11.30.22: U.S. Markets make a tremendous rally towards our target range stated from last month's strategy report. Danger is lurking at certain levels.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Powell’s speech today rocked bearish speculators, and from the nature of today’s price action, I believe that many Bears are close to capitulation. Once the capitulation of bears is complete, I would personally be VERY careful about this market.

If you’ve followed me for a while, you would know that I was looking for a 4100+ target on the S&P 500 back in late October/Early November. We are within a splitting distance of this target. There are major supply zones in the next 200 points for the index meaning that Sellers will make the next stage of a market advance a much more dangerous environment for those who did not enter at the 3750-3850 region.

Follow me on Instagram now to see all the headline opinions I’ve made since August from a Bi-Weekly timeframe. You will see where exactly where I stand since August.

My December Investment Strategy Report is now released on Patreon and Substack. Join today to ensure that you have a Strategist by your side helping you monitor the market’s risk/reward. Trust me, you do not want to get caught off guard in 2023. The admission cost to protect your portfolio is asymmetrical to the cost of being caught flat-footed. Prepare now. The last thing to do right now is be complacent.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4080.11

KWEB (Chinese Internet) ETF: $26.39

Analyst Team Note:

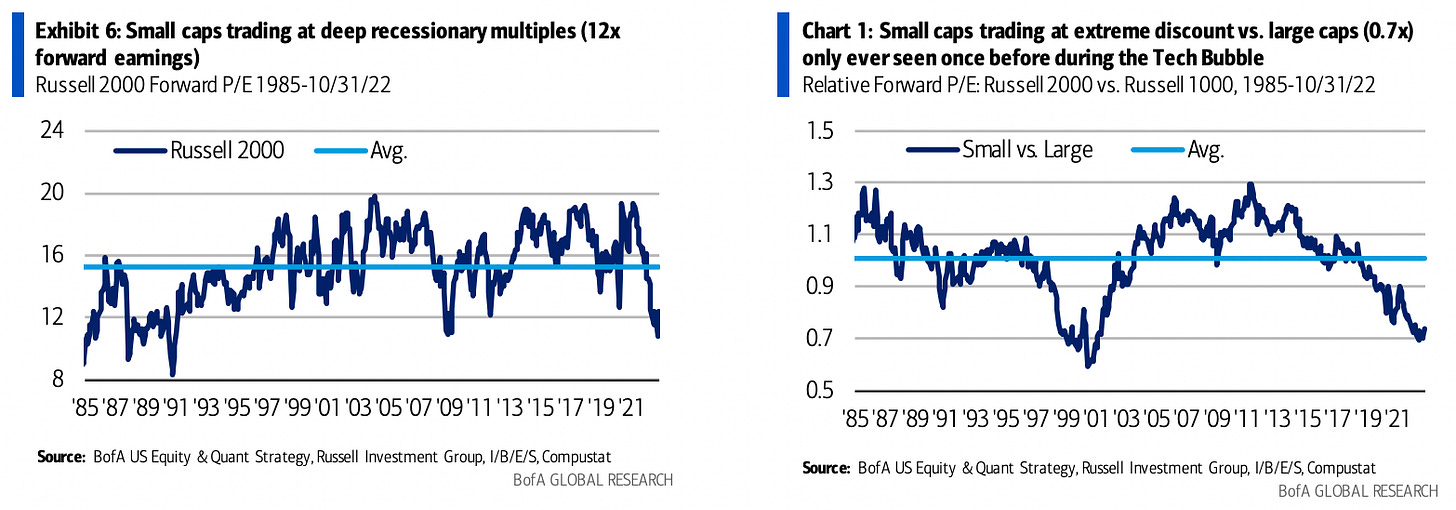

From Tim: Am looking to slowly add exposure to small caps (via Russell 2000 ETF).

At 12x, the Russell 2000 forward P/E is trading at its lowest levels in over 30 years, inline with lows during the GFC and below the COVID recession and 2001 recession lows.

The relative forward P/E vs. the Russell 1000 is also near historic lows.

Macro Chart In Focus

Analyst Team Note:

Jerome Powell gave a speech Wednesday at the Brookings Institute, which gave us some more hints about what’s likely to come.

“The time for moderating the pace of rate increases may come as soon as the December meeting.”

“Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level.”

“It will take substantially more evidence to give comfort that inflation is actually declining. The truth is that the path ahead for inflation remains highly uncertain. Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Yields on longer-term U.S. Treasurys have fallen further below those on short-term bonds than at any time in decades, a sign that investors think the Federal Reserve is close to winning its inflation battle regardless of the cost to economic activity.

Last week, the yield on the 10-year U.S. Treasury note dropped to 0.78 percentage point below that of the two-year yield, the largest negative gap since 1981, at the start of a recession that pushed the unemployment rate even higher than it would later reach in the 2008 GFC.

Chart That Caught Our Eye

Analyst Team Note:

More than $3 billion exited the $36 billion iShares Investment Grade Corporate Bond ETF on Monday. That’s the biggest one-day outflow since the fund’s inception in 2002.

The swift outflow was likely caused once again by St. Louis Fed President James Bullard’s warning that markets are underpricing the risk that the central bank “will have to be more aggressive rather than less aggressive.”

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs