11.21.22: Shortened U.S. Trading Week means that markets will find direction after Thanksgiving

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: For my friends in the U.S, enjoy your Thanksgiving Holiday with Friends & Family. I’ll be spending this time of narrowed trading ranges/lower volatility in the S&P 500 to learn additional skillsets and practical knowledge.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

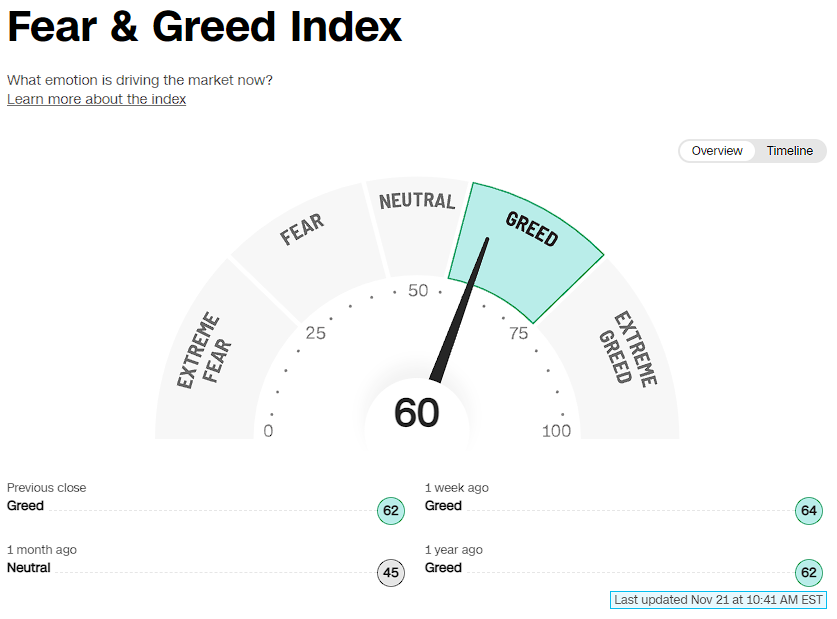

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3965.34

KWEB (Chinese Internet) ETF: $25.91

Analyst Team Note:

Investors have poured more than $86 billion into U.S. equity mutual and exchange-traded funds in 2022, according to Morningstar Direct data through the end of October. That is on track to mark the second-highest sum since 2013, following last year’s inflows of $156 billion.

“Investors are too bearish”… Ok.

Despite this year’s slump, U.S. stocks are nearly 1.8 times as expensive as the other 22 developed markets in aggregate, when comparing prices with corporate earnings over the past five years.

Source: WSJ

Macro Chart In Focus

Analyst Team Note:

“The key question in the outlook for the US economy in 2023 is how much of an adjustment in labor market conditions will be needed in order to put inflation on a clear downward trajectory.

Our baseline outlook calls for a sharper rise in the unemployment rate than the Fed expects. This forecast is based on i) history (soft landings are difficult to achieve), ii) our view that labor market imbalances are larger than the Fed is currently estimating, and iii) the Fed’s belief that the risk of tightening policy too little is greater than the risk of doing too much.” - BofA

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Per the WSJ, Saudi Arabia and other OPEC countries are discussing an output increase of up to 500,000 barrels a day.

“It is an unusual time for OPEC+ to consider a production increase, with global oil prices falling more than 10% since the first week of November. Brent crude traded at about $87 a barrel on Monday, while WTI, the U.S. benchmark, fell below $80 a barrel for the first time since September. Production increases normally cause prices to fall, while cuts lead prices higher.” - WSJ

Chart That Caught Our Eye

Analyst Team Note:

Great graphic visualizing the tightness/slack in financial conditions.

Source: Visual Capitalist

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs