11.11.22: U.S. Markets front-run future inflation prints. Bearish positioning is severely punished.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: I am now brainstorming ways of adding even further value to my public and private communities. I know my private audience really enjoys my long-form research content. I also know that “learning” is a major part of why folks join my Community. I will continue to provide insightful research and investor education integrated in my content.

I am planning that in the near future, my members will have the choice to either join me on Patreon or Substack (Letters from Larry). On both platforms, I will provide exactly the same research & content. Existing Patreon members do not have to take any action. They do not need to move over to Substack.

I’m simply giving folks the choice which platform they would prefer using. I’m personally fine with either, but I do have a slight bias towards liking the Substack user interface more (on my end). Substack takes a bigger cut of the processing fee, but I think their layout is more user-friendly for readers so if it’s better for you, I’ll do it.

Additionally, the public/free content that I provide on Substack on a weekly basis will continue to happen. The only thing that is changing is that I will be using Substack to host a private community as well. In other words, the premium content I post on Patreon will be posted as paywalled (with previews!) on Substack.

Substack allows me to show previews of premium content, provide limited free trials, and allows members to gift subscriptions with trials to friends & family. For now, Patreon doesn’t allow me to do any of that.

Bottom line: My private research content will be hosted on both platforms in the very near-future. Existing Patreon members & friends do not have to take any action. I’m simply giving more choices for newcomers which platform they choose to be on.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3956.37

KWEB (Chinese Internet) ETF: $22.68

Analyst Team Note:

2022’s bear market resulted in post-GFC leaders significantly lagging the S&P 500 YTD (Tech -8ppt & Cons. Disc. -14ppt) with the 2010’s laggard Energy outperforming by +80ppt. However, the top 50 stocks still represent >50% of the benchmark.

Macro Chart In Focus

Analyst Team Note:

Just before the pandemic, in the fourth quarter of 2019, American households held about $1 trillion in what was effectively cash—currency and accounts against which checks could be written. By the second quarter of this year, the amount had leapt to $4.7 trillion….

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

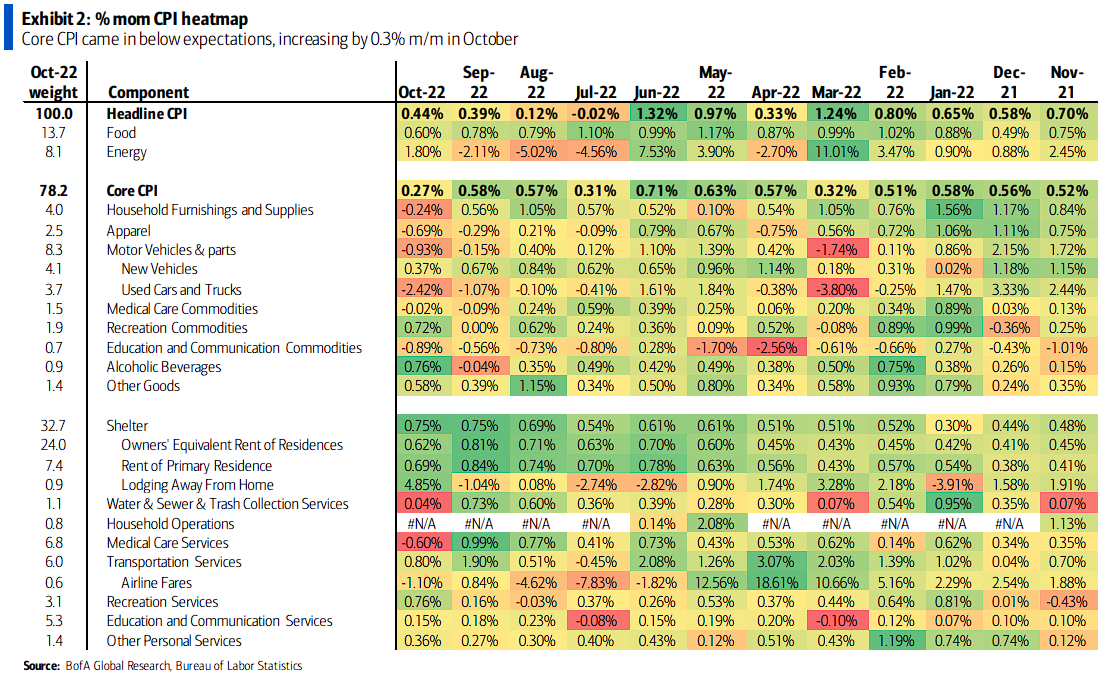

Core CPI came down from October while Food and Shelter stay hot. Regardless, consumer 5-to-10 year inflation expectations rose in October.

Chart That Caught Our Eye

Analyst Team Note:

Massive contagion effect for the “decentralized” world of crypto…

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.