11.2.22: Fed decides to signal that Fed Funds Rates target may be higher than previously expected at November FOMC.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: The Fed has decided to step up their hawkish rhetoric at the November FOMC, sparking a risk-off selloff across markets (but mostly concentrated among high-beta areas). We’ll be assessing the implications of their latest message and what it means for U.S. and China equities.

Meanwhile, a new video on our Youtube Channel has been released. The risks in Chinese ADRs (Alibaba/KWEB ETF/Tencent/JD) and H-Shares continue to be elevated, but the opportunity for a significant bounce may appear once any official news related to Zero Covid appears. I will be using this period of time to gain sector expertise in the A-Shares onshore market in China as well. .

Over the past 45 days, We’ve been very positive on one company inside the KWEB ETF, and this company has been performing very strongly relative to KWEB, S&P 500, Nasdaq, and even the Dow. We discussed this heavily inside our Investment Community, and urge our friends to not only focus on headline companies (like BABA) and dig into other opportunities in China as well. Members & friends inside know what this name is.

Use this bear market to sharpen up your equity research and company-selection skills.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable. Make sure to be on our main email list “Letters from Larry ” as well - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: $3856.10

KWEB (Chinese Internet) ETF: $20.26

Analyst Team Note:

The S&P 500 gained 8.1% in October (total return), paring some of the losses from its 9.2% drop in September. It was a 96th percentile month going back to 1936 and the best October since 2015. The equal-weighted index outperformed by 1.6ppt, as the bottom 450 stocks in the S&P 500 led the top 50 stocks by 4.8ppt (a 98th percentile spread since 1986).

Macro Chart In Focus

Analyst Team Note:

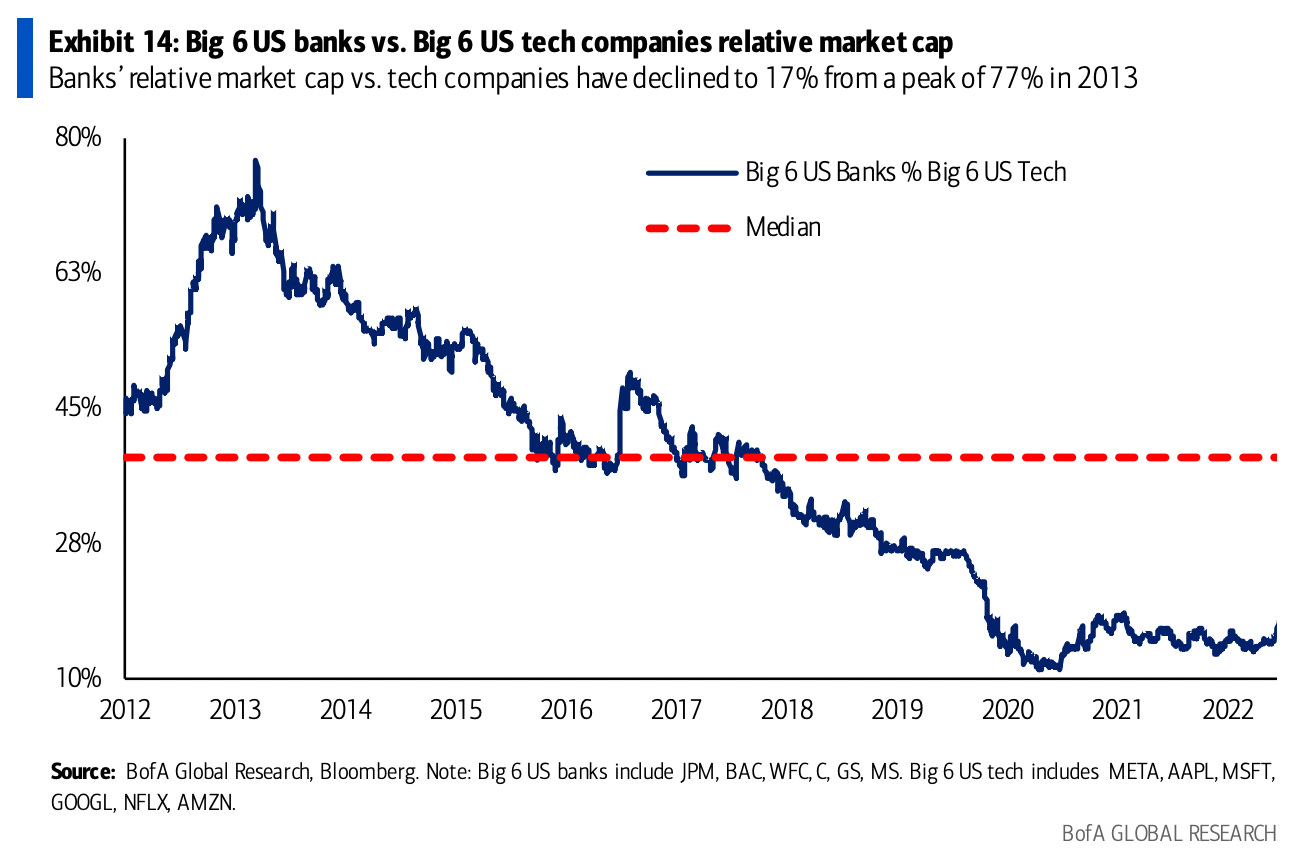

The big six US banks have seen their market-cap shrink relative to the largest tech stocks over the last decade to 17% from 77%. Structurally higher interest rates, re-shoring, limited policy overhang, a potentially mild recession and the ability of the large banks to gain market share from non-banks/digital native companies could drive a partial reversal.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

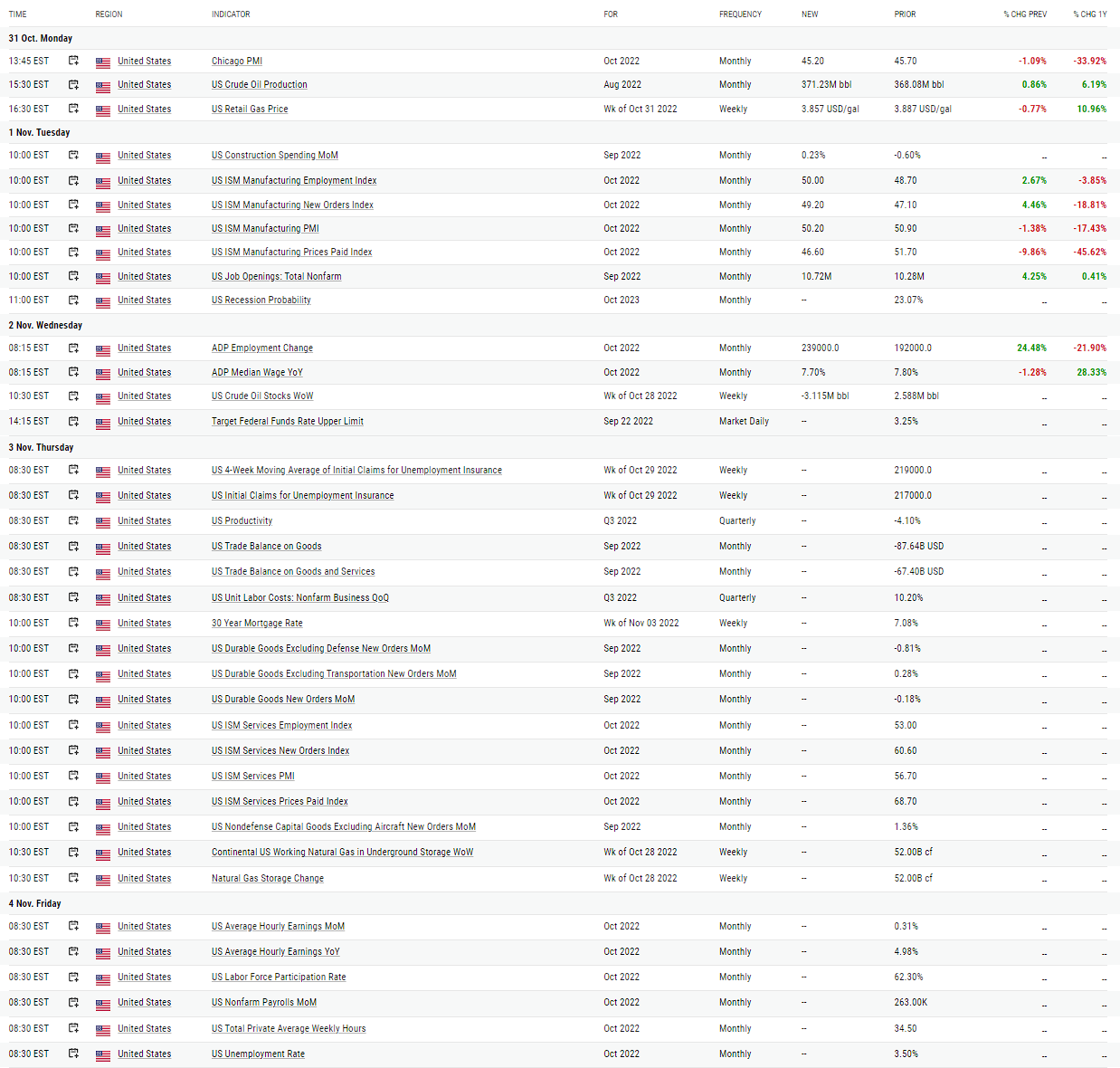

U.S Economic Calendar (Upcoming Data Points)

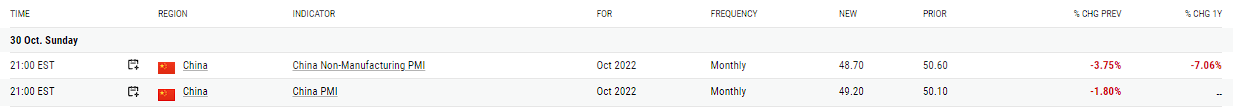

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

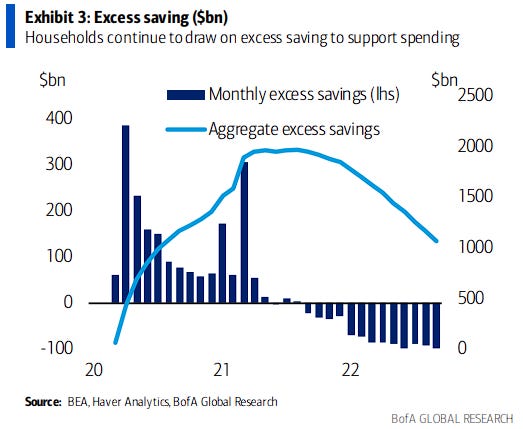

“At 3.1%, the saving rate in September has fallen fairly rapidly from 7.5% in December, and suggests households have had to more forcefully tap into saving to support spending during a period of rising inflation and tepid growth in real income. After taking into account revisions to income, saving, and spending, our estimate of excess saving on household balance sheets fell to $1.1tn, which is a little less than one month of personal consumption expenditures based on September spending data ($1.5tn). Households continue to draw down on excess saving to the tune of about $100bn per month.” - Bank of America

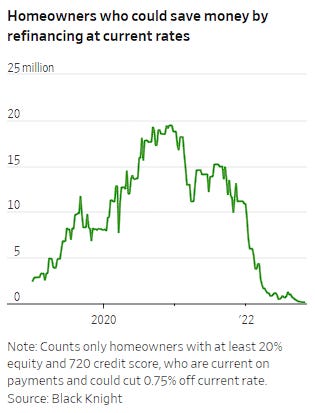

Chart That Caught Our Eye

Analyst Team Note:

With mortgage rates now above 7%, just 133,000 U.S. homeowners can save money by refinancing at today’s rates, down from a peak of over 19 million in late 2020, according to Black Knight.

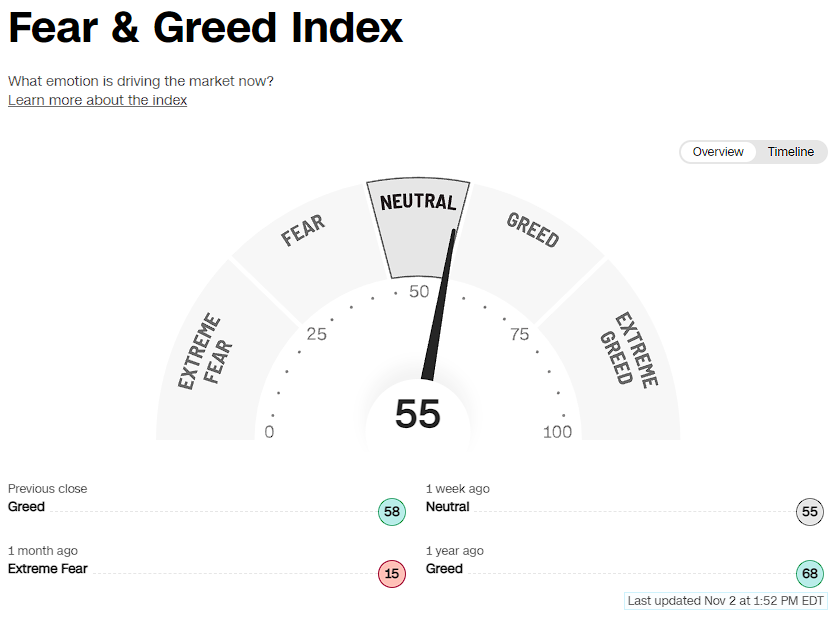

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs