11.7.22: U.S. Midterms outcomes will drive the S&P 500's next steps. China remains resilient in spite of reopening rumors officially denied.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Our next formal Bi-Weekly Investment Strategy update will be released inside our Patreon Community on November 15th-16th.

I am always, always rooting for you. Stay healthy. Stay fit. Protect your job security. 🤝

Make sure to follow my latest public thinking on Youtube, Twitter, and Instagram.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable. Make sure to be on our main email list “Letters from Larry ” as well - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3,770.55

KWEB (Chinese Internet) ETF: $22.81

Analyst Team Note:

According to Morgan Stanley’s Mike Wilson, investors should stay bullish on equities ahead of this week’s US midterm elections. Polls pointing to Republicans winning at least one chamber of Congress provide a potential catalyst for lower bond yields and higher equity prices, which would be enough to keep the bear-market rally going…

Macro Chart In Focus

Analyst Team Note:

Opportunity cost continues to increase as HY savings rates near 3.00%… There’s actually competition for capital now, compared to the past few years when it was clear equities were the ‘only option’.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“The ISM Prices Paid index for manufacturing last month dipped below 50, taken as the dividing line between expansion and recession. The supply shocks driven by the pandemic really do look now as though they have worked their way through the US manufacturing complex. The equivalent index for services prices ticked up slightly, so this is not an unalloyed positive, but again it looks as though the peak is in” - Bloomberg

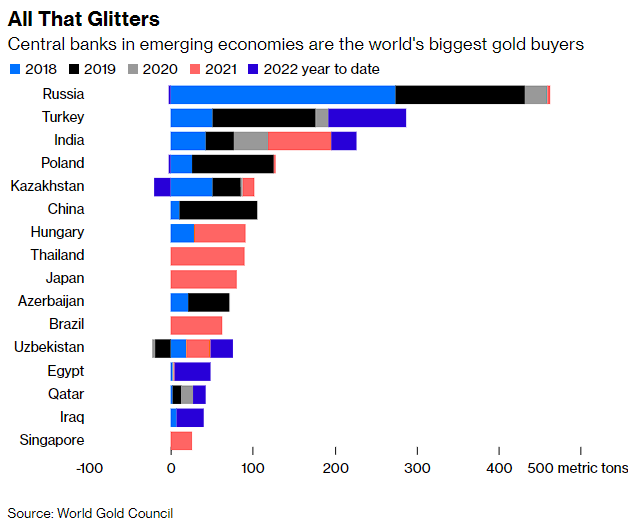

Chart That Caught Our Eye

Analyst Team Note:

Central banks bought 400 metric tons of gold in Q3, according to the World Gold Council. That’s a record inflow on par with what they’d purchase over a whole year in normal times.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs