11.15.23: Biden and Xi Strike Deals on Military Communications, AI, Fentanyl

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4495.70

KWEB (Chinese Internet) ETF: $27.77

Analyst Team Note:

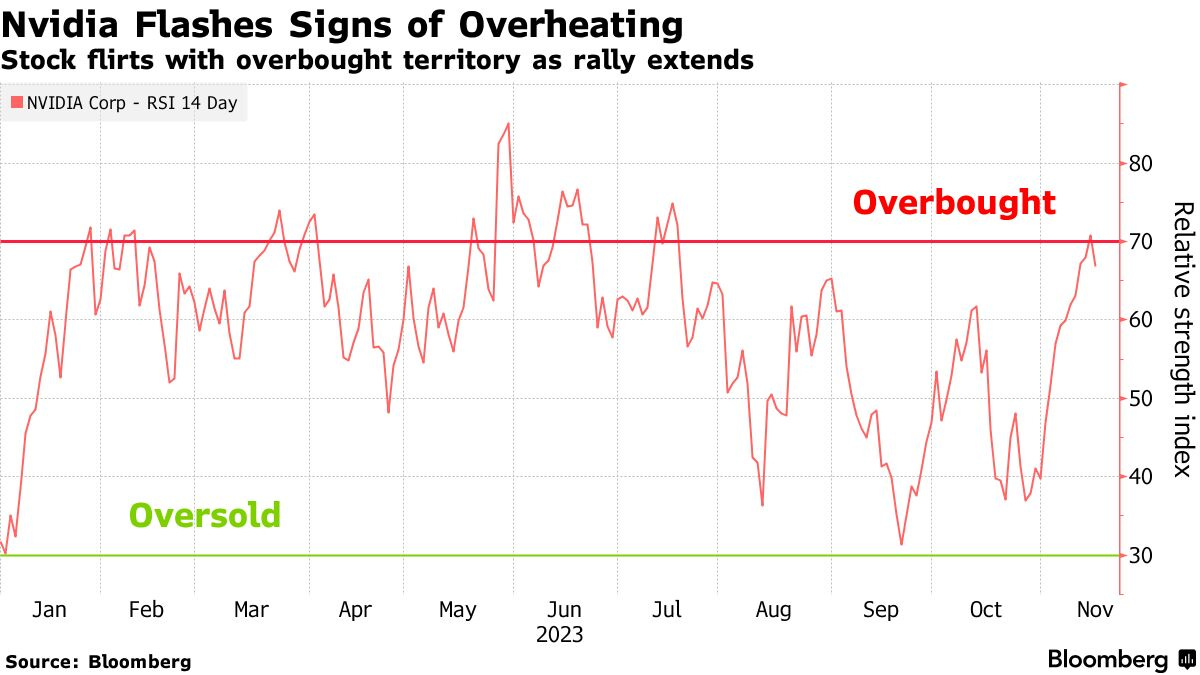

Nvidia's record 10-day streak of share gains ended, reaching overbought status, indicated by its relative strength index surpassing 70.

This decline coincided with Microsoft's unveiling of the Maia 100 AI chip, intensifying competition in the AI sector.

Nvidia's shares had previously surged 22%, adding nearly $220 billion in market value, driven by a tech stock rebound, cooling inflation, and updated AI processors.

Investors await Nvidia's earnings report on Nov. 21, amidst mixed market sentiment, with notable investors like Michael Burry betting against semiconductor stocks including Nvidia, and Stanley Druckenmiller's firm reducing its Nvidia stake.

Macro Chart In Focus

Analyst Team Note:

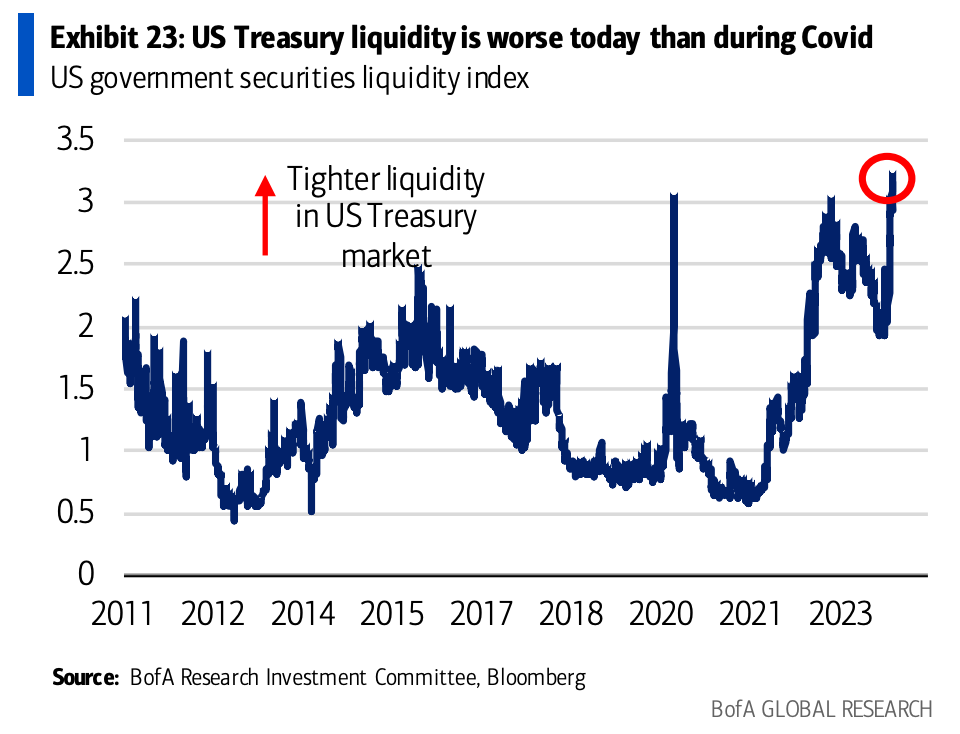

In the early 2000s, US corporate debt surged to five times more than earnings, leading to a debt crisis. Similarly, in 2005-2006, US household debt reached almost 100% of GDP before the housing bubble burst in 2008. Since then, both corporate and household borrowers have improved their financial positions by taking on fixed-rate, long-term debt.

However, the US government has been issuing short-term debt at record levels due to low interest rates, essentially relying on a floating-rate loan strategy.

This approach poses a significant risk, with over $8 trillion of securities maturing in the next few years and potential additional expenses of $100 billion for debt refinancing.

The US government's unsustainable spending, amounting to 44% of the economy, and the reliance on debt-fueled consumption through entitlement programs could have adverse effects on public finances and asset returns in the coming years.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

In October, US inflation showed a broad slowdown, with the core CPI, excluding food and energy costs, rising by 0.2% from the previous month, while the overall CPI remained unchanged, partly due to cheaper gasoline.

This development was welcomed by markets as a signal that the Federal Reserve may halt its interest rate hikes. Although inflation has eased from the 40-year high reached last year, Fed Chair Jerome Powell has emphasized that the central bank could still raise rates if necessary.

Chart That Caught Our Eye

Analyst Team Note:

“Recent US Treasury auctions have exhibited some of the largest bond auction ‘tails’ in history with final yields >5bps higher than the market expected. US Treasury market liquidity is now worse than during Covid (Exhibit 24) and foreign investors have fled US dollar-priced corporate bonds at the fastest pace on record (Exhibit 25).” - Bank of America

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.