11.11.23: Inflation Expectations Rise to Highest since 2011

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4347.35

KWEB (Chinese Internet) ETF: $26.82

Analyst Team Note:

The bear market in US government debt experienced a brief respite this week, but quickly returned to volatility, particularly after a poor auction of 30-year Treasury bonds and comments from Fed Chair Jerome Powell.

The auction resulted in soaring long-maturity yields, and Powell's mention of potential further rate hikes led to a spike in short-term yields.

The Bloomberg Treasury Index had it’s worst day in over six months for Treasuries.

Investors are now more price-sensitive, evident in the higher-than-expected auction yield for 30-year bonds, signaling concerns about the US government's ability to raise funds through bond auctions.

Macro Chart In Focus

Analyst Team Note:

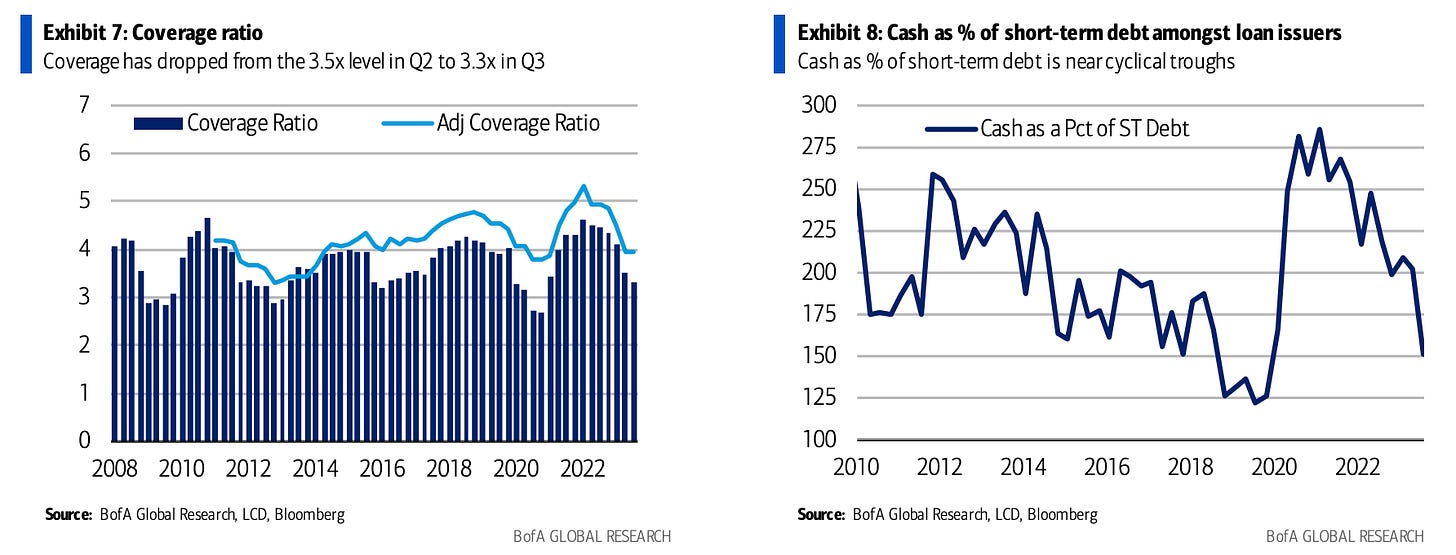

Fundamental pressures are intensifying among lower quality issuers due to higher cash outlays and inadequate earnings offset, leading to stagnant real revenue growth and declining EBITDAs.

The effective interest rate for US bond-loan issuers has risen to 5.5%, the highest since 2015.

Loan coverage ratios have dropped below 3x and are projected to further decrease to 2.5x next year. Consequently, 20% of the US loan index has been downgraded, with default rates escalating to 2.1%.

Balance sheet cash for these issuers has been diminishing since the COVID-era boom, with short-term debt remaining high due to loan and bond maturities.

Cash as a proportion of short-term debt is nearing its lowest levels since the COVID period, highlighting the limited cash resources available in a persistently high-interest rate environment.

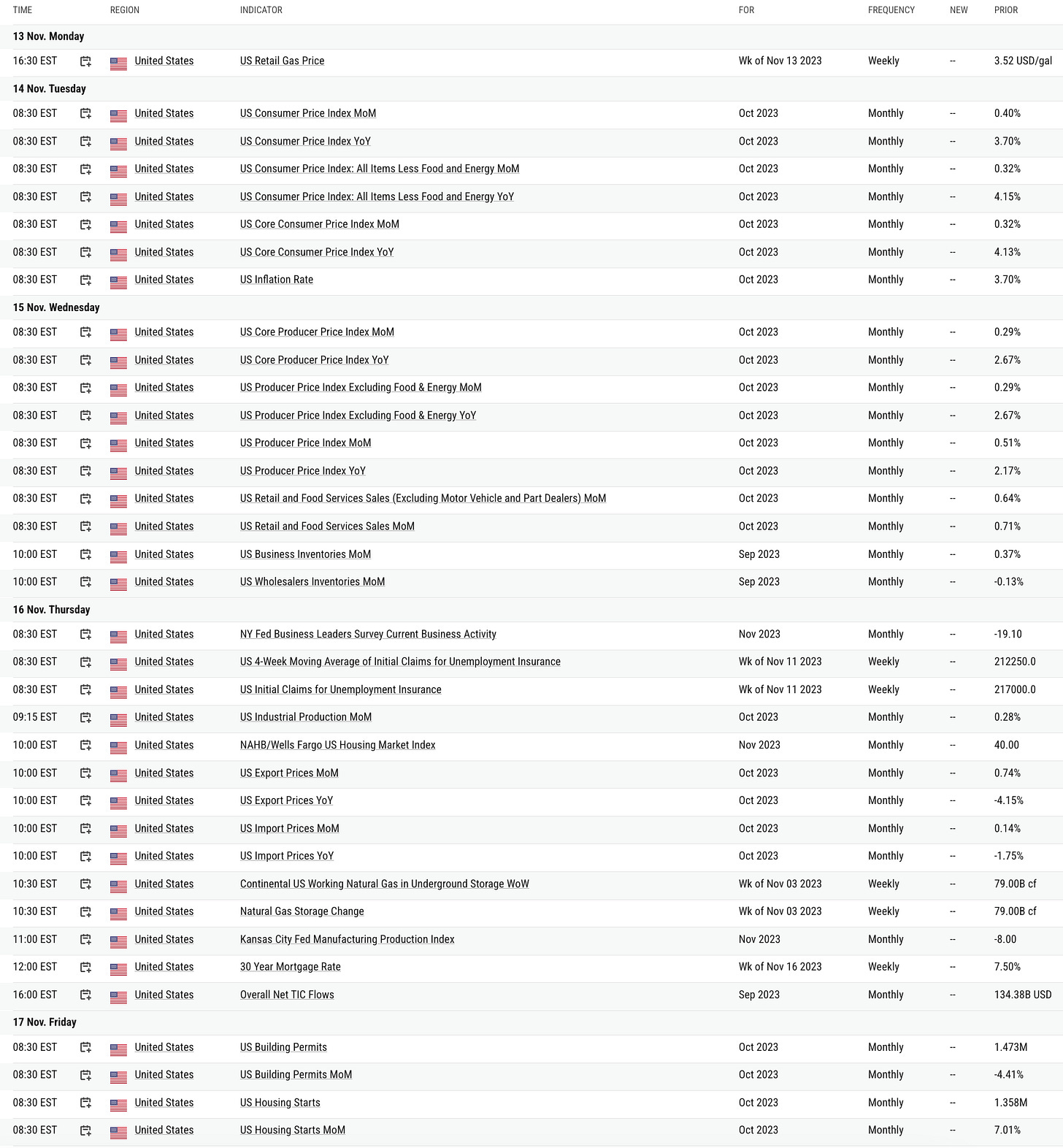

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

U.S. consumers' long-term inflation expectations have risen to the highest since 2011, with a projected annual rate increase of 3.2% over the next 5-10 years, and 4.4% over the next year, as per the University of Michigan's early November report.

The UMich consumer sentiment index declined to a six-month low of 60.4, reflecting increased concerns about high borrowing costs, the economic outlook, and gasoline prices, despite a recent decrease in pump prices.

There's growing worry among consumers about unemployment, with nearly one in five predicting it will cause more hardship than inflation in the coming year.

Buying conditions for durable goods has significantly dropped, with a record number of consumers attributing poor purchase conditions to high borrowing costs or tight credit.

Chart That Caught Our Eye

Analyst Team Note:

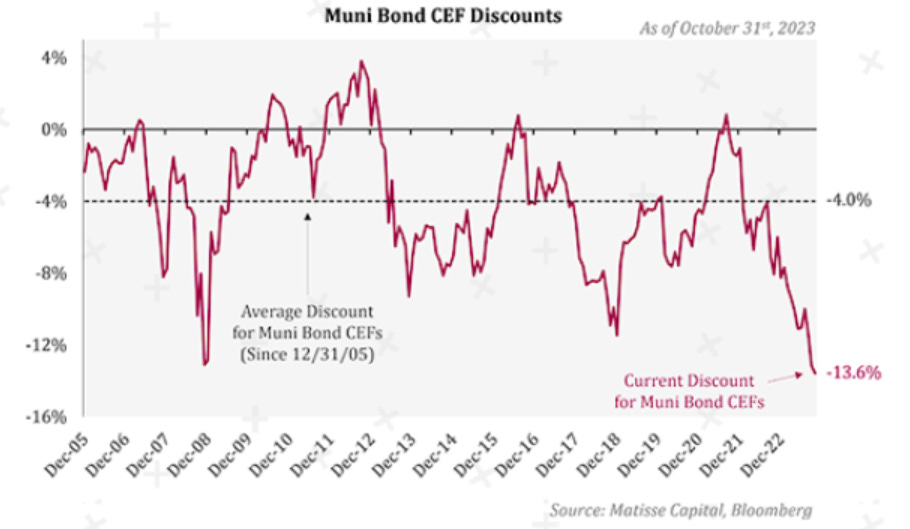

Major money managers are capitalizing on unusual dislocations in the market by purchasing closed-end funds (CEFs), which are now trading at notable discounts.

These funds, often appealing to retirees for steady income, have seen a drop in value due to rising bond yields, leading many individual investors to exit.

The scale of discounts on these funds is significant, with municipal bond closed-end funds trading at an average 13.6% below asset value at the end of October, a 15-year high and well above the historical average.

Closed-end funds, which allow asset managers to buy less frequently traded assets like long-term muni bonds, differ from open-end mutual funds in that investors sell shares to others instead of redeeming them with the fund manager.

Large discounts in these funds indicate heavy selling by individual investors, and hedge funds see a profit opportunity in closing the gap between share price and asset value.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.