10.5.22: Markets begin front-running next week's Inflation data.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: Our October Investment Strategy Report was published this past weekend and several key themes are starting to materialize. We’ll continue to monitor inter-market data points and provide thoughtful guidance on an intermediate-term perspective. We are known for our views on the intermediate-term as it is our core specialty - a view into the months ahead (and not day-to-day/intraday price action, which we find fickle and inconclusive).

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

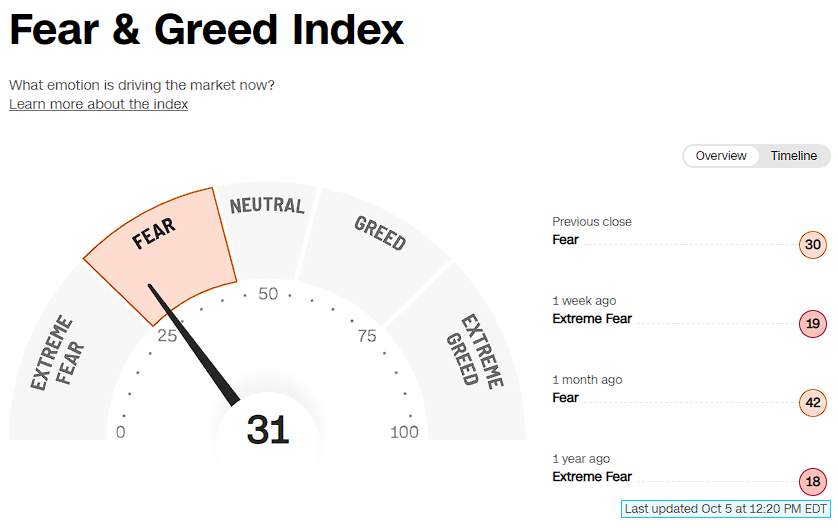

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3790.93

KWEB (Chinese Internet) ETF: $26.29

Analyst Team Note:

“NYSE stocks recorded two 90% up days: 10/4 and 10/3. This comes after a 90% up day last week on 9/28. We view three 90% up days in five sessions as bullish, but the last time the NYSE recorded two 90% up days in a row was 12/31/2012 and 1/2/2013, which preceded a 29.6% rally in the S&P 500 (SPX) in 2013.” - Bank of America

Macro Chart In Focus

Analyst Team Note:

Earlier this year, the Fed conducted a stress test of commercial bank to ensure that they would be able to handle an economic shock.

In the Fed’s hypothetical “adverse scenario”, it modeled a 1.5% 10Y treasury yield, 3.8% 30Y mortgage rate, and a 6.6% BBB corporate bonds. We’re clearly way past that point for treasury yields and mortgage rates.

This goes to show just how fast the markets have been moving this year…

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

OPEC+ agreed to cut its output by 2 million barrels a day, in an effort to halt a recent slide in oil prices. This is the biggest reduction by OPEC+ since 2020, which could add another inflation shock…

Chart That Caught Our Eye

Analyst Team Note:

The MOVE Index of Treasury volatility has been jumping to levels not seen since the 2008 financial crisis. Treasuries form the backbone of most portfolios and help fulfil capital requirements for many banks. High volatility in what is supposed to be a risk-free safe asset can have second and third order effects…

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Words of Affirmation from our Friends inside - thank you - we’ll continue to serve our Community well with our longer-term orientation towards investing.