11.3.23: Labor Market Continues to Cool Down

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4317.78

KWEB (Chinese Internet) ETF: $26.28

Analyst Team Note:

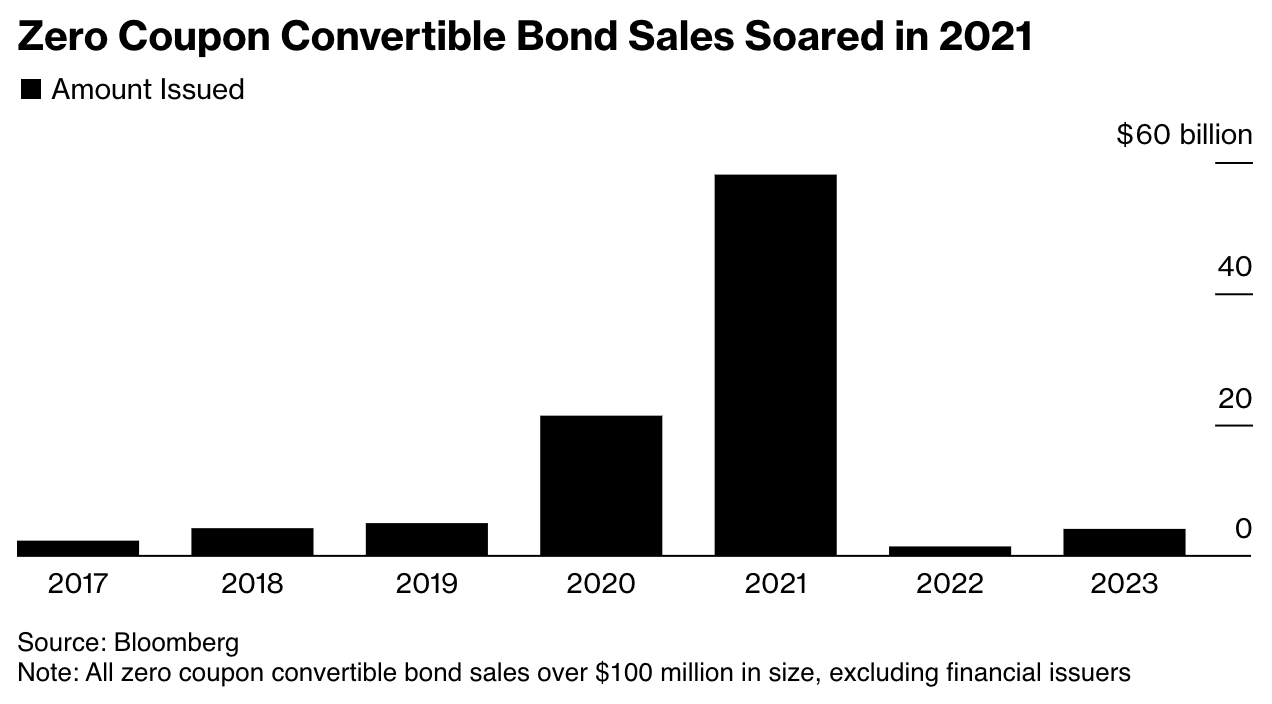

The surge in issuance of zero coupon convertible bonds by companies that thrived during the pandemic is leading to a significant refinancing challenge as the easy money era wanes.

These firms capitalized on the boom by issuing about $58 billion of these securities in 2021, marking a nearly 1,100% rise from two years prior.

However, with the reopening of offices and rising interest rates, the once favorable circumstances have shifted. Now, these companies, along with others holding zero coupon credit, are facing a daunting $69 billion repayment over the next three years.

The need for refinancing is escalating amid a backdrop of a slowing economy, weaker consumer spending, and spiking refinancing costs, especially for junk corporates, potentially raising the risk of defaults.

Macro Chart In Focus

Analyst Team Note:

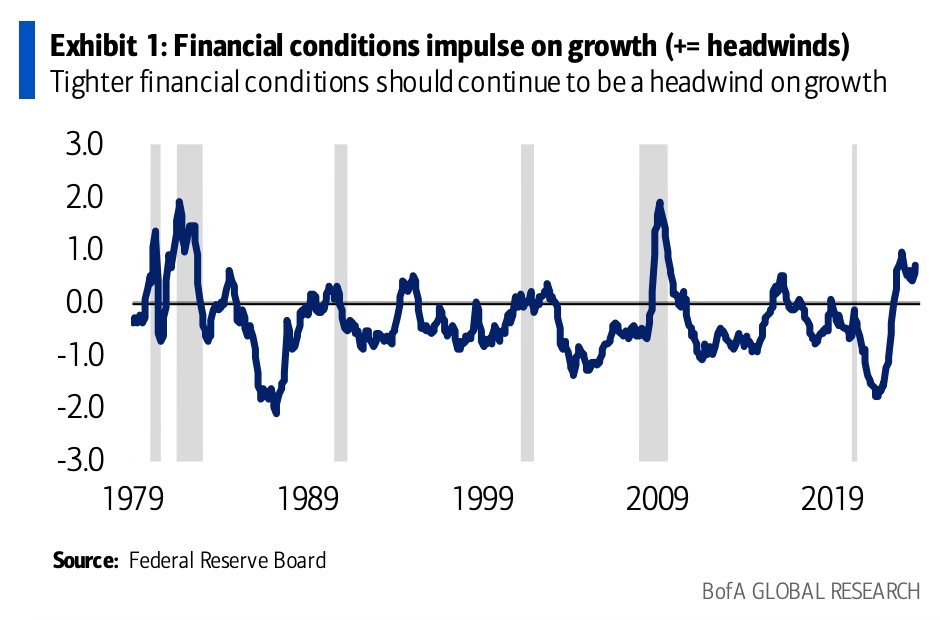

During the November FOMC meeting, the Federal Reserve maintained the target range for the Fed funds rate at 5.25-5.50%, aligning with recent communications over financial tightening concerns and market expectations, which had mostly ruled out a November rate hike.

Although there were no changes to the forward guidance language, emphasizing data dependency, Powell's tone suggested a continued bias towards future rate hikes, leaving the door open for a possible increase in December or later while indicating that discussions on how long to maintain the neutral rate haven't commenced yet.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

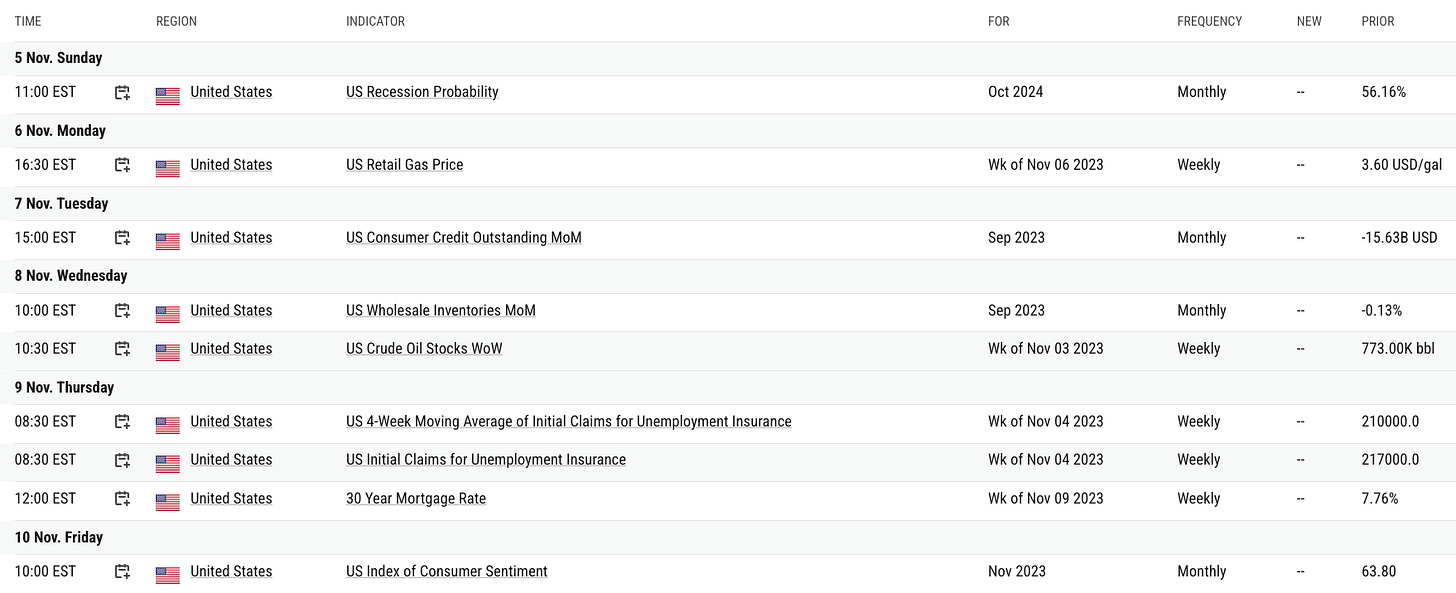

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

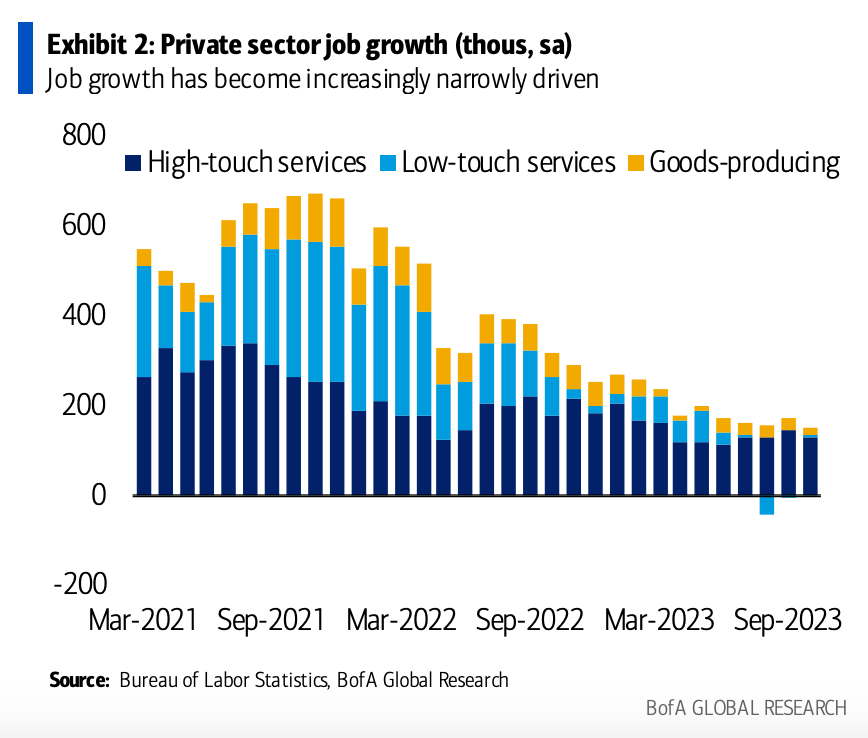

The October employment report indicates that job growth is primarily driven by a few sectors, with high-touch-service sectors such as education, health, leisure and hospitality making up the majority of private sector job gains, notably in October with 89k and 19k jobs added respectively.

Year-to-date, these sectors have contributed 1.36 million new jobs, constituting three-fourths of private employment growth.

Additionally, public employment increased by 51k in October, reaching pre-pandemic levels, although this pace is expected to slow down.

The construction sector also saw a positive trend, adding 23k jobs, an increase from the previous month, driven by a rise in single family permits and strong non-residential investment.

However, job growth declined in many other sectors, with manufacturing dropping by 35k largely due to a UAW strike impacting motor vehicle and parts employment.

In total, 44% of industries, or 36 out of 82, experienced a fall in employment in October, a rise from 32% in the previous month.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.