11.1.23: Job Openings Climb as Companies Add Fewer Hires…

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

This newsletter is brought to you by our friends at YCharts — a platform that is centered around efficiency, and built with speed in mind.

The intuitive interface helps save hours of time each week while uncovering better, and new, investment ideas.

With a fully web-based application and pre-built research templates to give you a kickstart, you’re empowered to act on an idea right when the light bulb flicks on.

With all-in-one solutions like fundamental charts, stock and fund screeners, scenario capabilities, proposal generation, and more, YCharts provides the information you need from any device, anywhere.

Visit https://go.ycharts.com/larry-cheung to start your free YCharts trial, and get 15% off your initial subscription (new customers only).

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4193.80

KWEB (Chinese Internet) ETF: 26.05

Analyst Team Note:

The concept of quantitative tightening remains relevant despite its recent lessened prominence in the news, as major central banks work towards normalizing their balance sheets.

Per BofA, correlating central banks' balance sheet activities with global equity prices (a correlation of 0.97 since the Global Financial Crisis), indicates that the current valuation of equities is fair.

However, the deep undershot levels, which could signal a strong buying opportunity, are yet to be reached, showcasing the cautious approach of central banks in the ongoing process of balance sheet normalization.

Macro Chart In Focus

Analyst Team Note:

The post-pandemic inflation surge has shifted the dynamics around US government debt, which for much of the past two decades was largely held by the Federal Reserve, foreign central banks, and commercial lenders using it as a cash reserve.

The Federal Reserve, during the peak of the easy-money era, was acquiring $100 billion a month in Treasuries and mortgage securities, holding them to maturity, keeping trading quiet and yields at minimal levels.

However, with the Federal Reserve now allowing the debt to roll off its balance sheet, and commercial lenders selling their holdings, the previous stability is giving way to a fragile economy with the potential of higher rates for consumer loans.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

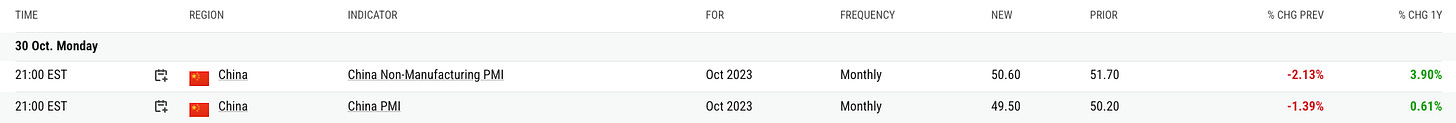

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The US job openings rose unexpectedly in September, marking a second month of increase, with available positions going up to 9.6 million from 9.5 million in August, according to a BLS report.

This increase, higher than the median estimate of 9.4 million by Bloomberg's survey of economists, signifies persistent labor demand, especially noted in accommodation and food services sectors.

The quits rate remained at 2.3%, indicating a lessened confidence among Americans in finding new jobs.

Despite a balanced job market hinted by a steady ratio of openings to unemployed individuals at 1.5, concerns linger as elevated labor demand could potentially fuel inflation, especially with the Federal Reserve likely maintaining the interest rates.

Chart That Caught Our Eye

Analyst Team Note:

Unrealized losses made up 25% of bank equity capital in Q2 2023.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.