11.28.22: U.S. Markets digest recent Fed Governor Commentary and Black Friday Sales Data

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4026.12

KWEB (Chinese Internet) ETF: $23.99

Analyst Team Note:

“Since COVID, idiosyncratic risk in the market has dropped, and average pair-wise stock correlations surged in 2022. The biggest rate shock in history, the most aggressive hiking cycle, the biggest inflationary pressure in 40+ years, rising recession fears (Bloomberg probability of US recession within 12 months at 100%), wartime and ongoing geopolitical risks, urgency building around carbon emission reduction suggest macro will loom large in 2023.” - BofA

Macro Chart In Focus

Analyst Team Note:

It’ll be interesting to see when equity leadership will flip from the United States to Emerging Markets. Is the decade of American equity dominance over?

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

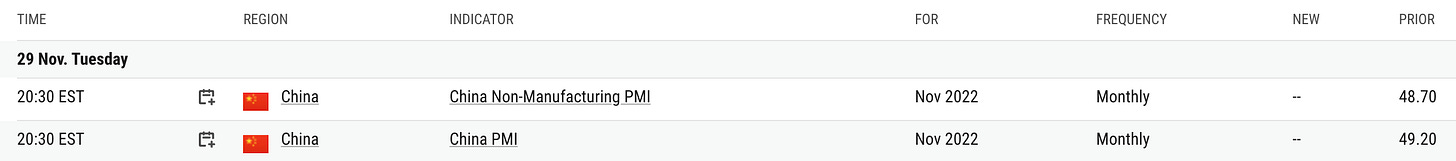

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Futures pricing indicates a downshift to a smaller, 50 basis-point, increase when policy makers gather on Dec. 13-14, in contrast to 75 basis-point hikes that had become norm, with the cycle ending next year with the key rate near 5%.

Cleveland Fed President Loretta Mester noted that she doesn’t think market expectations are “really off”.

Chart That Caught Our Eye

Analyst Team Note:

At current trends, the share of goods and services in personal consumption may not return to pre-pandemic trends for another 12-18 months. This assumes the pandemic did not induce any permanent shift in consumer spending patterns.

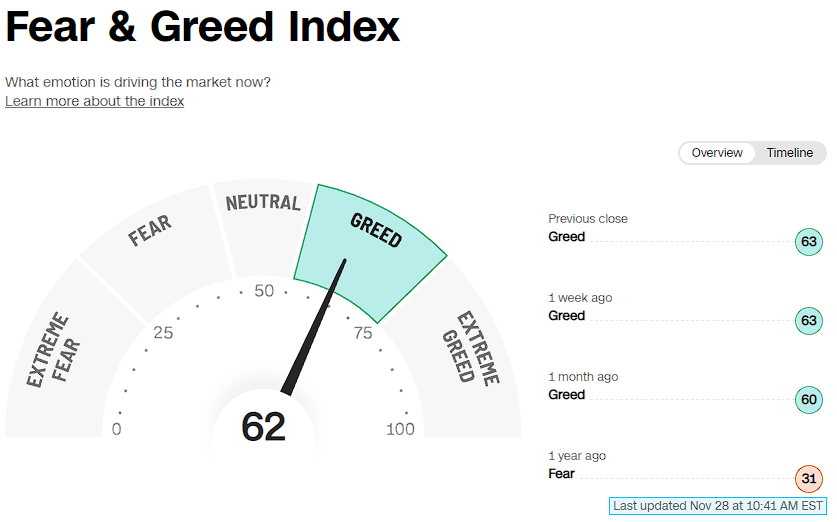

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update