11.16.22: NVDA Earnings Meet Buyside Expectations. U.S Markets digest recent rally.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Our mid-month November Investment Strategy is released where we provide intermediate-term research opinions on our covered themes. We like the longer-term outlook on Semis but we discussed that a near-term pullback was in order. We stay constructive on China, but add/re-entering at the right levels also need to be done with care after the large recent advance. All this and more is discussed in our report. A premium preview was provided on Substack yesterday evening. Feel free to take a look. The majority of my Investment Community members are currently on Patreon. But some new public friends have chosen to join me on Substack because they prefer to simply receive the research in email-format. The research content is precisely the same.

My strategy is best designed for investors with an intermediate-term or long-term orientation towards investing.

If you’re invested in China ADR stocks, consider checking out Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3991.73

KWEB (Chinese Internet) ETF: $26.81

Analyst Team Note:

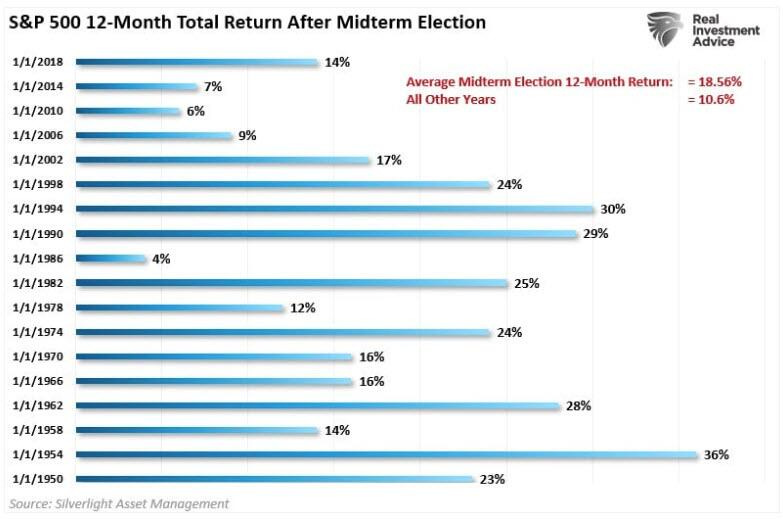

Since 1950, there have been 18 midterm election cycles, and in the twelve months following each of those cycles, the stock market has had positive returns. Over the subsequent 12 months, stocks delivered an 18.56% average annualized gain compared to just 10.6% over all other years.

Macro Chart In Focus

Analyst Team Note:

“The relationship between corporate revenue growth and tightening credit conditions (Exhibit 1) suggests that the outlook for corporate profits will continue to deteriorate at an accelerating pace, as already evident in Q3 corporate earnings reports and the declining ratio of analysts’ upward-to-downward estimates for future profits.” - Merrill Lynch

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

The October retail sales report was constructive, with the headline and the core control group coming in above estimates.

As expected, spending rose sharply at gas stations (due to higher gas prices), restaurants (as the reopening tailwind continues) and nonstore retailers (because of the additional round of Prime Day and related promotions). The only major pocket of weakness was general merchandise stores. Besides Prime Day, October retail sales were probably boosted by the distribution of stimulus checks in California.

Chart That Caught Our Eye

Analyst Team Note:

While homebuyer/homebuilder confidence have slumped to record lows, the current housing market is nowhere as leveraged as it used to be. Expect the cooling momentum to continue from here on out until we see a more balanced housing market.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Latest popular Tweet from Strategist Larry - follow me on Twitter and Instagram