11.8.23: Mortgage Rates Fall by Most in Over a Year

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4378.38

KWEB (Chinese Internet) ETF: $27.40

Analyst Team Note:

The current investment landscape shows a lack of conviction going into the year-end, as evidenced by five key indicators:

Long only funds (LOs) have barely altered their sector exposures over the last three months, with only slight increases in cyclical sectors, indicating a continued defensive posture

High beta exposure is low despite expected seasonal rallies; active share is at a ten-year low, suggesting a trend towards benchmark-hugging

Cash allocations remain high, albeit off their peak; and bond proxies such as Utilities, Staples, and Real Estate have suffered after interest rate increases.

Largest sector shift has been a significant increase in Communication Services (Tech/Media/Telecom), making it the most crowded sector.

Speculative positions in 10-year US Treasury bonds are at an all-time high, which typically foreshadows rising yields.

Macro Chart In Focus

Analyst Team Note:

Underwriters have adopted a cautious strategy in the IPO market, resulting in a smaller float and a larger allocation to long-term investors like mutual funds, which has led to liquidity concerns and disappointing aftermarket performance for recent listings.

For instance, Instacart and Birkenstock allocated significant portions of their offerings to cornerstone and long-only investors, resulting in reduced public float and liquidity.

While Instacart experienced a decline after its initial rise, Birkenstock saw a 13% drop on its debut, signaling a tough environment for new listings and challenging the expectation that the IPO market would remain robust through year-end.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

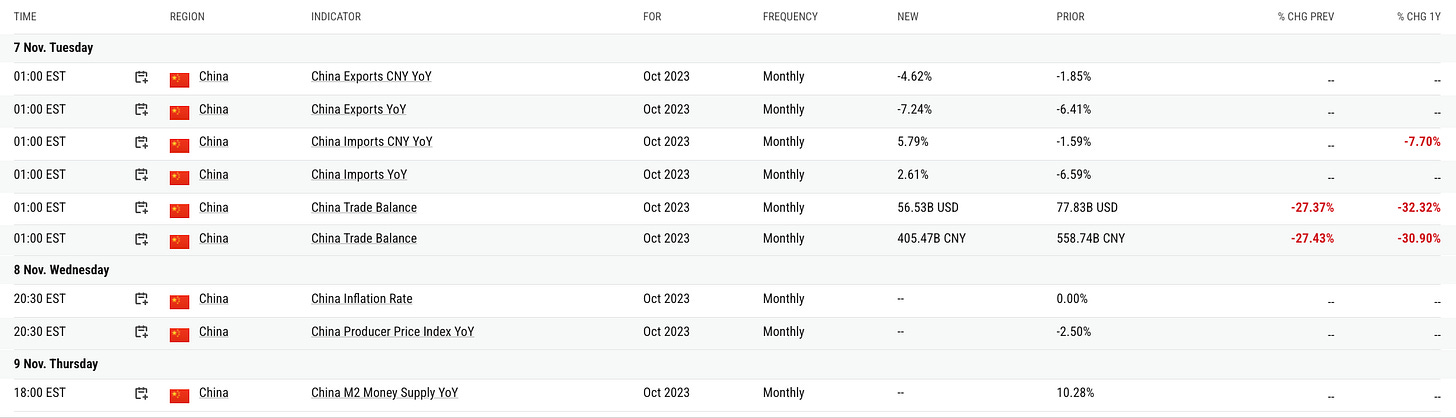

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

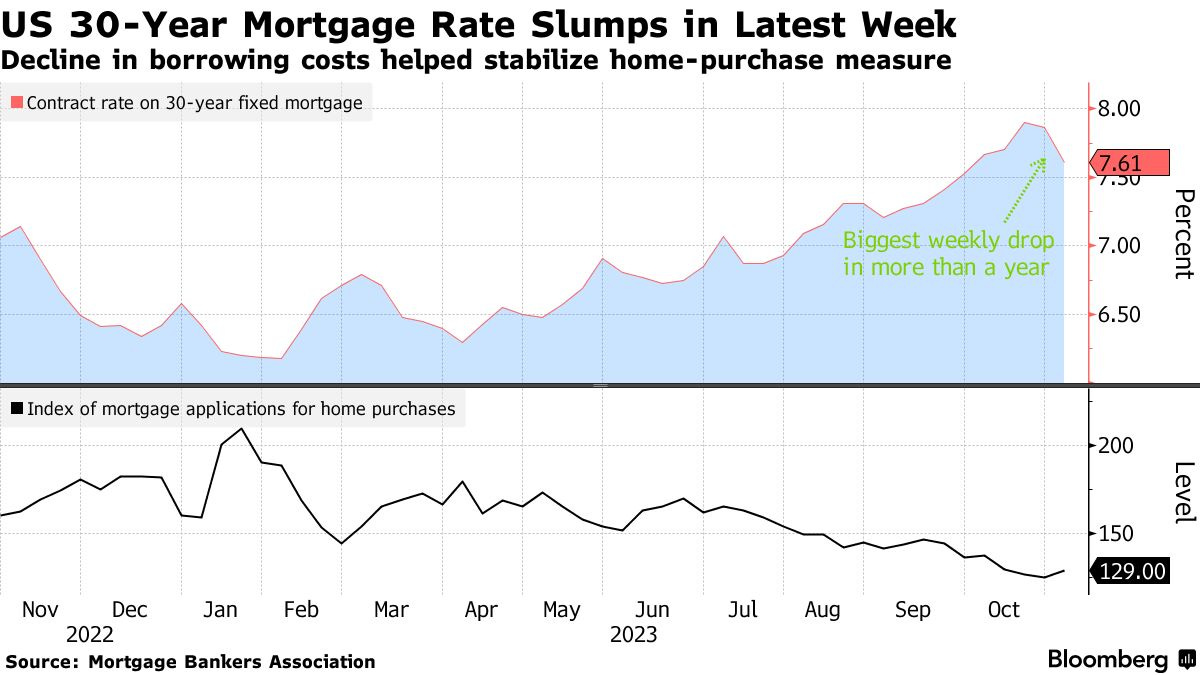

The average 30-year fixed mortgage rate significantly dropped by 25 bps to 7.61%, marking the largest decrease in over a year and contributing to a 3% surge in home purchase applications—the most since early June—according to the Mortgage Bankers Association.

This decline, the first consecutive weekly drop since mid-June, provides a slight respite for the beleaguered housing market, although rates are still high enough to deter many potential movers, maintaining pressure on supply and keeping home prices high.

Overall mortgage applications, including both purchasing and refinancing, have risen by 2.5% from a historic low.

Chart That Caught Our Eye

Analyst Team Note:

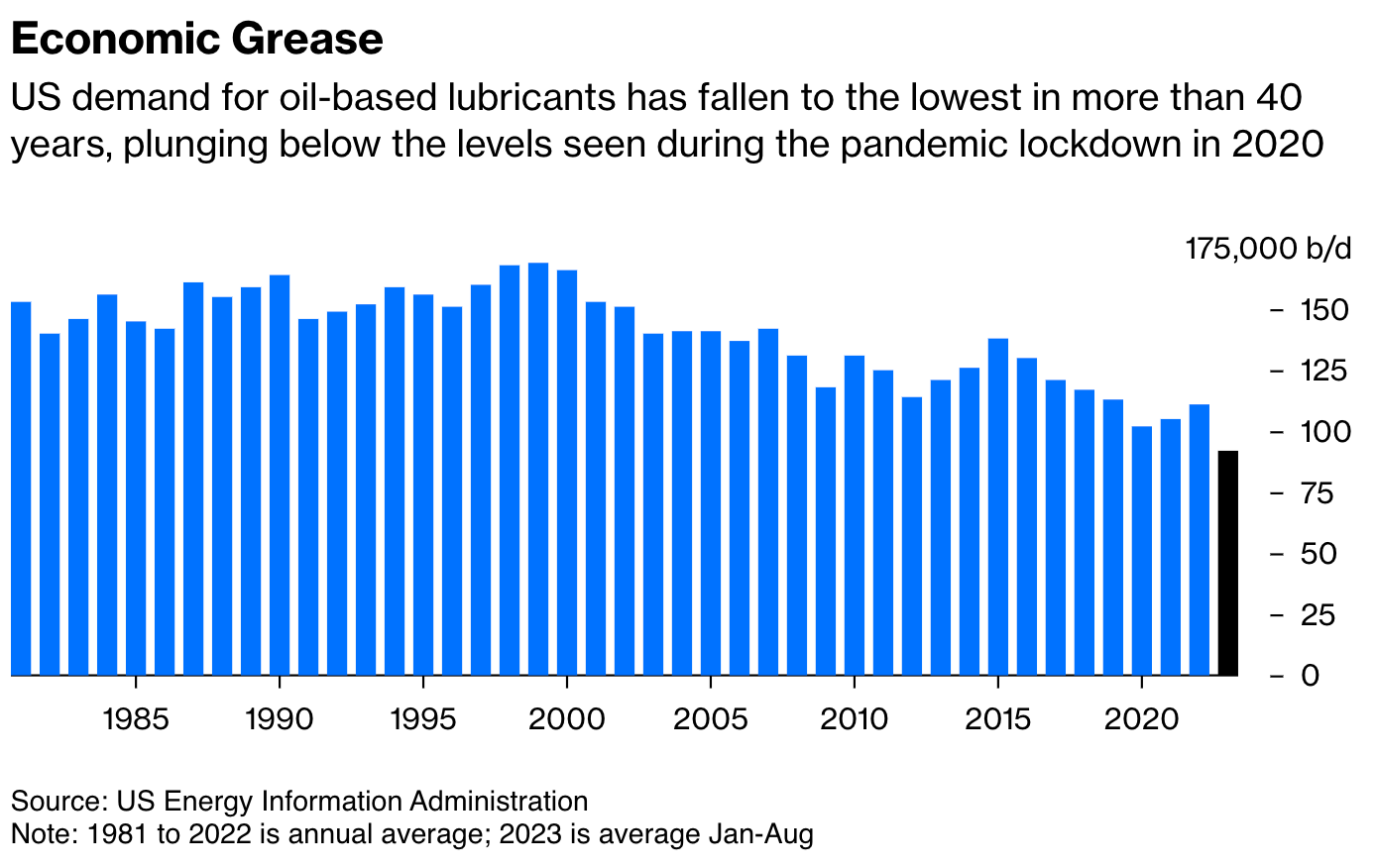

Currently, the lubricant market, dominated by major producers like Shell and ExxonMobil, is indicating a worrying decline in demand, which is emblematic of a broader economic downturn.

With U.S. lubricant consumption at its lowest in over four decades, this trend reflects not just structural shifts in the economy but also a cyclical slowdown in industrial activity across the world, including in Europe, India, and China.

This decline in lubricant demand, though it represents a small fraction of global oil consumption, is a significant indicator of reduced industrial production and is corroborated by other measures like the JPMorgan global manufacturing index and falling diesel consumption, signaling a period of economic deceleration that could impact broader markets and central bank policies.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.