11.14.22: U.S. Markets Consolidate and Digest recent large run-up. China Macro starts to improve.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Our Mid-Month update for November will be released tomorrow evening inside our Community. It will discuss U.S. and China macro strategy, research, and positioning. Hang tight.

My latest public email was released this past weekend if you haven’t yet see already. It includes exclusive research from my mid-October note to friends.

Hope you guys have a great week as always. I’ll be on Twitter and Instagram for more public short-form thinking.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

Thanks for reading Larry's Analyst Team! Subscribe for free to receive new posts and support my work.

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3992.93

KWEB (Chinese Internet) ETF: $24.09

Analyst Team Note:

Bank of America has turned “tactically constructive” on Chinese equities.

“While our long-term concerns on China remain in place, we turn tactically constructive on signs of credible easing of policies in recent weeks, which should help China equities, especially in the energy, materials, industrials, and consumer discretionary sectors.”

Macro Chart In Focus

Analyst Team Note:

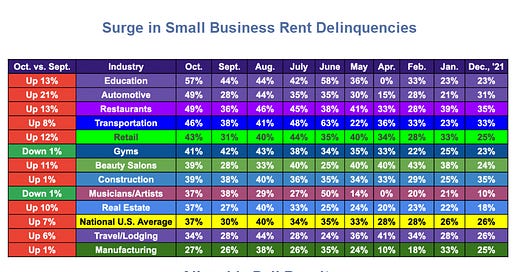

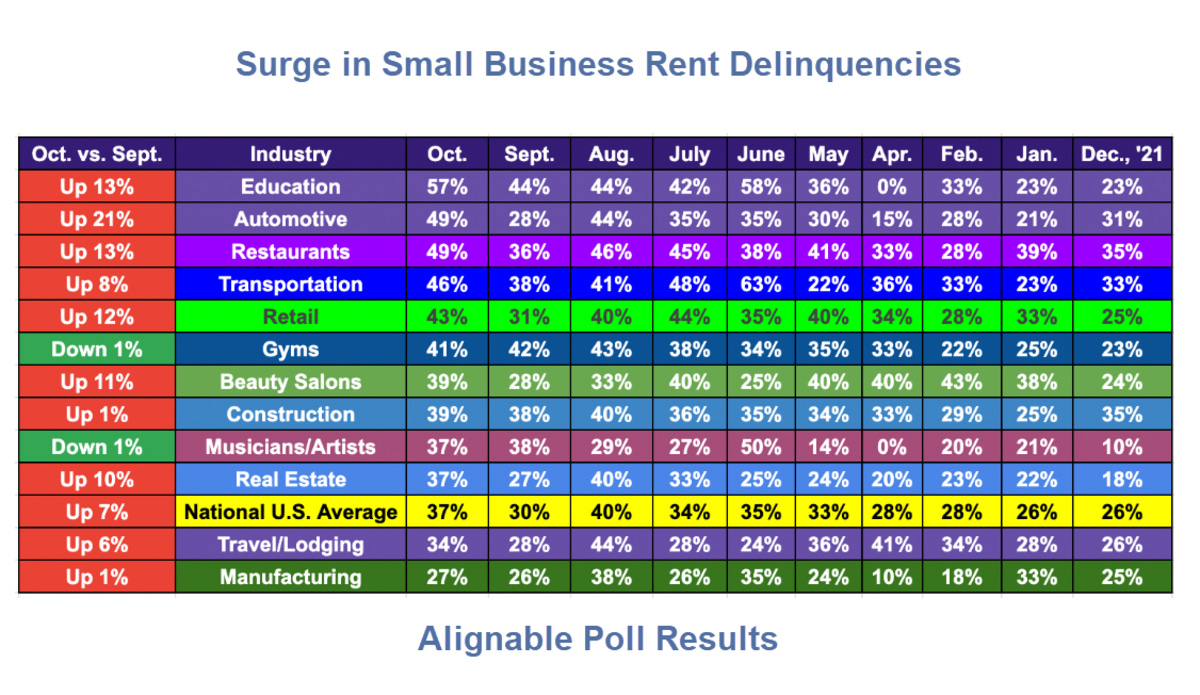

Due to ongoing economic challenges, small business owners' ability to pay their full rent on time in October took a major hit based on a new Alignable poll. In fact, the U.S. rent delinquency rate among small businesses jumped 7% in just one month, marking the largest, most rapid increase in 2022.

In September, rent delinquency was at a six-month low, as optimism for Q4's earning potential was high and some small business owners reported increased sales.

But now, a month later, 37% of small business owners in the U.S. were unable to pay their rent in full and on time in October, compared to just 30% in September…

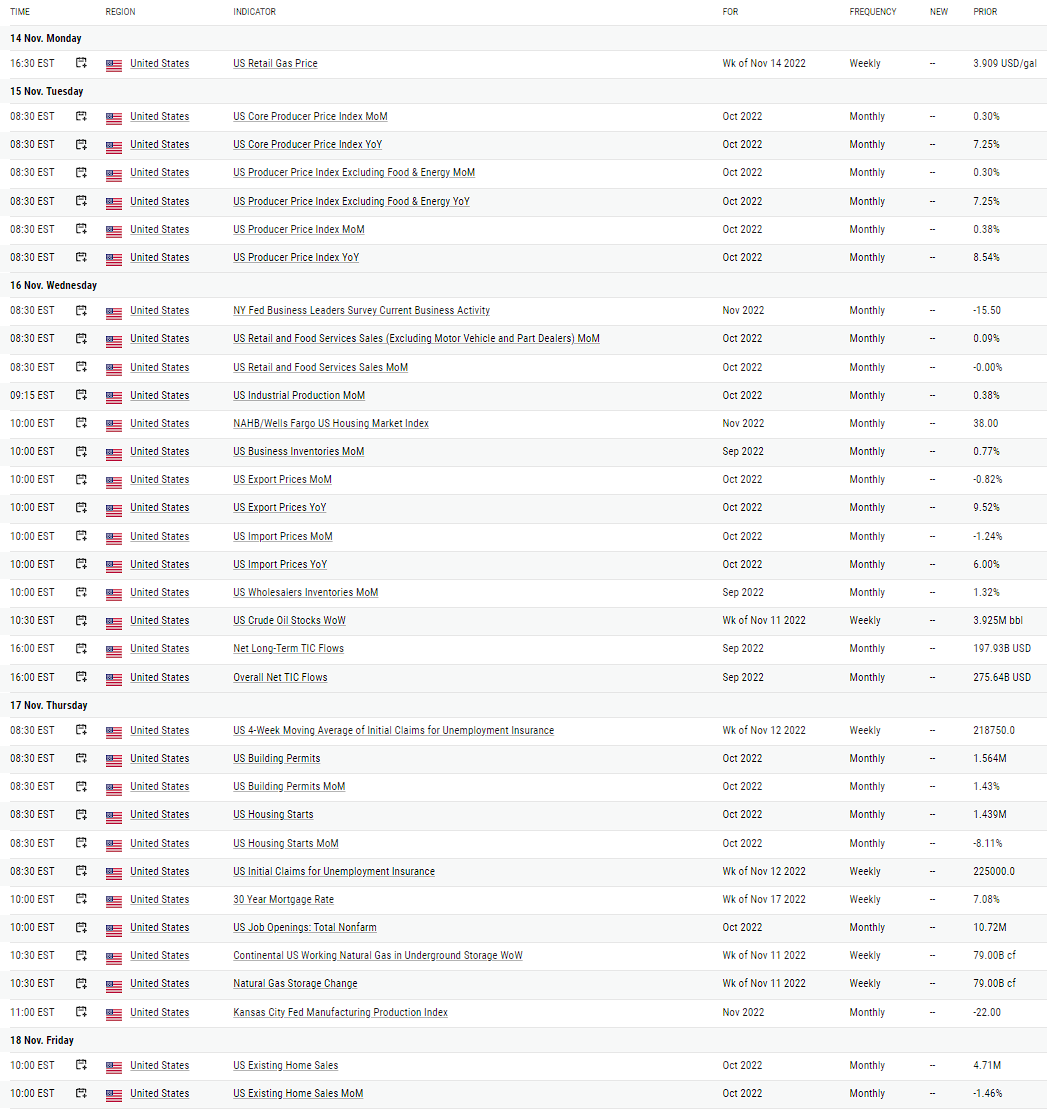

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

“China issued sweeping directives to rescue its property sector, adding to a major recalibration of its pandemic response in the strongest signs yet that President Xi Jinping is turning his attention toward shoring up the world’s second-largest economy.

Regulators issued a 16-point plan to financial firms for boosting the real estate market on Friday, with measures that range from addressing developers’ liquidity crisis to loosening down-payment requirements for homebuyers, according to people familiar with the matter. Authorities said separately in a public statement on Monday they’re allowing developers to access more money from home presales, the industry’s biggest source of funds.” - Bloomberg… more here…

Chart That Caught Our Eye

Analyst Team Note:

The biggest crypto fund, Grayscale Bitcoin Trust (GBTC), has declined ~74% this year and brings GBTC to a 42% discount to the value of the Bitcoin it holds…

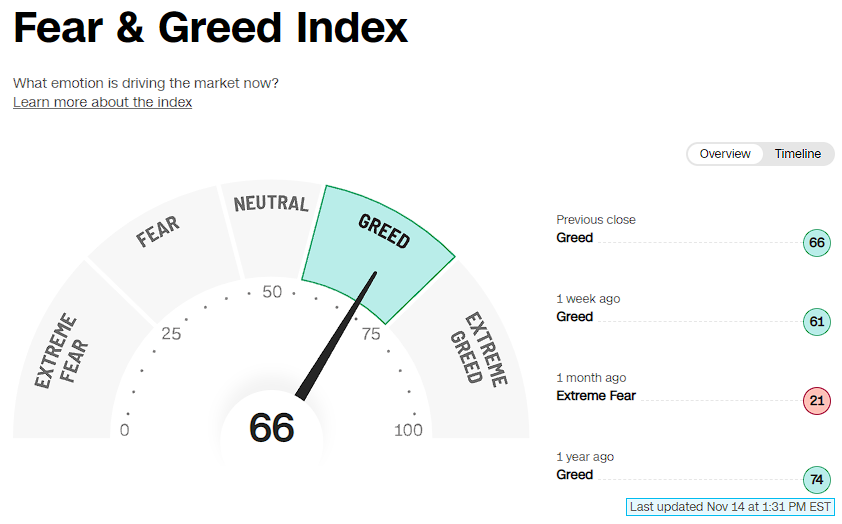

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Strategist Larry’s selected recent Tweets and Instagram Posts