1.12.24: JPM Reaches Profit Record, Red Sea Troubles Inflationary

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4780.24

KWEB (Chinese Internet) ETF: $25.63

Analyst Team Note:

JPMorgan reached a historic milestone recording the highest annual profit ever for a bank. In Q4 of 2023, the bank's net income reached $9.3 billion, contributing to an annual total of $49.6 billion.

This figure represents a 32% increase from 2022 and surpasses the previous record of $48.3 billion set in 2021.

The combined earnings of the six largest U.S. banks did not surpass $100 billion until 2018 and JPMorgan alone nearly achieved half of this milestone in 2023.

Macro Chart In Focus

Analyst Team Note:

China is experiencing a prolonged period of deflation, with consumer prices falling for the third consecutive month, marking the longest streak of declines since 2009. This comes along with a drop in exports, which fell 4.6% last year for the first time since 2016.

The People's Bank of China is expected to respond by cutting policy loan rates and injecting more cash into the financial system, as concerns grow about falling corporate revenues, increasing debt burdens, and delayed consumer purchases.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

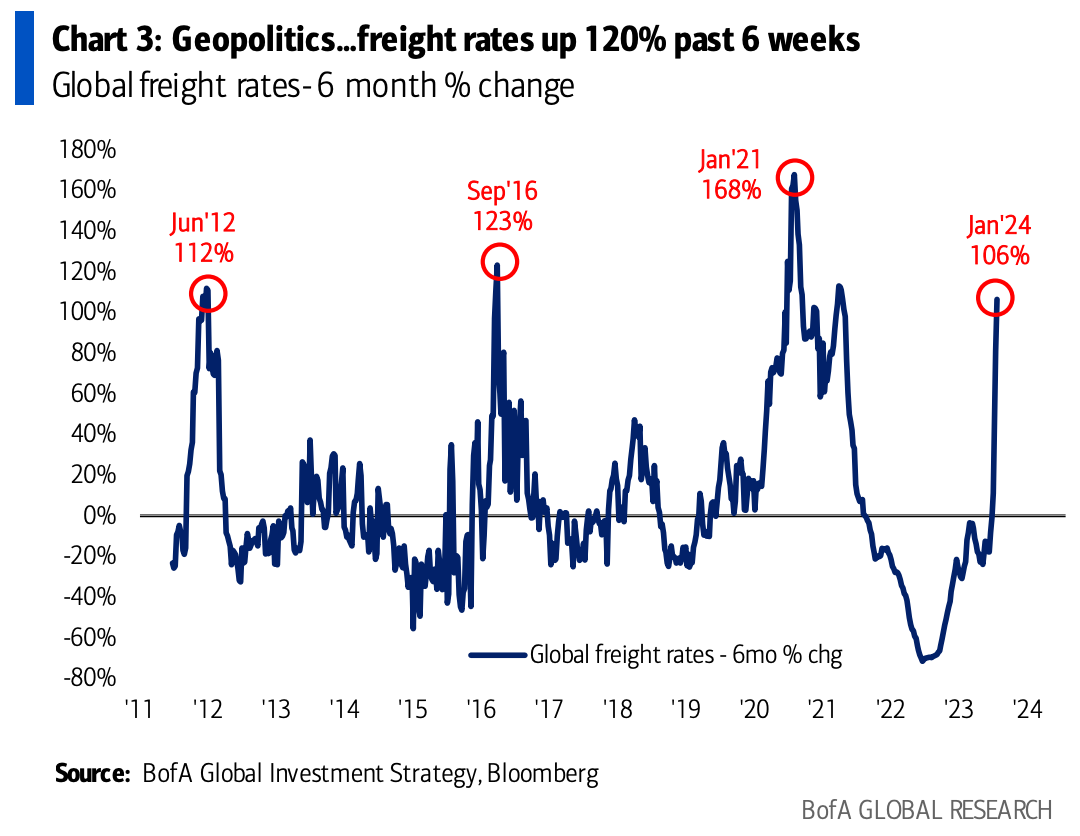

Chart That Caught Our Eye

Analyst Team Note:

“The Biggest Picture: geopolitics inflationary… transit volumes through Red Sea/Suez Canal down 35-45% past 4 weeks; Red Sea 12% world trade, 30% container traffic)… global freight rates up 120% past 6 weeks” - Bank of America

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.