10.7.22: Back to Square One for Bulls. Bears reclaim 3636 on the S&P 500.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers: This market has turned into a day trader’s paradise. Admittedly, we know our strengths (areas/timeframe that we decide to participate) and areas/timeframe where we don’t participate. We don’t engage in short-term trading, and provide guidance on a multi-week/multi-month level.

Out of full transparency, this broad market selloff is placing heat on some of our intermediate-term favorite ideas such as AMD and NIO. We continue to stand by the opinion that these names are best-in-class intermediate-term ideas, and that they are among the first to recover when the market stabilizes - especially if market participants can hold until 2H of 2023.

On the bright side, several of our key opinions such as hedging higher oil with the XLE ETF as well as key Defensive names are proving to be tremendously effective. You can see in the table below (published on Oct. 2nd), we offered our Friends inside a range of best ideas across different timeframes, with selection in offensive and defensive categories. We have members from different ages, risk-tolerances, and goals join us. Therefore, we offer both Offensive and Defensive guidance, across different time horizons.

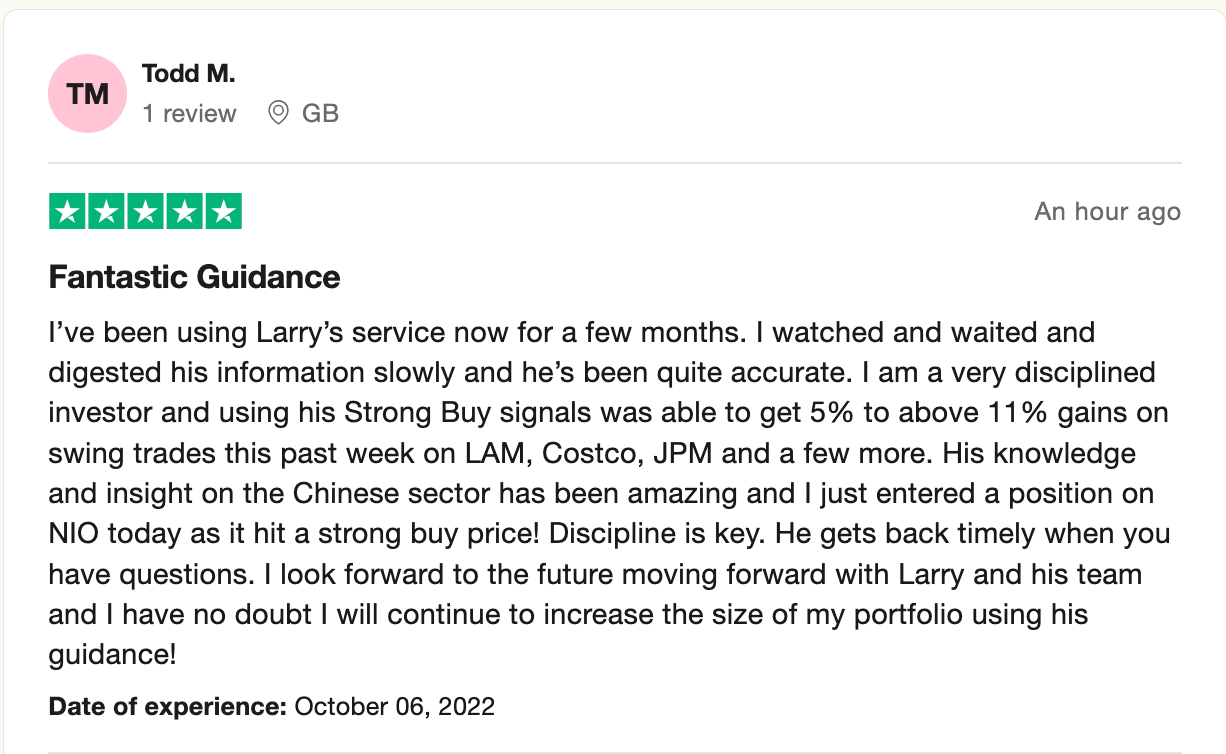

Several members were able to take advantage of SHOP, LRCX (both up 10-15% by mid-week before retracing) earlier this week on the market bounce, and secured short-term gains (See what our Friends said at bottom of this email).

Personally, Strategist Larry strongly dislikes short-term trading (not his specialty), and continues to Hold and eye further discounts for strategic accumulation.

The most important quality in this market is deep patience, and the ability to plan your moves in the weeks ahead and not react to sudden erratic market day-to-day moves. If you are looking for a guiding hand in this market, we will help our Community with a level of committment that is exceptionally difficult to find anywhere else.

We believe our guidance during market volatility is where we shine. We sincerely hope to help you navigate this environment.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3744.52

KWEB (Chinese Internet) ETF: $25.88

Analyst Team Note:

The BofA case for soft landing: “Central banks are still in business of bailing out Wall St, and governments now very much in the business of bailing out Main St, so moral hazard once again rescues asset prices while new bailout culture thanks to panicked government intervention leads to “soft landing” and ultimately destination of Yield Curve Control policies across the G7 to safely finance government debt”

Macro Chart In Focus

Analyst Team Note:

When the treasury market broke in 2020 as fears of Covid spread, the Fed came in and propped up the market.

We’re now seeing liquidity dry up to levels not seen since 2020. Will the Fed eventually step in again, contradicting their hawkish tone on monetary policy?

Per TD Securities, “The biggest nightmare for the Fed now is that they have to step in and buy debt”.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

There’s been some revitalized talk of a Fed pivot. As Mohamed El-Erian said best, investors who are hoping for a policy pivot should be wary, as a rate cut at this point would be the Federal Reserve's response to a major shock.

The fed funds rate is sitting at 3.25% and the average rate when the Fed u-turns is 5.7%.

Chart That Caught Our Eye

Analyst Team Note:

Despite deal activity across all stages showing more signs of distress, US VC fundraising set a new annual high through only three quarters of 2022. US based funds raised $150.9bn YTD and has now raised a cummulative $298.1bn over the past 21-months.

Per Pitchbook, “Given public market turbulence and frozen avenues for liquidity, we expected LPs to be concerned about their overexposure to this asset class and the potential for timely returns negatively impacting fundraising activity. Entering the second half of the year, we are finally beginning to see that momentum atrophy, as just $29.4 billion in fundraising was added to the dataset since our Q2 report, the lowest quarterly total this year.”

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs