11.27.23: Student Loan Payment Has Little Effect on Spending??

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4559.34

KWEB (Chinese Internet) ETF: $28.56

Analyst Team Note:

“Despite what feels like a big jump in sentiment recently, data still points to convictionless equity bears (except for Tech/AI love). Pension equity weights are at 25-yr lows, sell-side market targets are mostly underwater, consensus long-term earnings growth for the S&P 500 is at its lows (ex. COVID), and active funds are hugging their benchmarks. Bull markets typically end with high conviction and euphoria - we are far from that.” - Bank of America

Macro Chart In Focus

Analyst Team Note:

Recent data from Fidelity Investments reveals that Americans are increasingly tapping into their retirement savings to manage financial pressures, primarily for housing and medical expenses.

In the last quarter, 2.3% of workers took a hardship withdrawal, a rise from 1.8% the previous year, mainly to avoid foreclosure or eviction and to cover medical costs.

Additionally, the proportion of 401(k) participants taking loans against their accounts increased to 2.8% from 2.4% in the same period last year.

About 17.6% of workers currently have an outstanding loan against their 401(k), and the average 401(k) balance has dropped to $107,700, indicating a slight decrease from the previous quarter.

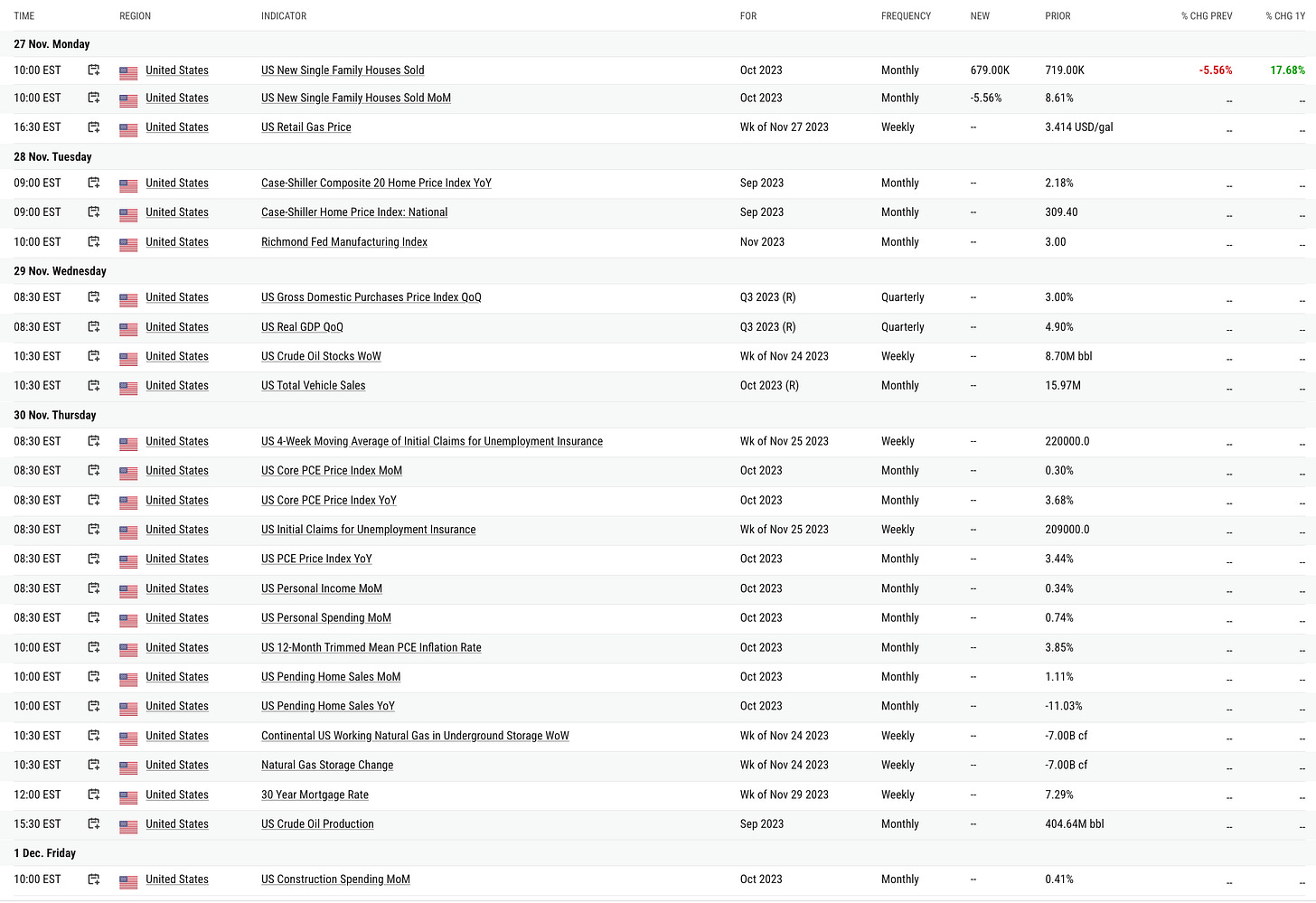

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The end of the student loan moratorium has raised questions about its impact on consumer spending.

Data from Bank of America indicates a significant increase in the number of households making student loan (SL) repayments in October, with the count doubling from September but still 25% lower than January 2020 levels.

Analysis of spending patterns of households making their first SL payment in 2023 reveals no apparent adverse impact on their spending compared to other groups.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.