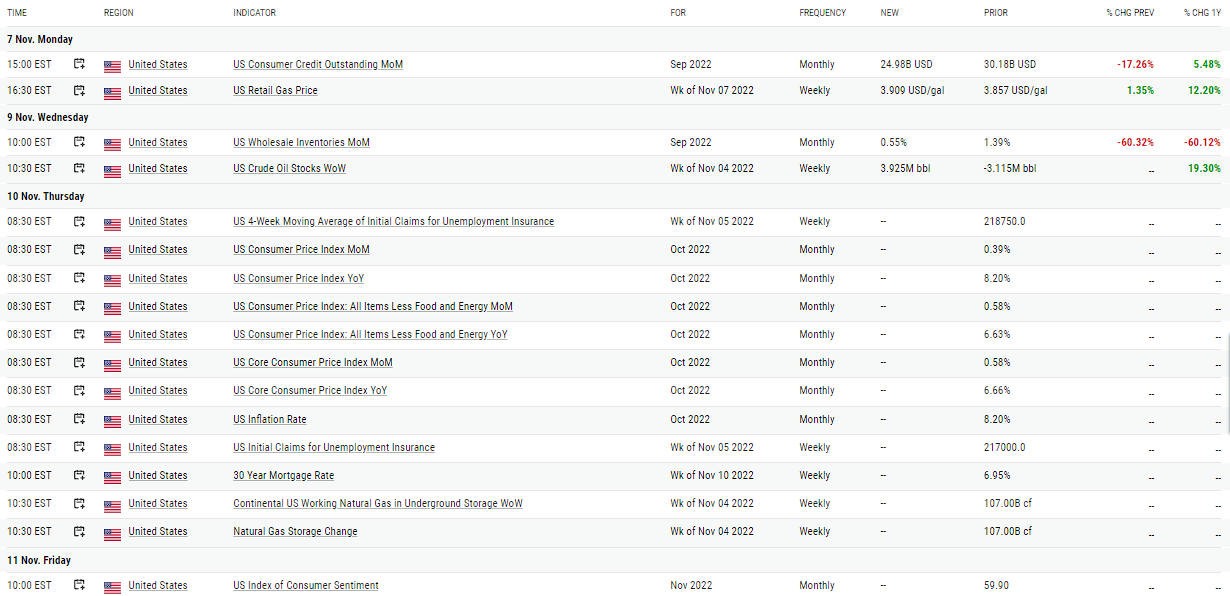

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“The midterm elections is also likely to have little, if any impact on the Fed. Ironically, in the past two years the Fed has inadvertently done the opposite of what a politically compromised central bank will do. Standard Political Business cycle theory argues that a central bank will want to ease going into elections so that incumbents enjoy low unemployment and low interest rates. Then as inflation picks up with the usual lags, the central bank tightens to bring inflation back down. This sets them up for the next election season. Last year, the Fed kept postponing rate hikes even though no election was looming. In our view, there was nothing political about this.” - Bank of America

Chart That Caught Our Eye

Analyst Team Note:

Americans have steadily allocated higher ‘share of stomach’ to FAFH (food away from home) over time, with the pace of change accelerating sharply over the past decade (share of stomach increased from 40% to 46%). In addition, in times where relative cost gaps has declined (i.e., cost of FAFH is more favorable relative value) restaurant demand tends to pick up.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs