10.30.23: Stocks Headed for Longest Losing Streak Since March 2020

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: Equities are still headed toward their third monthly slide — the longest losing streak since March 2020 — hurt by a surge in bond yields, disappointing earnings from some big techs and geopolitical concerns.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4117.37

KWEB (Chinese Internet) ETF: $26.49

Analyst Team Note:

The third week of earnings ended with 64% of S&P 500 companies, totaling 246, tracking a 7ppt beat against consensus, primarily driven by mega caps reducing costs.

Although the consensus 3Q EPS has been revised upward by 3ppt (+3% YoY), real sales growth remains negative at -2.5% YoY.

There has been a notable rise in "weak demand" mentions and a dip in corporate sentiment, indicating cautiousness among corporations.

There has also been a disparity in market reactions to earnings beats and misses, with rewards for beats improving but still below historical average, and penalties for misses exceeding the average underperformance against the S&P 500.

In the upcoming week, 161 companies, representing 23% of earnings, are set to report, which could provide a clearer picture of the overall earnings landscape.

Macro Chart In Focus

Analyst Team Note:

The impact of rising interest rates is primarily seen through demand reduction and diminished pricing power for corporations, with a gradual rise in interest expenses.

Corporate sentiment regarding higher rates has been notably negative, reaching the readings from the 2008 Financial Crisis, as management teams express concerns over the high cost of capital and credit conditions.

This sentiment aligns with the tangible effects seen as borrowing costs rise, substantially impacting demand, evidenced by a sharp decline in revenue growth (excluding Energy sector) from 14% in 2021 and 8% in 2022 to 4% this year.

Concurrently, S&P 500's net income margin has dipped from a record 13.3% in 1Q22 to 11.9% in 2Q22.

Every 1% decline in revenue translates to a -$2.25 EPS headwind for S&P 500, and every 25 basis points of margin compression results in a -$4.5 hit to EPS.

Compared to this, the direct impact of rolling the S&P 500's (excluding Financials) fixed rate debt of approximately $800B maturing through 2025 at current rates is more modest at around $3 EPS.

Large-cap companies, with weighted average maturities of about 12 years (excluding Financials), are better positioned compared to Small-caps at about 7 years due to greater exposure to variable debt.

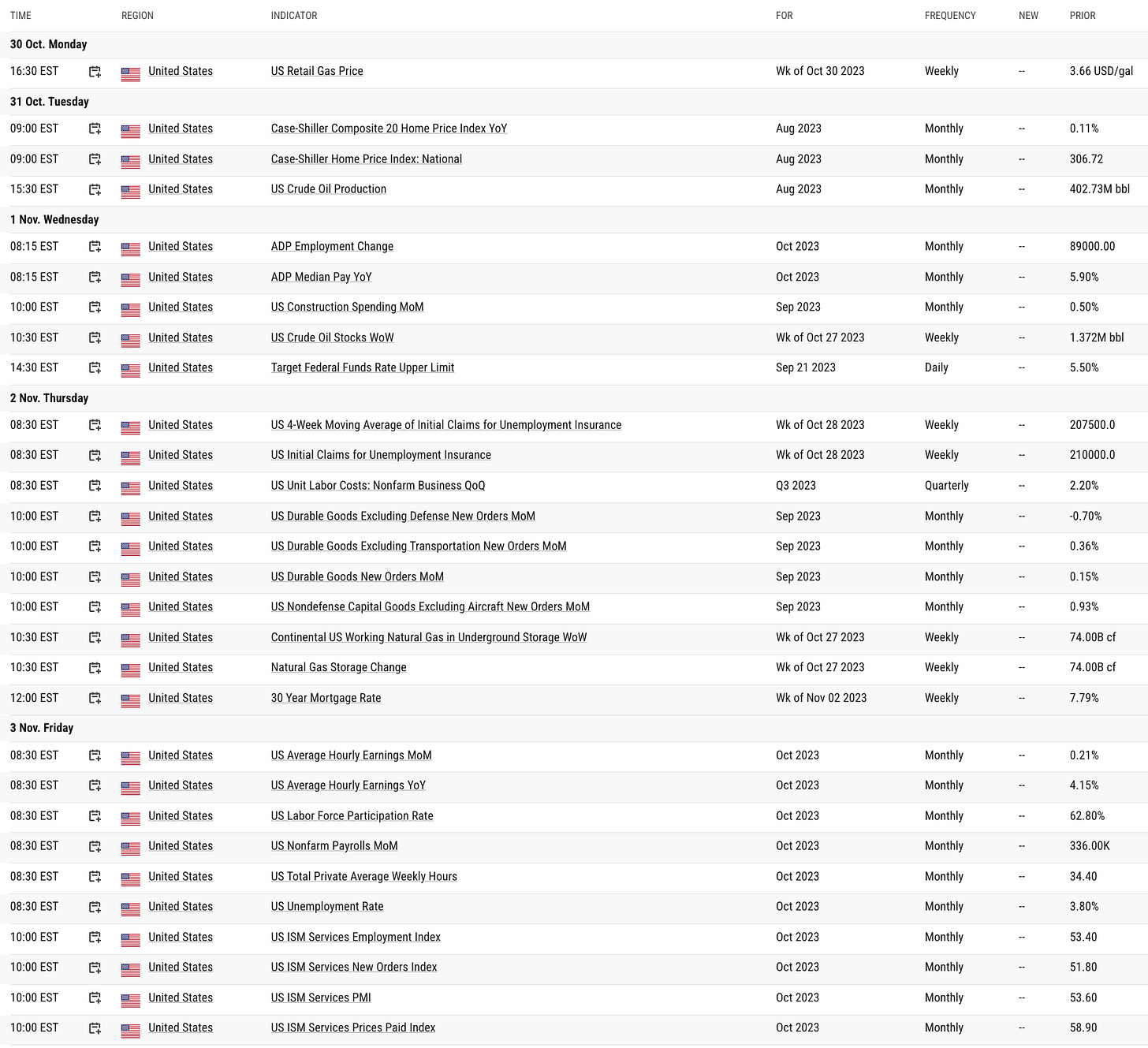

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Amid robust economic growth and a sturdy job market, a rising share of middle-class Americans express economic anxiety, driven by the Federal Reserve's escalated interest rates to control inflation, as per a Harris Poll for Bloomberg.

The poll shows 57% of middle-class respondents feeling the pinch of higher borrowing costs on their household finances, and 44% stressed about the economy, a rise from last year's 40%.

Despite a 4.9% annual growth in the US economy in Q3 2021, the persistent borrowing costs, alongside record $130 billion paid by consumers in credit card interests and fees in 2022, dampen the financial outlook of middle-class households.

The anxiety spreads across increased costs for essential goods, stagnated wages, and affordability issues, further fueled by concerns over geopolitical tensions and its economic repercussions.

Chart That Caught Our Eye

Analyst Team Note:

The divergence in 10-yr UST yield (higher) and bank stocks (lower) since August is notable, potentially setting-up for another bear market bounce (unless yields drop). Not many instances where these have diverged for long.

Signs of cooling inflation without severe damage to the economy, easing geo-political tensions could drive stocks higher into year-end.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.