11.23.22: U.S. Markets approach key technical levels - S&P 500 now 1-2% away from 200 Day Moving Average

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I wrote a long-form piece on Warren Buffet and his wisdom/insights from his Annual Shareholder letters which will be delivered to your inbox tomorrow. This will be provided to both my Public and Private Community out of my community to help my Global Friends here. In the meantime, enjoy your Thanksgiving holiday. 🦃

We sincerely appreciate all of the support we get from our Community and will continue to work hard for you.

To support this email newsletter, consider checking out our channel partners Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4003.58

KWEB (Chinese Internet) ETF: $24.50

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

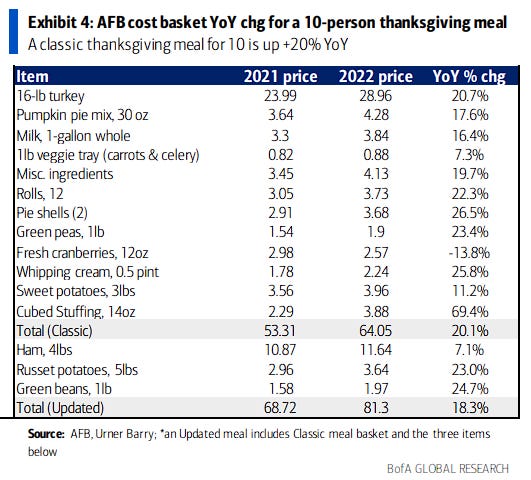

The American Farm Bureau (AFB) Thanksgiving cost index projects a +20.1% YoY increase to 2022. On a dollar basis, a classic Thanksgiving meal for 10 people this year is predicted to cost ~$10 more, tallying up to a total check of $64.05, or slightly under ~$6.50 per person.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The Fed has been raising rates at the fastest pace since the early 1980s. Typically, inflation falls after unemployment rises, and long after the first rate increase. If the fall in core inflation between September and October continues, and September proves to be the peak, the time between the first Fed increase and the high point of inflation will be one of the shortest of any Fed hiking cycle.

Chart That Caught Our Eye

Analyst Team Note:

Like consumers, US corporates have largely shifted to longer-dated fixed rate debt. Today, over 75% of S&P 500 debt is long-term fixed vs. 40% in 2007. The average maturity of debt on S&P 500 balance sheets today is 11 years vs. 7 years in 2007.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Interesting Tweets from Strategist Larry (Follow) - Make sure to follow the right account. Many impersonators out there, some of whom have been blocked by Twitter.