10.31.22: November FOMC will set the tone this week.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: We have published our November Investment Strategy this past weekend, and one of the first opinions that we had to share was to be wary of the value trap that Meta has become. Sure, Meta can (and probably will) bounce. But any bounce is technical in the face of declining fundamentals. We don’t judge companies day-by-day, but their declining top-line AND increasing cost-structure is a recipe for investor disappointment, especially when there are other solid companies out there competing for investor capital.

A new month brings new opportunities. Do not waste this opportunity to sharpen your skills. Bear markets are enormous opportunities to pick up great companies at great value - but you must know which ones to pick.

On Instagram - we recently shared our opinions that went in our favor or against us in October. See the outcomes by following us on Instagram (click image).

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

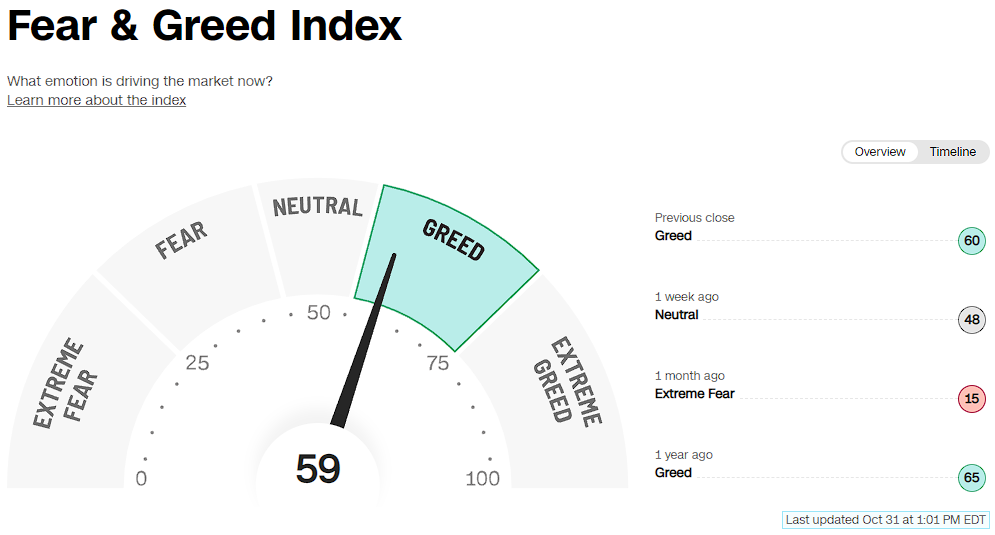

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3901.06

KWEB (Chinese Internet) ETF: $19.07

Analyst Team Note:

“If the 10/12 low of 3577.03 holds as the midterm year correction low for the S&P 500 (SPX) in 2022, history suggests the potential for a rally from this low into yearend of 8.4% to 13.3%, which puts the SPX into the 3870 to 4050 range.

The average and median year end rallies of 10.6% and 10.3%, respectively, from prior October midterm year lows (1946, 1966, 1974, 1990, 2022 and 2014) equate to SPX 3950 into year end. Only three years saw a midterm year low after the elections: 1930, 1978 and 2018.” - BofA

Macro Chart In Focus

Analyst Team Note:

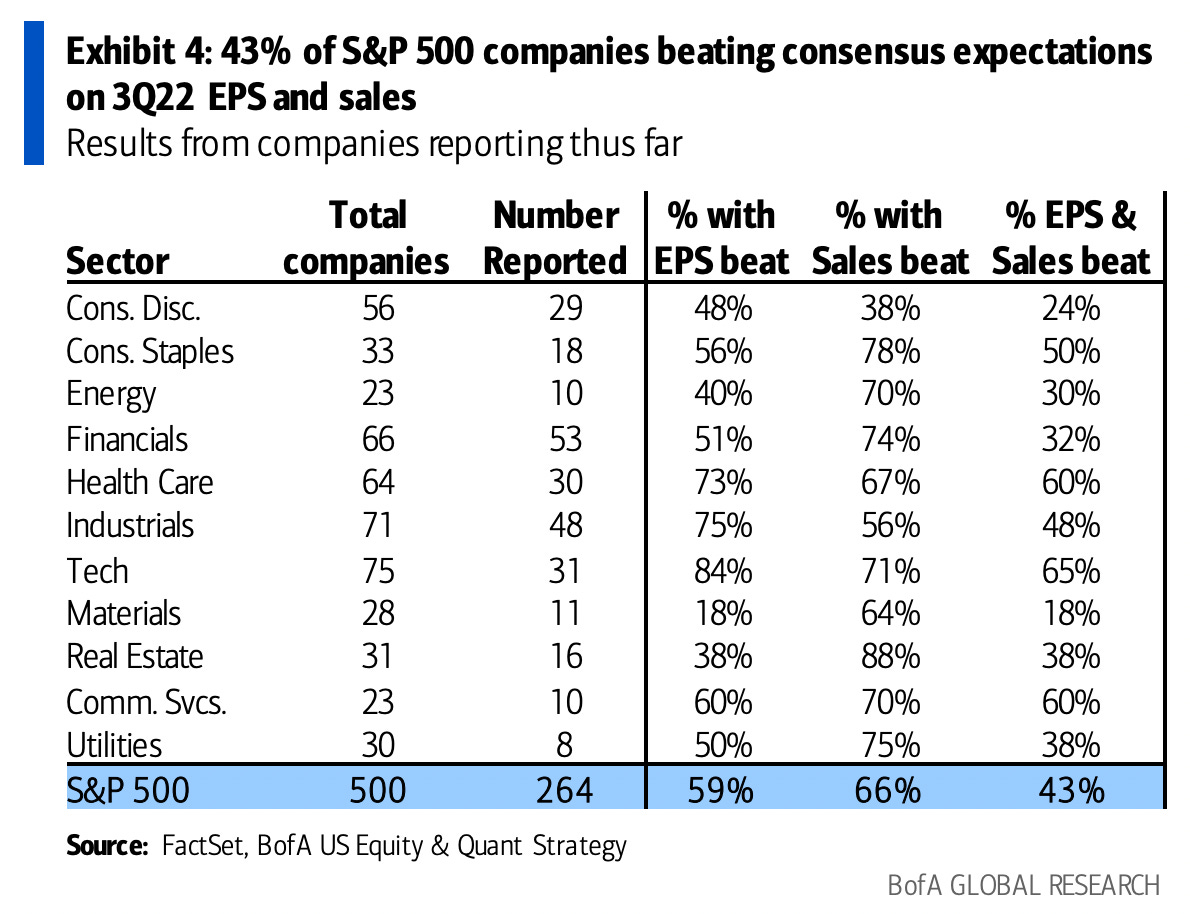

264 S&P 500 companies (68% of index earnings) have reported earnings so far. As evidenced by the GDP print, 3Q wasn’t an ugly quarter, with EPS tracking just 1% below consensus.

But it wasn’t great either: this would mark only the third miss post-GFC, and 54% of reporters (ex-Financials) had negative real sales growth.

But the big risk is in forward estimates: Q4 EPS has been cut by 2% MTD, but for reported companies, Q4 estimates fell more, -4%, suggesting further downside risk as analysts update their estimates after results.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

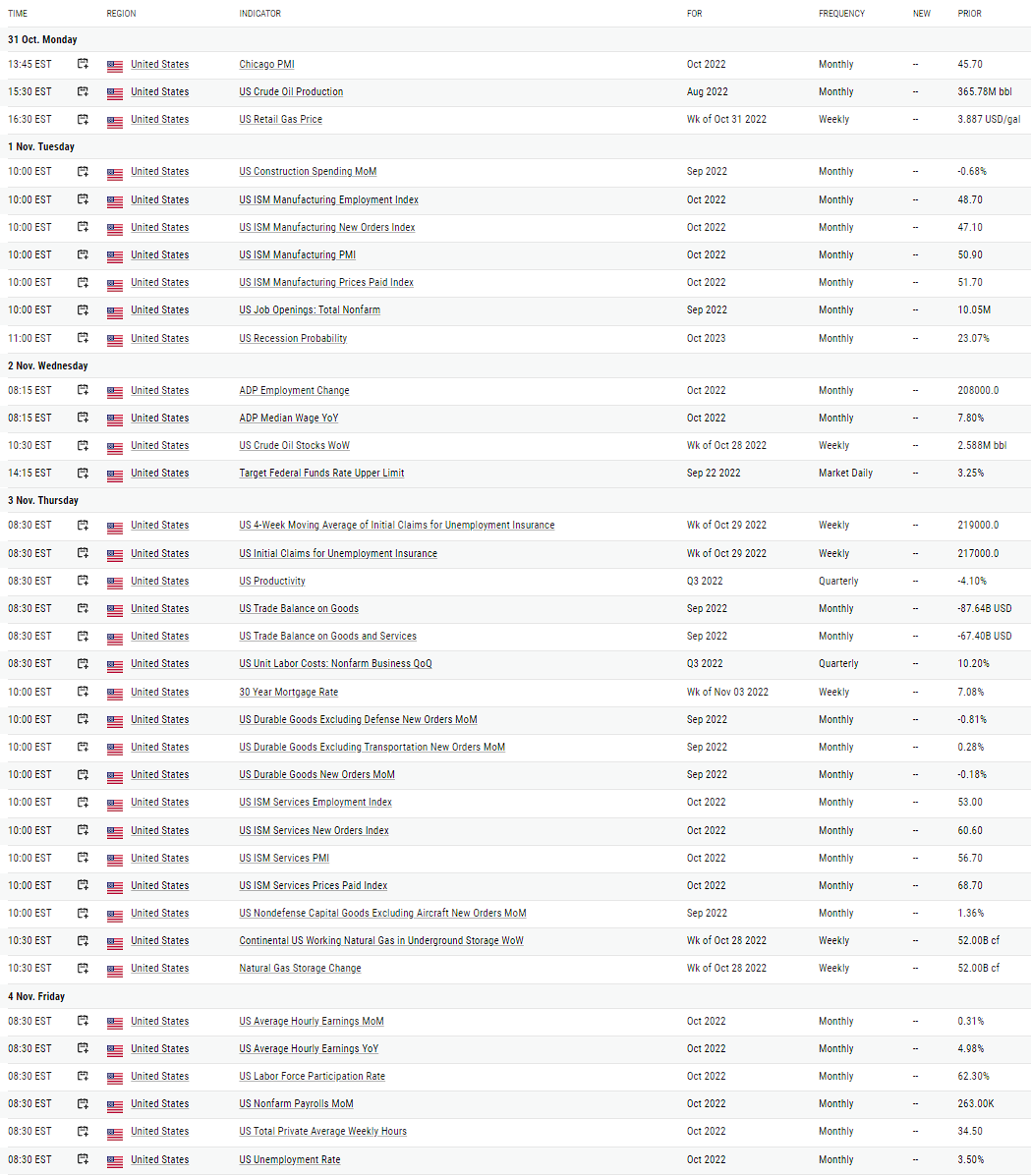

U.S Economic Calendar (Upcoming Data Points)

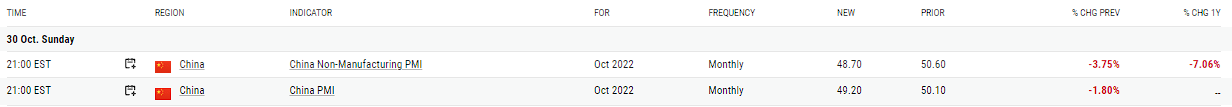

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Total card balances in the U.S. hit $916 billion in September, nearly identical to December 2019 levels, according to Equifax. Balances are up 9% from January and about 23% higher than their pandemic low in April 2021.

Chart That Caught Our Eye

Analyst Team Note:

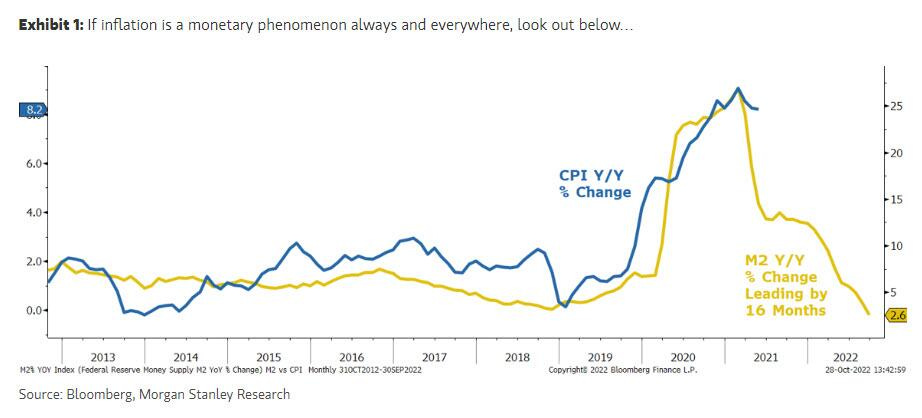

“M2 is now growing at just 2.5%Y and falling fast. Given the leading properties of M2 for inflation, the seeds have been sown for a sharp fall next year. The implied fall in CPI outlined in Exhibit 1 would be highly out of consensus, and while it won’t necessarily play out exactly as in our chart, we believe it's directionally correct. This has implications for Fed policy and rates. Indeed, part of our call for a rally assumes we are closer to a pause/pivot in the Fed’s tightening campaign, and while we don’t expect to see a dramatic shift at next week’s meeting, the markets have a way of getting in front of Fed shifts.” - Morgan Stanley

Note: M2 refers to the M2 money supply

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs